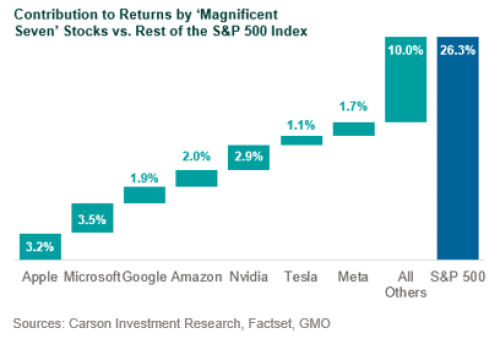

The Magnificent Seven dominated headlines in 2023, most notably for its performance throughout most of the year but also for its concentration within benchmarks. Individually, each stock (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, Tesla) was up over 50% for the year, and collectively the group accounted for nearly 60% of the S&P 500 Index’s total return for the year.

The Seven’s presence, both in weight and attribution, affected just about every large cap portfolio. Investment managers, regardless of whether they were concentrated or diversified, saw their upside participation challenged, particularly for those with zero weights or underweights to names within the cohort. This was even true for large cap value and ACWI portfolios when their respective benchmarks had one or more of the Magnificent Seven.

Key Considerations About the Magnificent Seven

Index concentration and the contribution of a small cohort of holdings to index performance are not new challenges for active large cap managers. The outsized weight and performance of the Magnificent Seven stocks have continued to highlight the importance of philosophical and structural considerations when assessing managers’ relative underperformance to the benchmark. Some of these key considerations include:

- Adherence to diversification requirements for U.S. mutual funds: Diversification guidelines under the Investment Company Act of 1940 limit the aggregate of greater than 5% stock allocations to 25% of total portfolio assets (in other words, no more than one-quarter of the total portfolio can consist of stocks that, individually, represent 5% or more of the value of the portfolio). This rule has become a structural limitation for diversified managers as it has challenged their ability to actively weight holdings within the Magnificent Seven. Throughout various periods in 2023, zero weights and/or underweights to these stocks hurt relative performance. It should be noted that some large mutual fund providers have pivoted from a diversified to non-diversified status in recent years to circumvent weighting challenges with top benchmark stocks, though many have elected to remain diversified.

- Alignment with underlying portfolio parameters around risk: Many managers have elected to maintain construction parameters, particularly around position sizing, active weights, and percentage of total portfolio assets within the top 10 to 20 holdings, in the spirit of ensuring a balanced distribution of active risk. Much like the structural limitations enforced by the mutual fund diversification rules, equal to active weights in the largest benchmark names were difficult to establish for managers that desired to avoid top-heavy portfolio concentration and outsized single-issuer active risk.

- Alignment with valuation considerations: The precipitous rise in the valuations and share prices of the Magnificent Seven stocks suggest a high hurdle for initial participation (and for additional allocations), particularly for managers with a valuation-conscious discipline. While Magnificent Seven returns were less outsized in the second half vs. the first half of 2023, there was little to stymie the overall momentum of these stocks, subsequently limiting the opportunity for certain managers to initiate and/or build meaningful positions as the year ended.

Not all hope was lost as some managers were able to outperform in spite of challenges for large cap growth active management. Returns within the Magnificent Seven decoupled briefly in the fall of 2023 in the face of potential interest rate volatility, rewarding managers with zero weights or underweights to stocks, like Tesla, that traded away from the group.

Some managers benefited from themes that buoyed the performance of Magnificent Seven stocks but approached exposure through basketing or diversification. For instance, instead of taking an outsized position in NVIDIA to participate in the momentum of artificial intelligence, some managers elected to do so through a basket of several semiconductor positions or exposure to other Technology positions; this not only gave them exposure to the theme but also helped to navigate potential active risk issues by avoiding a concentration in one position.

Innovation within Health Care, particularly related to GLP-1s (diabetes/weight loss treatments), strongly benefited investors as share prices of participating pharmaceutical companies soared on the uptake of these drugs. Cyclical positioning—such as tilts to housing, infrastructure, and reshoring—through diversified Industrials exposure also buoyed managers’ performance.

Exploring diversified sources of alpha within a portfolio will remain important in 2024 as, thus far, the Magnificent Seven continues to account for a significant portion of S&P 500 returns. Disaggregation of returns within the cohort also continues, leading to even more concentration of leadership. For instance, only four stocks—Amazon, Meta, Microsoft, and NVIDIA—account for nearly 75% of the S&P 500’s total return year to date. However, much like last year, understanding managers’ biases and limitations around the Magnificent Seven (and portfolio construction in general) will not only help to deconstruct attribution, but re-affirm decision makers’ alignment with the underlying philosophy supporting a portfolio construction approach.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.