Listen to This Blog Post

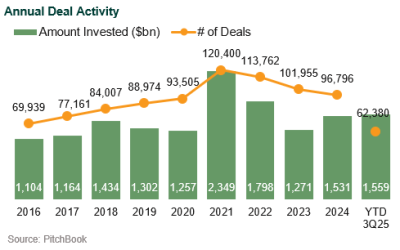

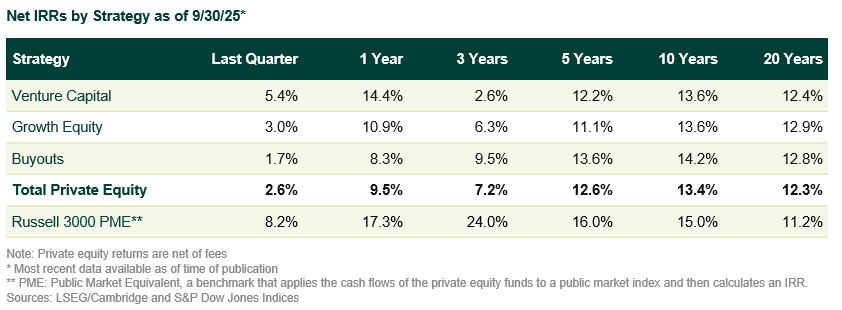

Fundraising plunged for the year-to-date period ending 9/30/25 compared to the same period last year, by both volume and count. Deal volume rebounded, although deal count continues to drop, reflecting the concentration of capital in bigger transactions. Buyouts soared, while the artificial intelligence (AI) boom continued to drive venture capital activity. Exits are beginning to recover, with M&A driving most of the activity. Private equity returns trailed the strong gains seen in the public equity markets.

Details on Private Equity Activity

Fundraising | By both volume and deal count, fundraising for YTD 3Q25 declined by ~30% versus YTD 3Q24. Persistent exit backlogs and limited distributions have constrained LP capacity for new commitments.

Deal Activity | Deal volume rebounded sharply during the quarter, rising 80% versus 2Q25 and returning to levels last seen in 2021. Deal count continues to drop, however, falling an additional 6% this quarter. The divergence between rising deal volume and declining deal count has persisted throughout the year, reflecting the continued concentration of capital in larger transactions.

Buyouts | Buyouts roared back in 3Q25 after a brief lull in 2Q25. Greater macroeconomic certainty, strong public markets performance, and Fed rate cuts fueled a rapid rebound in activity, confirming that the 2Q25 slowdown (following April’s Liberation Day) was only temporary.

Venture Capital and Growth Equity | The AI boom continues to drive venture capital activity, with deal volume and valuations pointing to a bull phase in venture’s typically cyclical market. Capital is concentrated in the largest transactions; YTD 3Q25 deal volume is up 33% from the same time last year, while deal count is down 21%. AI “mega deals” (>$1b) represented 70% of 2025 deal value.

Exits | Exit volume picked up meaningfully during the quarter, with 3Q activity nearly doubling 2Q levels. M&A has driven the majority of the recovery in exits, posting the strongest rebound with YTD 3Q25 volume up by 57% from the same point last year. IPOs have also regained momentum in 2025, led by several high-profile listings like Figma and Navan. YTD 3Q25 activity is up 20% from the same point last year.

Returns | Private equity posted steady gains of 2.6%, although trailing public equity’s strong performance. Over the short term, private equity’s more conservative valuation practices mean the asset class lags when public equity posts such outsized returns.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.