Both new investment activity and exit activity slowed markedly in 2023, following rising interest rates, declines in the public markets, and continued price uncertainty.

Details on 4Q23 Private Equity Activity

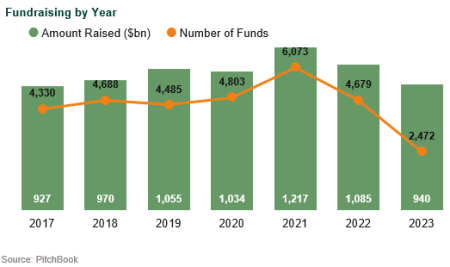

Fundraising | Fundraising declined back closer to historical levels in 2022 after its frenzied peak in 2021. So far, 2023 has been another down year, with LPs being more selective with their commitments.

Buyouts | There was a significant decline in deal activity this year after the highs of 2021-2022, caused by high interest rates, a wide bid-ask spread, and lingering effects from the slowdown in the public markets. There was also greater difficulty in obtaining financing this year, particularly for mega buyout deals, which has brought down leverage ratios across the industry.

Buyout valuations are finally starting to normalize in 2023 after their peak in 2021. Buyout valuations are sensitive to changes in interest rates—as the cost of borrowing rises, it is harder to justify high valuations.

Venture Capital and Growth Equity | There was a substantial decline in venture capital and growth equity activity in 2023, following the crazed highs of 2021 and early 2022. Valuations, likewise, have reverted back to historical levels, particularly at the late stage.

Exits | Exits have declined dramatically after hitting all-time records in 2021. Only 8% of total private equity AUM generated liquidity in 2023 (the lowest level ever)—lower even than the depths of the Global Financial Crisis.

With the IPO window still closed and increasing antitrust sentiment, it is unclear whether exit activity will rebound in 2024. IPO exits in 2023 were at just 15% of pre-pandemic levels.

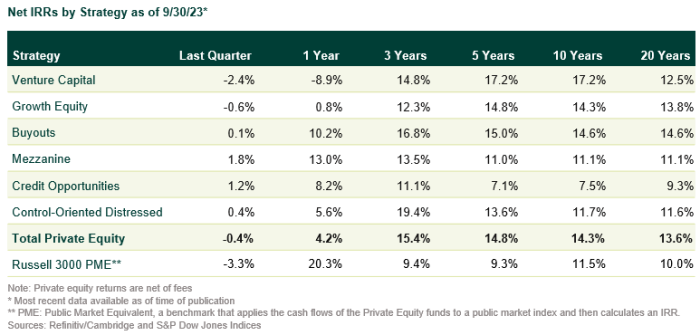

Returns | Public equity’s strong recovery in 2023 (led by the “Magnificent Seven” technology stocks) has left private equity in its wake. Private equity only saw about a fifth of the gains of the public markets over the last year, on a PME basis.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.