At the start of every year, foundation investment committees examine a number of portfolio optimizations to arrive at a CPI+5% return portfolio. The inflation term ensures that the corpus of the fund remains intact, and 5% covers the average annual distribution requirement. But is that the whole story?

Traditional financial theory would hold that foundations as tax-exempt investors should be indifferent between sources of return—capital growth versus income. Both are subject to the same level of excise tax, and if one assumes level trading costs across asset classes, then a mean variance-optimized (MVO) portfolio should represent the best solution. But the funny thing about MVO is that while it is highly precise with regard to projected risk and return, it does not address the potential variation in a foundation’s annual net operating cash flow (NOCF).

Similar to an operating business, foundations have annual cash flows that determine their ability to make grants. Here’s a simplified accounting of how it is calculated:

NOCF = Investment Revenues (Realized Gains + Dividends + Yield) – Operating Expenses (Grants + Admin + IM fees + Taxes)

Investment revenues, especially for a CPI+5% return portfolio, are expected to display significant variation from one year to the next. On the expense side, the only item that displays significant variation is grants; administrative expenses are generally fixed, and investment management fees and taxes are pro-cyclical with investment returns. Therefore, the amount of cash available to pay grants is highly correlated to the variation in investment returns.

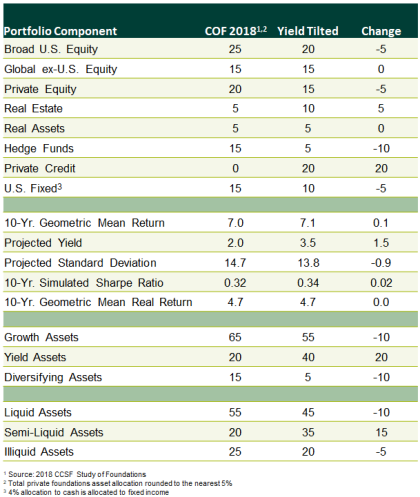

So while a foundation may need to hold a portfolio with a substantial allocation to growth assets to achieve its CPI+5% target, the investment committee has the purview to determine the composition of that CPI+5% return stream. When evaluating potential investment portfolios, taking the NOCF of a foundation into consideration can highlight some tradeoffs that the standard portfolio optimization does not. Consider below the 2018 Council on Foundations average total asset allocation for private foundations compared to a portfolio tilted toward yield-generating investments.

The two asset allocations are very similar, the most significant change being a shift from the hedge fund allocation toward private credit. Furthermore, there is little change in the expected 10-year nominal and real return, though the yield-tilted portfolio has a lower expected volatility of returns. In liquidity terms, the yield-tilted portfolio decreases liquid and illiquid allocations to fund a 15% increase in semi-liquid investments.

The big difference is the change in projected yield. The yield-tilted portfolio generates a 3.5% annual expected yield, representing 70% of a foundation’s 5.0% average annual distribution. Relative to the COF 2018 portfolio, it also displays a 75% increase in annual portfolio yield.

So what are the expected benefits of an increase in yield?

- The budgets of some grantees are heavily reliant on foundation distributions to run their operations. Having 70% of a foundation’s annual distribution flowing into the portfolio as yield can significantly help reduce annual spending volatility.

- Times of stress frequently leave foundations with public equities as the primary source of liquidity to service grants, administrative expenses, and capital calls. Having a good proportion of the annual distribution covered by yield helps to mitigate the need to source liquidity from assets where market prices are dislocated.

- With many foundations following a growth-oriented portfolio strategy similar to the COF 2018 portfolio, many grant-funded organizations will feel the pain more intensely as all of their funding sources reduce spending at the same time.

- Grantees may experience less variation in support from year to year and potentially have more impact through the ability to implement a longer time horizon for planning.

- The stability that an increase in yield brings to NOCF can also help foundation staffs plan more efficiently for grants throughout the year.

When considering asset allocation strategies, foundations should evaluate to what degree their grants and operating expenses should be supported by income-generating investments versus capital growth investments. In some cases, the operating budgets of grantees may be sufficiently flexible and/or sources of external cash flows large enough that a more total return-oriented approach is suitable.

However, for those where the foundation asset base is fixed and the financial flexibility of grantees is judged to be low, evaluating the components of expected portfolio return may lead to valuable discussions on portfolio structure and its role in supporting foundation operations.