For many portfolios and asset allocation studies, private equity plays a starring role because it boasts high projected returns and low enough expected correlations that mathematical models such as mean variance optimization love it. But private equity is not magic.

The reality is that valuation smoothing, company-size tilts, comparatively longer investment and holding periods, and higher market exposure derived from leverage explain the vast majority of the median buyout manager’s returns. So why do we invest in private equity? One reason: The implementation risks of private equity, commonly thought of as unrewarded, bind investors to their long-term portfolio growth objectives.

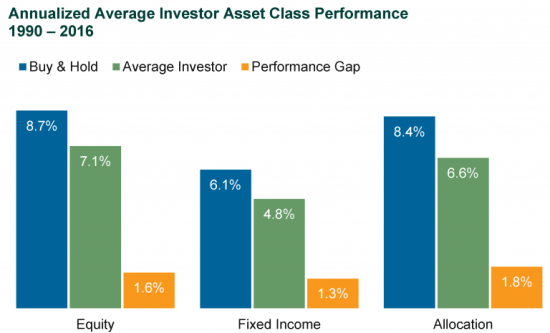

Illiquidity risk is an inherent characteristic of private equity investing. The return premium for accepting the risk is hard to estimate and varies over time, but the potential behavioral benefit is easy to understand. Most investors, driven by cycles of fear and greed, vastly underperform a buy-and-hold approach. Since this underperformance is created by buying high and selling low, the illiquidity of private equity allows investors to capture the long-term growth of a levered equity risk premium without emotional inference. In the exhibit below, the performance of a buy-and-hold strategy is compared to the results of a hypothetical average mutual fund investor. The performance gap isolates what the average investor lost due to poor timing decisions, and it can be extraordinarily large—1.6% annually in equity mutual funds over the 26 years analyzed.

Source: 2017 Advisor Perspectives, Inc.; David Blanchett, PhD, CFA, CFP®

Intuitively it makes sense that investments with higher expected volatility require longer time horizons to achieve their higher expected returns. However, it’s hard for investors to sit on their hands when public equity markets swoon. Private equity’s illiquidity forces investors to be patient. This forced patience also diminishes the return drag associated with unnecessary strategy turnover when skilled managers are penalized by short-term market trends.

A close relative to the illiquidity risk of private equity is timing risk. For example, when a public equity manager is hired, commitments are usually fully invested within a month. This is by design because the strategic asset allocation decision is made under the assumption of being fully invested. With private equity, committed capital is drawn deliberately by the general partner. As a result, most private equity programs include allocations to multiple vintage years and thus exhibit lower entry point or timing risk than public equity investments while exhibiting the j-curve distribution of returns.

Valuation risk, another structural element of private equity, arises from the lack of an active market in which a company’s individual assets and cash flows are priced in a transparent, transaction-based environment. In public equity markets, assets and cash flows are continually bought and sold. In private equity, pricing is quarterly and computed on an appraisal basis. The valuation risk resulting from this appraisal-based environment dampens the overall observed short-term volatility despite private equity’s higher levels of leverage. The resulting smoothed return pattern helps keep investors from abandoning their long-term growth investments during times of market stress.

As investors, we build portfolios where optimally all asset classes have an identified role. For example, public equity provides growth and volatility while U.S. Treasuries provide cash flow and flight-to-quality protection. In private equity, we expect exposure to a levered equity risk premium and a small cap size tilt while accepting exposure to illiquidity, timing, and valuation risks. Those three additional risks have a significant effect on how returns are generated and delivered over time. While these risks are regularly viewed as unrewarded, they in fact help to secure the benefits of a long-term investment approach.

1.6%

Performance gap annually between a buy-and-hold strategy and a hypothetical average equity mutual fund investor.