Listen to This Blog Post

A Favorable Backdrop for Corporate DB Plan Risk

The last several years have delivered an unusually favorable environment for corporate defined benefit (DB) plans. The sharp rise in discount rates used to value pension liabilities during 2020 drove liability values down almost overnight. That led to two fast and meaningful outcomes:

- Plans that were already well hedged preserved their strong positions.

- Plans that were not fully hedged saw an immediate funded ratio improvement, in some cases up to 10 percentage points (i.e., from 90% to 100%).

Since then, the equity markets have provided an additional tailwind. From 12/31/20 to 9/30/25, the S&P 500 generated a cumulative gain of over 90%, boosting the return-seeking side of portfolios and pushing funded ratios even higher.

While none of this is really “new news,” we wanted to understand what else happened, specifically with respect to glidepath positioning, hedge ratios, and the construction of liability-hedging fixed income portfolios.

1) Plans Progressed Down the Glidepath as Funded Status Improved

Funded ratios have risen broadly across corporate DB plans. Approximately 90% of Callan’s corporate DB clients have seen their funded ratio remain flat or improve since year-end 2020, with the median ratio moving from 91% to 108% as of 9/30/25. By comparison, S&P 500 plan sponsors, based on Goldman Sachs Asset Management data culled from 10Ks, saw median funded ratios shift from 89% (year-end 2020) to 100% at year-end 2024.

These funded ratio improvements pushed many sponsors further down their glidepaths. Today, 50% of our clients on a glidepath have either reached or are within 5% of reaching their terminal glidepath journey point. The terminal glidepath point for our clients typically starts at a funded ratio of 110% and runs all the way up to 130% for plans that are closed but still have a small benefit accrual.

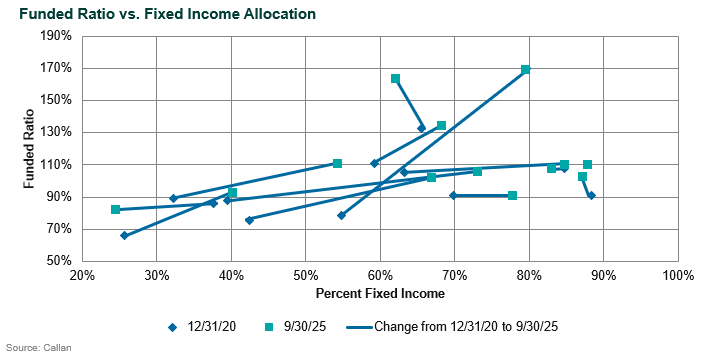

As plans advanced down the glidepath, their asset allocations shifted accordingly: The median fixed income allocation increased 10 percentage points from ~60% at the end of 2020 to ~70% at the end of 3Q25. For our clients not on a glidepath, the median allocation to fixed income remained unchanged at 50% throughout the period. The chart below illustrates how our client allocations to fixed income and funded ratios have changed since year-end 2020.

2) Interest Rate Hedge Levels Increased—Without Creating Over-Hedging

The interest rate hedge ratio is calculated as:

IRH = Funded ratio × portfolio duration ÷ liability duration

The blog post I wrote with my colleague Adam Lozinski goes into more detail about this key metric.

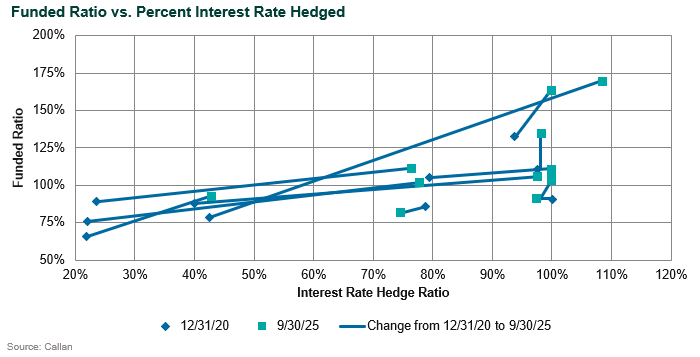

As funded ratios improved so did hedge ratios, often without requiring any action. Plans that were previously under-hedged naturally moved higher while plans that were already fully hedged generally remained fully hedged, instead of drifting into excessive hedge positions. The chart below illustrates how hedge and funded ratios have improved since year-end 2020.

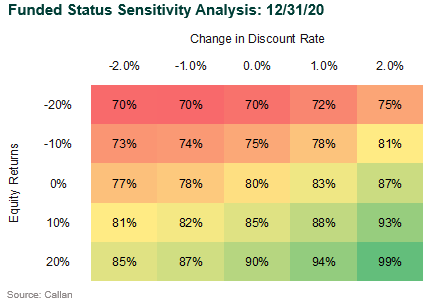

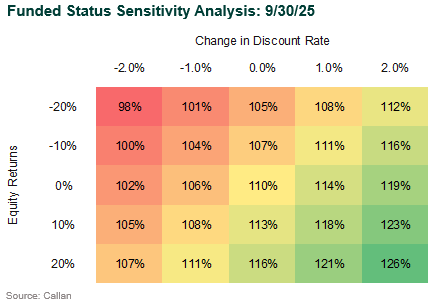

This matters because plans are now in a much better risk position than they were at the end of 2020. This can be illustrated by looking at the classic heat map, which illustrates the total funded ratio risk from changes to both equities and interest rates.

Notice that the funded ratio in the upper left-hand corner is now in a much better position than it was five years ago.

3) Once Fully Hedged, Plans May Have to Adjust Fixed Income Allocations

The more nuanced development is what happened to fixed income portfolios under the surface.

Even with higher allocations to fixed income, many plans reduced or held flat their overall portfolio duration. Why? Because liability durations have been shortening over time, especially for closed and frozen plans, as benefit payments accelerate and participant populations age. Couple that with higher funded ratios and higher allocations to fixed income, and the assets just do not have to work as hard to offset the interest rate risk found in the liabilities.

Without restructuring fixed income exposures, plans risk unintentionally becoming over-hedged. To avoid that outcome, sponsors have shifted away from STRIPS-heavy, ultra-long constructions toward more balanced, intermediate-focused sub-asset-class mixes.

These adjustments help plans:

- Stay aligned with shortening liabilities

- Maintain appropriate hedge ratios

- Prevent duration mismatch and over-hedging

- Right-size risk rather than a simple increase to fixed income

In other words, having more fixed income has led to a more thoughtful duration so that plans don’t become overhedged.

Conclusion: What This Period Really Taught Us

It’s no secret that the combination of a sharp increase in interest rates and a historically strong equity market has lifted corporate DB plans to higher funded ratios and better hedged positions. To make the most of the opportunities this unique period has created for corporate pension plans, we believe there are several key lessons to keep in mind:

- Rising funded ratios alone do not guarantee optimal hedge positioning.

- Falling liability durations require proactive recalibration.

- Avoiding over-hedging has become just as important as fixing under-hedging.

- Sub-asset-class construction in fixed income—not just allocation size—now drives success.

This last bullet is where we expect to see plan sponsors for fully hedged plans spending an increasing amount of their time. As the focus on sub-asset-class construction in fixed income evolves, we see intermediate allocations increasing over time, helping to reduce overall asset duration, which will help to more precisely target key rate exposures along the yield curve. As other plans reach fully funded status, we expect them to follow suit as soon as equity and interest rate hedging risks are subdued.

Callan’s Corporate Defined Benefit (DB) Group provides extensive research to assist clients with their plans. More of the group’s work can be found on our blog.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.