For instance, to offset risk in a crisis situation, plans have examined strategies including Treasury bond allocations, momentum, multi-asset class (MACs), and even gold.

These discussions, as we have noted before, turn diversification on its head: Investors are looking for investments with similar underlying return factors (in this case equity) while seeking at least some diversification to smooth the ride within that large growth allocation. A broader growth allocation can then consider investments like high yield, convertibles, low volatility equity, hedge funds, MACs, and option-based strategies. This approach also allows for new strategies to be brought into the fold, based on prospective diversification or return enhancement. The broadening of growth assets often leads to a sharper focus on refining fixed income exposure to gain a “purer” exposure to interest rates.

In addition, the active/passive discussion continues to loom large. The argument to retain active to protect in a down market and be nimble in a volatile, low-return environment is compelling, but plan sponsors are weary of historical underperformance in actively managed equity. And tied to that discussion is the use of passive management to control costs.

For defined contribution (DC) plans, regulations, lawsuits, and implementation are driving factors for the decision-making process. Some of this conversation has led to negotiating a reduction of fees for the plans, in some cases to a significant extent. Heightened fee sensitivity and litigation have resulted in little traction for non-traditional asset classes such as liquid alternatives.

Target date funds (TDFs) dominate asset flows in DC plans; they now account for almost 30% of DC assets, according to the Callan DC Index™. TDFs have received an average of 71% of flows into DC plans over the last three years.

Over the last five years, Callan has seen several trends in asset allocation by different types of fund sponsors:

- Corporate funds: The range of U.S. fixed income allocations has widened, as these sponsors are in different stages of efforts to de-risk.

- Public funds: Many have increased their allocation to non-U.S. equity and real estate at the expense of fixed income. Capital market return expectations have created a difficult environment for total return investors.

- Endowments and foundations: They continue to move assets from fixed income to asset classes with expectations for higher returns. Global equity, non-U.S. equity, and real estate have all benefited from this shift.

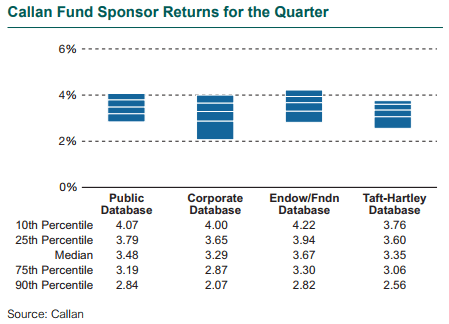

The performance by fund sponsors continued to be robust. Over the one-year ending with the third quarter, only corporate sponsors did not exceed the 10.9% return of a quarterly rebalanced 60% S&P 500/40% Bloomberg Barclays Aggregate portfolio. Endowments and foundations performed best over that one-year period, while corporate plans did best over a 10-year period. Taft-Hartley plans were the best-performing group over the past three and five years, partially due to a larger home-country bias.