Listen to This Blog Post

Private credit delivered another quarter of strong performance, extending its long-term track record of outpacing public credit markets. Yet the asset class continues to face competition from broadly syndicated loans, especially for larger deals, as well as persistent fundraising headwinds.

Key trends in private credit

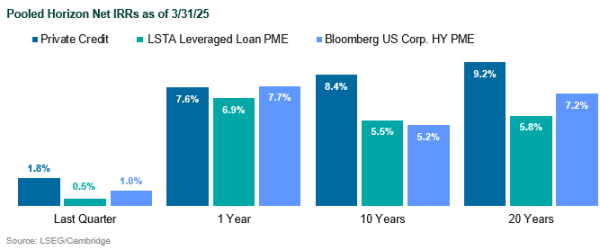

Performance | Private credit continued to outperform leveraged loans and high yield bonds over 1Q25 and across longer horizons. Loan market sentiment deteriorated as 1Q25 progressed due to tariff concerns, volatility, and uncertainty over macroeconomic conditions, leading to a decline in loan prices and investor appetite and widening new-issue spreads, especially for lower-rated borrowers. This volatility hurt the performance of the LSTA benchmark, which allowed for private credit to stand out.

For the 10 years ended March 31, 2025, the asset class delivered a net internal rate of return (IRR) of 8.4%. Higher-risk strategies led performance during this period.

Yields | U.S. sub-investment grade corporate yields rose dramatically at the beginning of 2022, with yields peaking in September, due to a combination of higher interest rates due to tighter Fed policy and a widening of high yield spreads. Effective yields dropped in 2024 but then increased to start 2025. Spreads contracted in 2024, a continuation from late 2023, due to stronger credit conditions as the U.S. economic outlook improved. However, by the end of March 2025 high yield effective yields spiked.

Spreads | On the pricing front, average spreads for M&A-related institutional loans rose notably in 1Q25, climbing to 372 basis points (bps) over SOFR by March—up from 324 bps in January. Original issue discounts also widened, pushing new-issue yields on these loans to 8.6%, compared to 7.9% just two months prior. Despite this increase, overall spreads for riskier borrowers remained historically tight. Loans to B and B- rated issuers averaged spreads of 330 and 370 bps over SOFR, respectively—levels not seen since before the Global Financial Crisis.

Fundraising | Fundraising remained subdued. 1Q25 saw the lowest number of fund closes for any first quarter in the last seven years. Still, demand from institutional investors remained solid. Direct lending dominated new fundraises, followed by mezzanine debt.

Refinancing | Borrowers continued to refinance private credit loans through cheaper syndicated markets. The quarter saw $8.8 billion of direct lending debt refinanced via broadly syndicated loans, the second-highest quarterly volume in at least four years. Borrowers realized average spread savings of 260 bps in the process—an attractive tradeoff in a volatile environment. This dynamic underscores a growing challenge for private lenders. As large syndicated markets re-open and offer lower-cost capital, some borrowers are opting for public loan solutions.

Loan Volume | Institutional loan issuance related to mergers and acquisitions reached $52 billion in 1Q25, the highest total since early 2022. Leveraged buyouts (LBOs) comprised nearly half that total, supported by a resurgence in private equity activity. Notably, higher-rated issuers drove most of this growth. Just 14% of M&A volume came from B- borrowers—the lowest share in two years—as investors favored stronger credits amid widening spreads.

Credit Conditions | Fundamentals remained robust. Corporate bond and loan default rates stayed below 2%—well under the historical average of 3% – 4%. Indicators of market distress, such as the Corporate Bond Market Distress Index, have continued to decline since peaking in 2022. Looking ahead, North American private credit is forecast to grow at an annualized rate of 11%, reaching $1.74 trillion in assets under management by 2029. European markets are also expected to expand, albeit more gradually. Amid continued macro uncertainty, the asset class appears well positioned—but the race for quality deals remains fierce.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.