Listen to This Blog Post

Private credit return outperformance over leveraged loans and high yield continued in 2Q25. Spreads and yields to maturity compressed compared to 3Q24. Direct lending continues to dominate fundraising. Banks have re-entered the market aggressively, with capital now split more evenly between broadly syndicated loan and direct lending markets, signaling renewed competition. Effective yields rose not from higher base rates, but from price declines in lower-quality bonds, heavier issuance, and a shift toward riskier, higher-coupon credits.

Key Trends in Private Credit

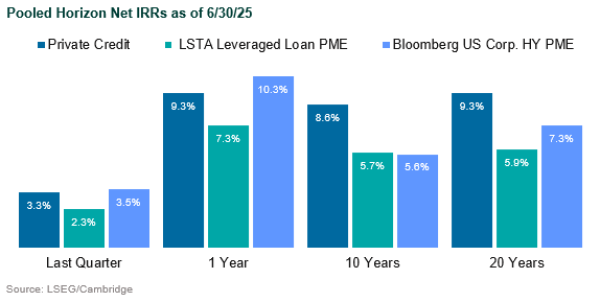

Performance | Private credit outperformed leveraged loans and high yield over the last quarter and the 5-, 10-, and 20-year periods ended 2Q25. Over the past 10 years the asset class has generated a net IRR of 8.6%, outperforming leveraged loans by three percentage points as of June 30, 2025.

Spreads | Spreads and yields to maturity compressed from 361 bps / 8.97% (Sep 2024) to 322 bps / 7.31% (June 2025), reflecting broad credit tightening and lower required yields. The sharp early-2025 decline followed a strong credit rally and improved default sentiment. Lower base rates, strong yield demand, and better credit fundamentals pushed yields toward cycle lows.

Fundraising | The top four funds raised in 2Q25 spanned multiple private credit verticals. Direct lending continued to dominate, with mezzanine following, while funds-of-funds and venture debt lost LP interest. Specialty finance/ABL strategies continued to attract increased attention.

Refinancing | Borrowers switching from private credit to syndicated loans achieved average spread savings of 147 bps in 2025 YTD, versus 216 bps in 2023. Banks have re-entered the market aggressively, with capital now split more evenly between broadly syndicated loan and direct lending markets, signaling renewed competition.

Loan Volume | The 2023 flow gap has effectively closed as banks resumed underwriting and syndicating large, high-quality loans after rebuilding balance-sheet capacity and confidence in the leveraged market.

Yields | Option-adjusted spreads tightened in 2Q25 as confidence in credit quality improved, defaults stayed low, and demand for high yield remained strong. Effective yields rose not from higher base rates, but from price declines in lower-quality bonds, heavier issuance, and a shift toward riskier, higher-coupon credits—reflecting a “risk rotation” toward more speculative or longer-duration paper.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.