Four of the primary types of institutional investors (public and corporate defined benefit (DB) plans; nonprofits; and Taft-Hartley plans) experienced sharp declines in the first quarter and smaller drops for the 12 months ending March 31. A quarterly rebalanced 60% S&P 500/40% Bloomberg Barclays Aggregate portfolio declined 10.9% during the quarter and 0.4% over the year. Equities, represented by the S&P 500 Index, experienced a much-sharper decline of 19.6% in the first quarter.

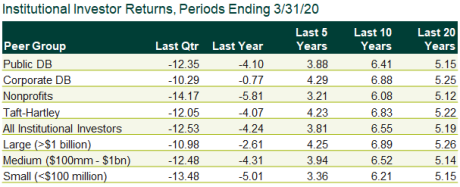

Over the one-year period, corporate DB plans showed the smallest decline, nonprofits the sharpest.

Over longer time periods, corporate DB plans have been the best performers. But over the last 20 years, all plan types have produced returns in a narrow range of 5.1%-5.3%, in line with the performance of the blended equities/fixed income benchmark.

In gauging performance by size, large plans (>$1 billion) consistently outperformed medium plans ($100 million-$1 billion), which outperformed small plans (<$100 million), over almost all time periods. This held true for all institutional investors as well as by plan type. Large nonprofits performed best of all plan types last quarter, followed closely by large corporate DB plans; large corporate DB plans did better for the year and outperformed the 60-40 benchmark.