Callan’s Capital Markets Assumptions are developed at the start of each year, detailing our long-term expectations for return, volatility, and correlation for broad asset classes. These projections represent our best thinking regarding the outlook for equities, fixed income, real assets, and alternatives, and they are a critical component of the strategic planning process for our institutional investor clients as they set investment expectations over five-year, ten-year, and longer time horizons.

Our assumptions are informed by current market conditions but are not directly built from them since the forecasts are long term in nature. Equilibrium relationships between markets and trends in global growth over the long term are the key drivers, resulting in a set of assumptions that typically changes slowly (or not at all) from year to year. Our process is designed to ensure that the forecasts behave reasonably and predictably when used as a set in an optimization or simulation environment.

How the Callan Capital Markets Assumptions Process for 2023 Worked

We began the assumption-setting process for 2023 on the heels of yet another truly historic year that saw U.S. stock and bond markets fall together for only the third time in a calendar year since 1926. Low interest rates combined with kinks in the supply chain and the invasion of Ukraine sent inflation soaring across the globe in 2022. Central banks around the world, including the U.S. Federal Reserve, responded by raising borrowing rates in an attempt to slow inflation. In the U.S., the Bloomberg US Aggregate Bond Index fell 13% as higher rates hurt existing bond prices, while the S&P 500 Index dropped 18% as investors became spooked by the growing threat of recession brought about by tightening.

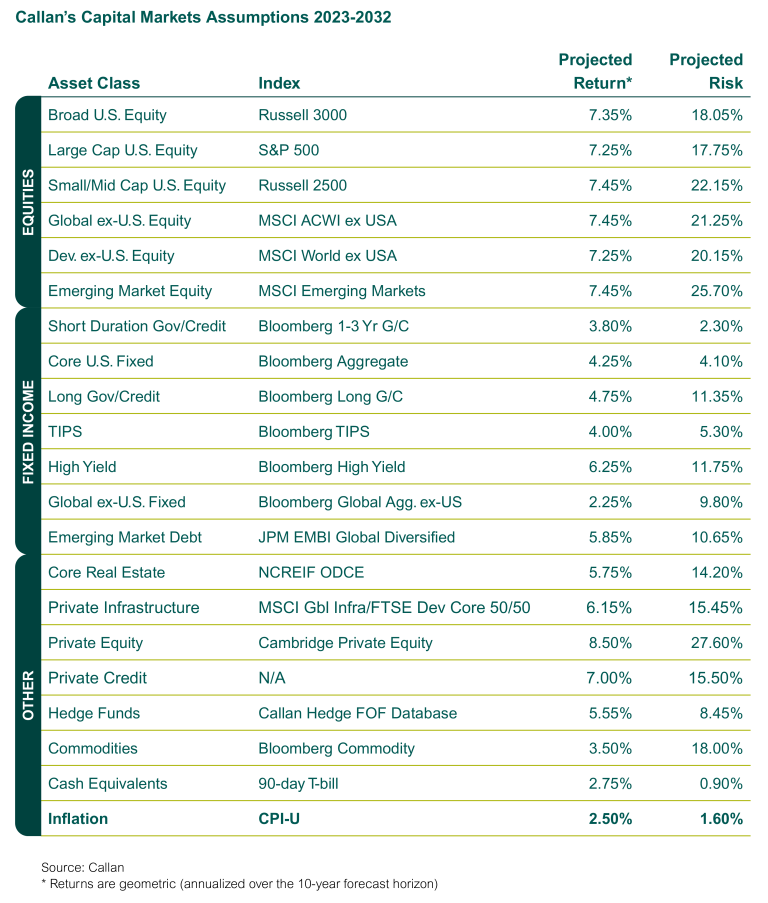

Key inputs to our assumption-setting process included equity valuations back in line with their historical averages and bond yields that once again made fixed income attractive purely from a return standpoint. Not surprisingly, our 2023 Capital Markets Assumptions differed quite a bit from the prior year, particularly for fixed income. Our core U.S. fixed income assumption rose 250 basis points to 4.25% for the next 10 years on the back of higher starting yields. We increased our return expectations for public market equity segments by approximately 75 basis points from a year earlier, centered around 7.25% for large cap U.S. equity. Returns for private markets asset classes rose as well, with the exception of private real estate. Finally, we increased our 10-year inflation assumption to 2.50% from 2.25%.

Our white paper on Callan’s Capital Markets Assumptions, available at the link below, provides extensive detail about the process behind our assumptions, the economic environment in which they were made, and the specific factors that went into projections for individual asset classes. In addition, we have a web page with even more information here. And we have published a blog post that examines how our projections have done compared to actual returns over time.

The table below summarizes our risk and return projections for individual asset classes as well as the relevant benchmarks: