Listen to This Blog Post

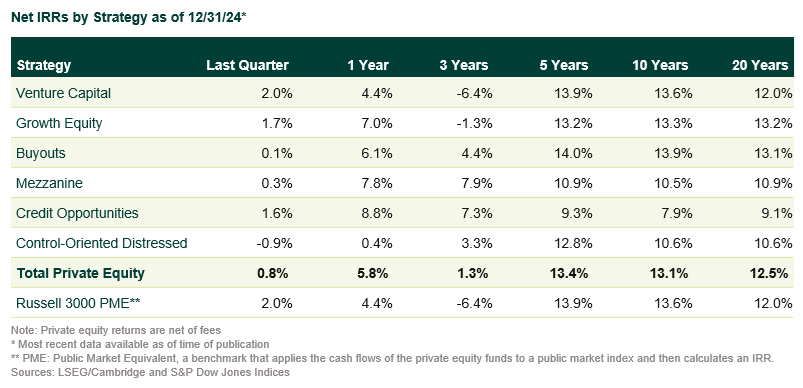

Private equity faced a mixed backdrop in 4Q24. Short-term results continued to trail public equities—unsurprising given the stellar run of the “Magnificent 7” tech names in listed markets—yet long-term performance remained solid. Because private equity returns are smoothed, the asset class tends to lag when public indices set record highs, but it likewise avoids the steep drops of those indices.

Details on 1Q25 Private Equity Activity

Fundraising | The industry closed roughly 40% fewer funds in 2024 than in 2023, extending a slide that began in 2021. Dollars, however, hardly budged as money flocked to established franchises: the 10 largest vehicles captured 20% of the year’s volume, and the average fund size jumped 45%. Constrained budgets and unsettled markets nudged institutional investors toward “safe” re-ups instead of backing smaller or emerging managers.

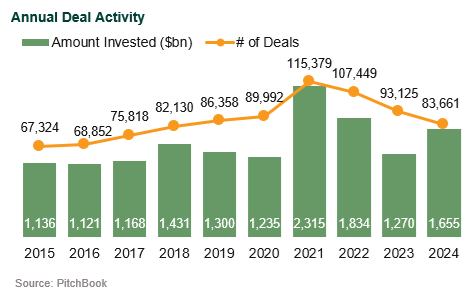

Deal activity | Dealmaking mirrored fundraising. The number of completed transactions fell for a third straight year—down another 11%—yet total value climbed 31% as sponsors pursued fewer but larger targets. The average deal size nearly doubled from 2023, and multibillion-dollar transactions spanned buyout, venture, and growth equity strategies.

Buyouts | Buyout managers finished 2024 with invested capital rising 22% while deal count edged up 5%, pushing valuations back toward their 2021 peaks. Cheaper debt, moderating inflation, and better credit availability supported activity into December. Those tailwinds faded early in 2025 as rate hopes reversed and tariff policy gyrated. Against that backdrop, operational know-how—pricing power, cost control, and nimble supply chains—looks more valuable than ever.

Venture Capital and Growth Equity | Venture and growth equity posted a third consecutive yearly drop in deal count, now roughly in line with pre-pandemic norms. Yet invested dollars gained 16%, buoyed by record-high early-stage valuations—up 28% year-over-year—thanks to fierce competition for AI startups. Late-stage managers responded by downsizing new funds, acknowledging a tougher deployment environment than in 2021’s frothier days.

Exits | Initial public offerings (IPOs) remained elusive. Exit value in 2024 sat at roughly 75% of pre-COVID levels for the second year running, marking a third straight year of subdued realizations. Early 2025 optimism, predicated on policy clarity from a new U.S. administration, has collided with renewed uncertainty and shifting tariffs. Roughly 4,000 sponsor-backed companies await an open M&A or listing window.

Returns | Short-term performance continues to lag public equity (driven by the “Magnificent 7”). Due to the smoothed nature of its returns, private equity doesn’t outperform when public equity is at record highs (it likewise doesn’t drop as sharply when public equity drops). By strategy type, buyouts, venture, and growth equity are comparable over the 10-year period, with buyouts continuing to outperform over short time horizons. In addition, the spread between the top 5% and bottom 5% funds hovers around 60 percentage points over a decade.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.