Volatility returned in the first quarter, with the Dow Jones Industrial Average and S&P 500 Index both finishing lower—a first since the third quarter of 2015.

U.S. Stocks: Dow, S&P 500 Fall, First Time Since ‘15

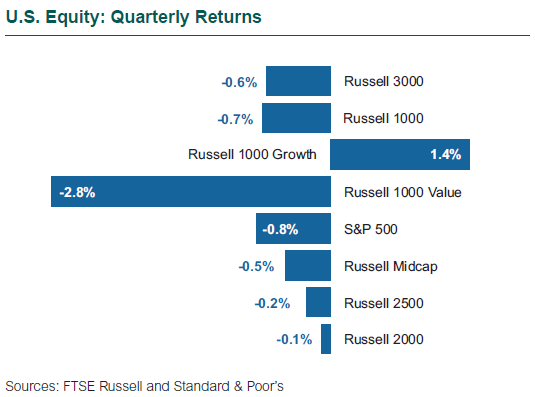

After starting strong on the back of solid earnings and tax law changes, U.S. equities faltered in the second part of the quarter over concerns about a more aggressive global trade policy and uncertainty over the pace of interest rate hikes. The S&P 500’s modest quarterly loss (-0.8%) belied volatile intra-quarter results. The Index experienced six days of movements greater than 2% during the quarter (versus none in 2017). And the Index reached a record high on Jan. 26, then fell about 8% to close the quarter. Volatility as measured by the VIX Index skyrocketed by 116% on Feb. 5 when the market sank 4%.

Small capitalization stocks outperformed large caps (Russell 1000: -0.7%; Russell 2000: -0.1%), though sector performance was mixed. The prospect of a trade war with China weighed on large caps since many of these companies are exposed to international markets (S&P 500 aggregate exposure is approximately 40%) while small caps were less affected as they tend to derive a higher proportion of their revenue from domestic markets (approximately 80-90%) and benefit from a more protectionist policy.

In mid-March, some mega-cap Tech firms saw their stock prices drop in the wake of Facebook’s Cambridge Analytica scandal, leading to declining trust for the industry and negative investor sentiment. The market began pricing in the potential for more regulatory oversight for these internet companies. Performance for the “FANGs” split during the quarter, with Facebook and Google down while Netflix and Amazon advanced.

Growth continued to top value (Russell 1000 Growth: +1.4%; Russell 1000 Value: -2.8%). Value trailed as the prospect of increased inflation and accelerating interest rates weighed on interest rate-sensitive sectors (Financials: -1.0%; Real Estate: -5.0%; Utilities: -3.3%). Energy (-5.9%) also took a hit despite a more promising outlook for the sector as the Saudis agreed to continued oil production cuts into 2019; performance for the first quarter was impacted by Exxon Mobil and Chevron missing fourth quarter earnings expectations.

Despite the increased volatility and price drop in the broader index, defensive sectors underperformed cyclicals due in large part to the rising interest rate environment. Technology (+3.5%) and Consumer Discretionary (+3.1%) were the only two sectors that posted positive returns. Telecommunications (-7.5%) and Staples (-7.1%) were the two worst-performing sectors.

Global Stocks: Spooked Markets Lag

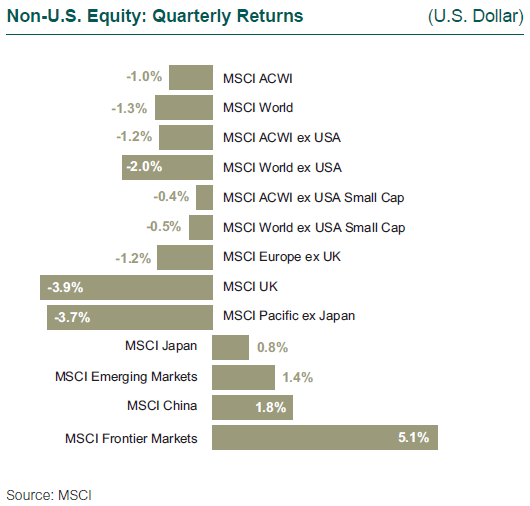

Despite positive economic data, non-U.S. developed equity under-performed U.S. as non-U.S. equity markets were spooked by geopolitical tension and market volatility along with fears of rising U.S. interest rates and inflation (MSCI World ex USA: -2.0%; MSCI Europe: -2.0%). Emerging markets continued to outpace developed, fueled by a soft dollar and synchronized global growth; however, fears of inflation and its implication on the trajectory of U.S. monetary policy—as well as a potential trade war between the U.S. and China—weighed on the market. Developed non-U.S. small cap outperformed large cap given the risk-on market environment spurred by synchronized global growth.

While developed non-U.S. equity market returns were negative, results were helped by U.S. dollar weakness. Overall, the MSCI EAFE fell 4.3% in local terms but only 1.5% in U.S. dollar terms. The U.S. dollar has been hurt by growing worries over a trade war with China as well as signs that rates may be poised to rise in other countries as global economies improve. Likewise, Brexit woes sank the U.K. market (-8%) but the pound’s appreciation versus the dollar offset a good portion of the loss for U.S. investors; on that basis the country fell 4%. The euro-zone recovery continued, with GDP growth of 2.7% in the quarter year-over-year driving the euro up 2%—and the pound by nearly 4%—relative to the dollar.

Japan’s economy grew by 1.6% fueled by infrastructure development ahead of the 2020 Olympics, enabling the yen to surge by 6% relative to the dollar. It hit a 17-month high as worries over trade policy spurred demand for the safe-haven currency and was the best-performing currency among developed markets. In local terms, Japan equities fell nearly 6%, but the strength of the yen brought returns in U.S. dollar terms to +0.8%.

The only sectors that posted positive returns were Consumer Discretionary, Tech, and Utilities. Positive earnings supported the Tech sector (top performer), and Utilities benefited as investors fled to safety amid market volatility and yield curve flattening in March. Telecom struggled as competition for wireless services within the euro-zone eroded profitability, and Staples was notably challenged due to fears of interest rates returning to normal levels and the prospect of beleaguered growth.

Growth outpaced value, and earnings growth and quality factors were in favor as markets were jittery in light of the global economy’s looming risks. As such, high-beta, cyclical sectors and factors struggled.

Emerging Markets: Oil Propels Shares Higher

The MSCI Emerging Markets Index rose 1.4%. Brazil (+12%) and Russia (+9%) were among the best performers due to climbing oil prices and improving economic conditions. China (+2%) continued to thrive despite trade tension with the United States and a slowdown for Chinese tech companies; China’s supply-side reforms are kicking in and economic growth in retail and home sales exceeded expectations, driving up returns for the Financials and Real Estate sectors.

Although India announced better-than-expected GDP growth of 7.2%, the country notably lagged (-7%) due to poor market sentiment surrounding asset-quality issues at large state-owned banks and relative valuations of Indian equities.

Supported by rising oil prices, Energy was the best performing sector; conversely, Consumer Discretionary fared worst, weighed down by India. Value and sentiment factors were in favor as the economic recovery story gained traction and momentum; however, quality factors also added value given that this is the mid-cycle of the recovery.

Non-U.S. Small Cap: Growth in Favor This Quarter

Developed non-U.S. small cap outperformed large cap (MSCI World ex USA Small Cap: -0.5%) given the risk-on market environment spurred by synchronized global growth, although within emerging markets, small cap lagged large cap (MSCI Emerging Markets Small Cap: +0.2%).

Growth was favored in both developed and emerging market small cap, as growth-oriented sectors such as Health Care and Consumer Staples outperformed cyclical sectors.