Listen to This Blog Post

Estimates of the number of furloughed federal workers due to the government shutdown that started on Oct. 1 and ended in early November varied from 600,000 to 900,000, while what sounds more like a guess of the number of workers compelled to work without pay ranges from 600,000 to 2 million. These estimates must be taken with a large grain of salt, because the source is of course not the federal government, but actors with a stake in the current political developments: public policy research organizations, political parties, and politicians themselves.

The Congressional Budget Office serves as a research body for all members of the elected Congress and was established as a counter to the Office of Management and Budget, which serves the executive branch in budget debates. The CBO is clearly a political body, so keep that in mind, but it has the resources to conduct thorough analyses of federal spending. The CBO estimates of the impact of the shutdown, dated Oct. 29, have been more measured than some of those floated by policy organizations and politicians, and the CBO accounts in detail for the impact of the length of the shutdown. The CBO estimates the number of furloughed workers at 650,000, and the number compelled to work without pay at 600,000, the very low end of the range of speculation. Delayed spending for a six-week shutdown is estimated to total $54 billion, with two-thirds of that hitting government spending on goods and services ($38 billion) and delayed compensation totaling $16 billion.

As the shutdown dragged on, programs like SNAP (food stamps) lost funding. According to the U.S. Department of Agriculture, 42 million people received monthly SNAP benefits in 2024. The average benefit per person was $187, so that adds up to almost $8 billion in spending per month.

Impact of the Shutdown on the Economy

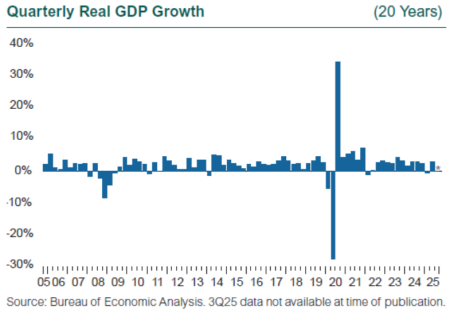

The macroeconomic impact of the shutdown includes spending put off by households hit by delayed compensation, suspended government outlays, and consumer spending funded by programs like SNAP. The CBO estimate of the hit to the economy is between 1 and 2 percentage points of GDP growth in 4Q25, with the expectation that spending will almost fully recover when the shutdown ends. The uncertainty imposed on households from withheld wage payments and benefits is harder to quantify. While workers are furloughed or compelled to work without pay as essential employees, it should be noted that the members of the U.S. House and Senate are still being paid. Given that the shutdown was resolved within the fourth quarter, the economic impact will indeed be temporary, with a spring back in higher-than-usual economic activity once spending resumes.

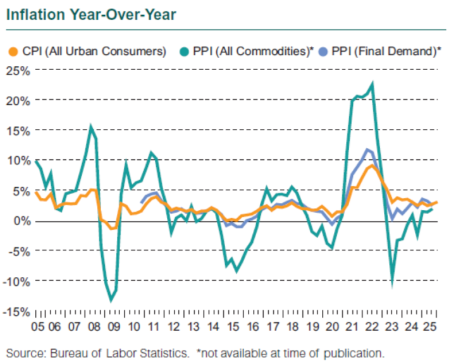

For those who follow the economy and markets, one of the more disruptive outcomes of the shutdown is the suspension of economic data releases. Federal workers were called back in to calculate and release the September CPI number (3%), as it is contractually tied to spending and benefits throughout the economy, not just the federal government. However, there have been no data releases on personal income, or consumption, or investment, or GDP. A delayed September jobs report released on Nov. 20 showed the economy added 119,000 jobs that month, while the unemployment rate rose to 4.4% from 4.3% in August. Revisions to July and August’s data showed a net 33,000 fewer jobs than previously reported. (If GDP growth falls, but there is no one around to record it, is it a recession?)

The last few months before the shutdown saw a dislocation between different measures of economic growth. The job market stopped expanding after April and generated the same number of jobs cumulatively over the next four months (107,000) that we would see in just one month over the previous two years. The unemployment rate remains at a historic low, but job turnover has ground to a halt, as the quit rate by workers and the rate of job creation (new jobs as a percent of total employment) have fallen to recessionary levels. So unemployment remains low, but no one dares make a change. This job market stagnation is hitting while GDP growth keeps surprising to the upside, surging 3.8% in 2Q, and with estimates for 3Q ranging between 1.5% and 3%. One explanation may be that the weak labor market is not due to softening labor demand, but rather to a lower labor supply because of a slowdown in immigration. Less easy to document is the impact of AI implementation; if AI improves productivity, it should reduce demand for labor, which would slow consumer spending, but that increase in productivity could also boost GDP and capital spending.

Alternative data sources on consumer and business activity offer fascinating insights into the specifics of spending, such as hospitality and food-away-from-home spending, entertainment, surging airline travel, credit card spending patterns, debt and household finances—and they are terrific complements to the broad spending, consumption, and investment data. But they are just that, complements, and these alternative sources are collected with a particular business in mind, so context and interpretation are key.

Just when the interaction of traditional and newer economic data from the private sector seems to be transforming how we understand our economy, we stop reporting the traditional data due to a shutdown! What is a market-following nerd to do? Losing the supply of traditional economic data, even temporarily, as the canvas against which these richer details can be cast highlights the importance of the vast data collection enterprise we entrust to the government, and our reliance on these data to make informed decisions. Who knew one could pine for a jobs report?

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.