Listen to This Blog Post

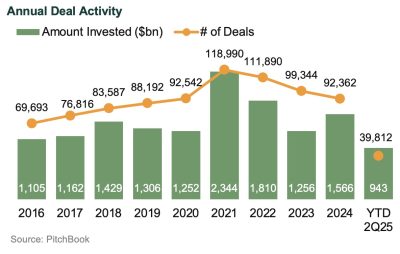

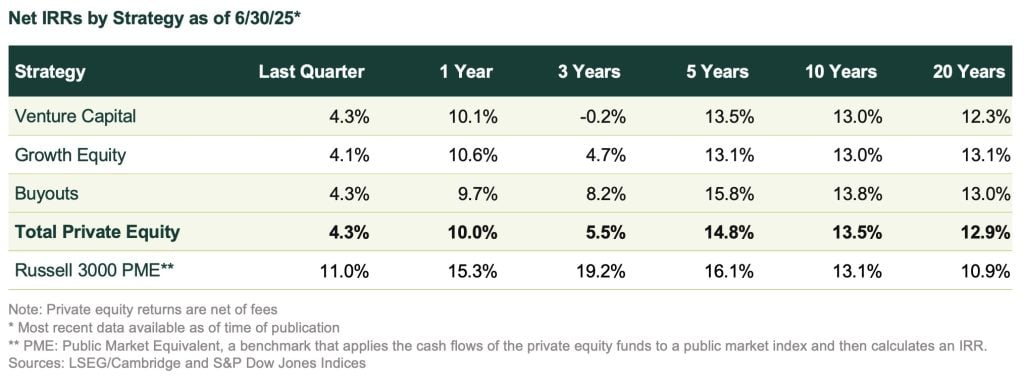

Fundraising year-to-date has lagged last year, while deal volume has gone up even as deal count declines. Buyouts are on pace for 2024 levels, although the first two quarters of 2025 had starkly different results. Late-stage AI mega rounds drove venture capital, and there were signs of life in the IPO market. Returns lagged those of public market equivalents.

Details on Private Equity Activity

Fundraising | By both volume and fund count, 1H25 fundraising fell 30% versus 1H24 as exit backlogs and limited distributions left LPs with less capital to redeploy. Longer timelines mean more funds in market without final closes, further understating activity. Fundraising remains bifurcated, however: a small cohort of in-demand funds are oversubscribed while the broader universe remains challenged.

Deal Activity | There has been a persistent trend: deal volume going up and deal count going down. Deal volume saw a massive boost in 1H25, on track to reach 2021 levels. Deal count, on the other hand, was down 22%. Capital has been concentrated in the largest deals across both buyouts and venture capital/growth, driven by (1) a business-friendly administration encouraging larger deals that once feared antitrust scrutiny, (2) companies of scale seen to be more resilient amid ongoing trade uncertainty, and (3) AI’s heavy capital needs driving venture “mega” rounds.

Buyouts | Activity dropped in 2Q25 following Liberation Day and its resulting tariff fluctuations and macroeconomic uncertainty. The first quarter buoyed the YTD statistics, which, in the aggregate, have continued 2024’s pace. Valuations were at their lowest levels in 10 years.

Venture Capital and Growth Equity | Despite slower exits in recent years, venture activity has climbed as billions flow into AI startups. The surge in 2Q25 was driven by late-stage AI “mega” rounds, pushing overall activity and late-stage valuations to ~80% of 2021 levels, while early-stage valuations have nearly doubled.

Exits | A handful of high-profile exits this summer has renewed optimism about private equity exits. The IPO market is warming as seven unicorns (a startup company with a valuation exceeding $1 billion) listed in 1H25 and seven more in 3Q25. “Mega” exits dominate, pushing 2025 median exit size near 2021’s peak, with holding periods shortening.

Returns | Private equity posted a 4% gain versus the public market’s double-digit rebound. Performance was largely aligned across time horizons, with one key exception: over three years, venture capital and growth equity lagged amid the 2022–23 tech downturn.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.