Listen to This Blog Post

U.S. equity market performance was marked by a sharp risk-on reversal following a steep early-April sell-off tied to the rollout of Liberation Day tariffs, which triggered widespread market volatility. Equity markets subsequently staged a remarkably strong recovery driven by the pause in tariff implementation, solid macroeconomic data, and healthy corporate earnings, especially in the Technology sector. The Federal Reserve kept policy rates steady, but U.S. Treasury yields were volatile, particularly among longer-dated bonds, influenced by mounting fiscal concerns, supply/demand dynamics, and the potential for tariffs to be inflationary. During the quarter, the 10-year Treasury yield rose by 3 basis points to 4.23%.

S&P 500 performance was driven by high-beta sectors, led by Technology, Communication Services, and Industrials. Gains in these cyclical areas more than offset weakness in Energy and Health Care, which had been among the best-performing sectors in 1Q25 but lagged in 2Q amid falling commodity prices and a rotation away from defensive companies. Corporate earnings grew during the quarter, driven by investments in AI infrastructure and productivity enhancements.

2Q25 Hedge Fund Performance

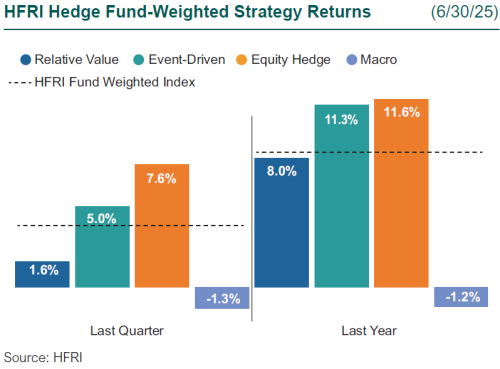

Hedge funds ended the quarter higher, as equity hedge strategies drove performance, with gains coming from sector-focused strategies in Technology and Industrials. Event-driven strategies gained momentum throughout the quarter, on speculation around M&A situations. Relative value strategies also had a positive quarter, as they were able to profit from volatility around credit and equity positions. Macro strategies ended slightly lower, as some managers had difficulty trading around interest rate volatility, while commodity trading offset some of those losses.

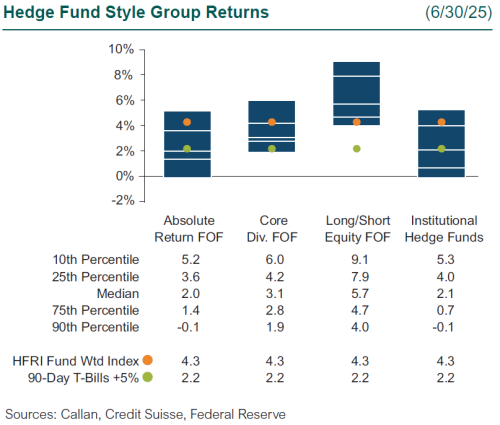

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median manager in the Callan Institutional Hedge Fund Peer Group rose 2.1%. Within this style group of 50 managers, the average hedged equity-focused manager gained 5.1%, as growth-oriented companies drove performance. The average hedged rates-focused manager rose 3.0%, as managers were able to navigate interest rate volatility during the quarter successfully. Meanwhile, the average hedged credit-focused manager moved 1.7% higher, as managers were able to profit off both long and short credit positions. Following a difficult start to the quarter, cross-asset multi-strategy funds added 1.2% in a generally risk-on environment.

Within the HFRI indices, the best-performing strategy was equity hedge, up 7.6%, as managers focused on higher beta names saw strong performance. Event-driven strategies also had a strong quarter, up 5.0%, as managers profited off higher beta companies that have some type of ongoing special situation. Relative value strategies also had a positive quarter, up 1.6%, as managers were able to profit off fixed income volatility during the quarter. Macro strategies ended lower, down 1.3%, as managers had difficulty trading around interest rate volatility while commodity trading offset some of the losses.

Across the Callan Hedge FOF database, the median Callan Long/Short Equity FOF ended up 5.7%, as managers with exposure to higher beta stocks drove performance. The Callan Diversified FOF gained 3.1%, driven by exposure to relative value and equity hedge managers. The Callan Absolute Return FOF rose 2.0%; macro managers were a slight drag on performance while equity and relative value managers aided gains.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

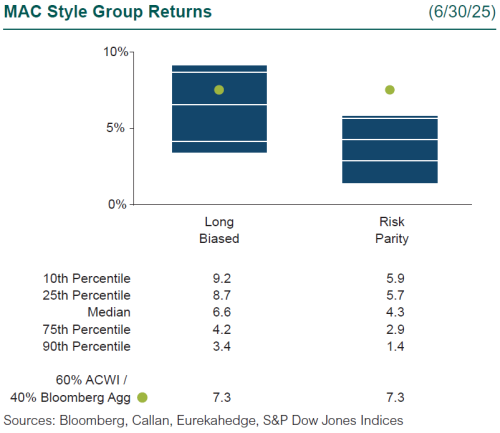

Within Callan’s database of liquid alternative solutions, the median manager in the Callan MAC Long Biased Peer Group rose 6.6%, as weakness from the U.S. dollar and commodity trading was a slight drag on performance. The Callan MAC Risk Parity Peer Group gained 4.3%, as fixed income and equities drove gains while weakness in the U.S. dollar slightly offset some of that performance.

Though equity markets finished 2Q at all-time highs, many hedge fund managers continue to have a defensive posture in their portfolios. They view U.S. equities as priced to perfection and are concerned that protracted negotiations around tariffs may cause markets to retreat. Callan continues to believe that hedge fund managers that are able to opportunistically adjust their portfolios in real time to changing market environments will be best positioned to profit from broad market moves.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.