Listen to This Blog Post

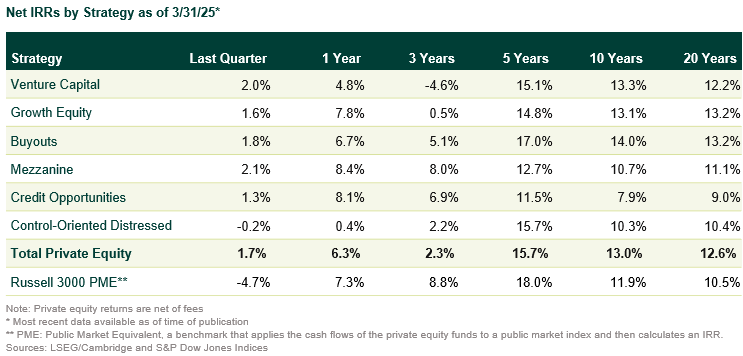

Private equity returns in 1Q25 outperformed public equity for the first time in six quarters. The quarter was fueled by greater investor optimism in anticipation of a more favorable deal and exit environment in 2025—this enthusiasm was soon stifled by the tariff fluctuations and macroeconomic uncertainty of 2Q.

Details on 2Q25 Private Equity Activity

Fundraising | The fundraising drought that began in 2022 has persisted into 2025. Commitments in 1Q25 remained on par with the prior year’s subdued pace, and limited partners (LPs) continued to show caution in recommitting capital to the asset class. Capital is increasingly consolidating in the largest and most established general partners. Multiple mega funds closed this quarter—underscoring that while the overall fundraising pie is smaller, the largest firms are still able to attract significant investor interest.

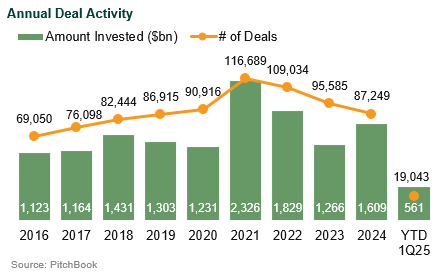

Deal Activity | Deal volume showed momentum in 1Q25, fueled by growing optimism around potential macroeconomic policy shifts and more favorable market conditions under the new administration. This followed a similar uptick in 4Q24, suggesting a cautiously constructive tone heading into the year. However, this momentum was short-lived. In early 2Q25, the markets were upended by “Liberation Day” and the resulting tariff fluctuations and uncertainty around global trade. From a longer-term perspective, overall deal activity is still above pre-pandemic levels by about a third, reflecting the broader growth of the asset class.

Buyouts | Activity mirrored broader market trends, carrying forward late-2024 investor optimism into 1Q25. Quarterly buyout volume was pushed to a pace last seen in 2021. Valuations, however, continued to fall, with a more disciplined pricing environment driven by higher interest rates and tighter bid-ask spreads.

Venture Capital and Growth Equity | Venture capital (VC) and growth equity deal activity surged in 1Q25, continuing an upward trend supported by investor excitement around artificial intelligence (AI). 2025 has featured multiple “mega” financing rounds, signaling enthusiasm for large-scale bets in the sector. Contrary to the trends seen in buyouts, venture and growth valuations climbed across all stages. Early- and mid-stage valuations hit record highs, while late-stage valuations are nearing their 2021 peak.

Exits | The exit market showed tentative signs of improvement in 1Q25. Building on the start of the recovery in 4Q24, investors entered the year with hopes of a more open IPO window and active M&A environment. While conditions were better than the lows of 2023, from a longer-term perspective, exit activity remains below pre-pandemic levels. 1Q25’s progress on exits soon stalled in April following tariff announcements and increased economic uncertainty. The IPO market remains effectively shut, and M&A activity was subdued as buyers and sellers struggled to reconcile valuation expectations.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.