Best gain for ODCE in a decade

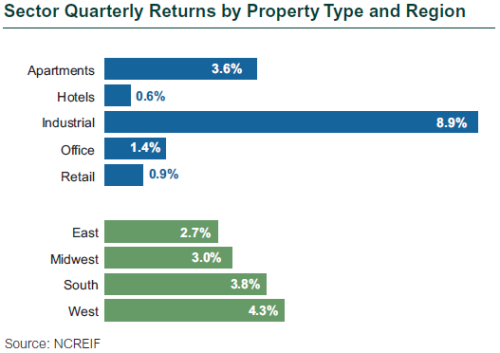

- The recovery gained steam as the NCREIF ODCE Index posted its strongest quarterly return in 10 years; Industrial remains the best performer.

- Income stayed positive except in the Hotel sector.

- Niche sectors such as self-storage and life sciences continued to be accretive.

- Vacancy rates kept compressing in Industrial and Multifamily as demand stayed strong.

- Net operating income stayed negative for Office and Retail but a recovery continued.

- Tenants were poised to return to work but the Delta variant may change that.

- Pent-up demand is evident through foot traffic in retail centers.

- 2Q21 rent collections showed relatively stable income throughout the quarter in the Industrial, Apartment, and Office sectors; the Retail sector remained challenged, with regional malls impacted most heavily.

- Class A/B urban apartments were relatively strong, followed by Industrial and Office.

- Demand outpaced supply as new construction of preleased Industrial and Multifamily occurred.

Global REITs outpace broader equity market recovery

- Global REITs outperformed in 2Q21, gaining 9.2% compared to 7.7% for global equities (MSCI World).

- U.S. REITs rose 12.0% in 2Q21, beating the S&P 500 Index, which gained 8.5%.

- Globally, REITs are trading above NAV with the exception of those in Hong Kong, the United Kingdom, and Continental Europe.

- Ongoing volatility in REIT share prices offers opportunities to purchase mispriced securities, individual assets from REIT owners, and discounted debt.

- It also gives investors the potential to lend to companies and/or execute take-privates of public companies.