Listen to This Blog Post

Private credit has outperformed leveraged loans over the past 10 years ending Sept. 30, 2025. Spreads continued to compress and yields ground tighter. Secondaries strategies led fundraising. The economics of switching from private credit into the syndicated loan market were largely unchanged from 2Q25. Default rates stayed low.

Key Trends in Private Credit

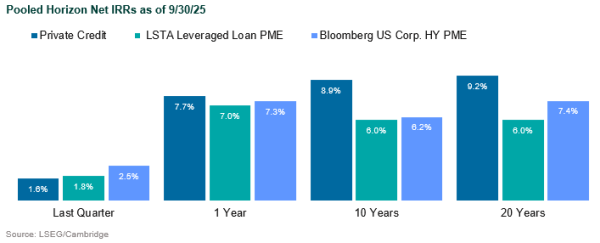

Performance | Over the past 10 years the asset class has generated a net IRR of 8.9%, outperforming leveraged loans as of Sept. 30, 2025. It has also topped leveraged loans and high yield over the last 1, 5, and 20 years ended 3Q25. Higher-risk strategies have performed better than lower-risk strategies.

Spreads | Spreads and yields continued to grind tighter into 3Q25, with average M&A loan spreads compressing from 361 bps and YTMs of 9.0% in September 2024 to 307 bps and 7.4% by September 2025, reflecting sustained credit spread tightening and materially lower all-in borrowing costs.

Fundraising | The top four funds raised in 3Q25 were across various verticals of private credit. In 3Q25, secondaries strategies led capital formation, followed by opportunistic funds, with distressed debt trailing.

LBO Financings | Relative economics for switching from private credit into the syndicated loan market were broadly unchanged from last quarter, with average spread savings in 2025 YTD holding around ~150 bps, modestly below the ~160 bps implied through mid-year and still well under the ~215 bps achieved in 2023, as direct lending spreads continued to compress in parallel with BSL pricing.

Yields | Option-adjusted spreads tightened in 3Q25 as investors grew more confident in credit quality, defaults remained low, and demand for high yield stayed strong amid improving risk sentiment. Effective yields still increased, not because of higher base rates, but due to price declines in lower-quality segments, heavier issuance, and a shift toward riskier credits with higher coupons, which lifted the overall yield level even as spreads narrowed.

Distressed and Opportunistic Debt | Default rates for U.S. corporate bonds and loans remained subdued through 3Q25, with LTM data continuing to trend below 2%, well under the historical average of 3% to 4%, reflecting a prolonged period of limited credit stress.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.