Listen to This Blog Post

Callan’s 2025 Asset Manager Sustainable Investment Practices Study revealed several notable developments and trends in how investment managers are approaching environmental, social, and governance (ESG) integration, compared to our first study two years ago. Overall, momentum behind ESG efforts has slowed since our last survey in 2023. Fewer firms reported having a firmwide ESG policy, and several other ESG-related practices have leveled off or declined. The gap between larger and smaller managers, and between U.S.-based and non-U.S. firms, also persisted.

The study captured responses from more than 1,600 investment managers worldwide, spanning a broad array of public and private asset classes. While public equity managers represented the largest share of respondents (46%), fixed income, real estate, and private markets managers were also meaningfully represented. Most respondents (66%) were smaller firms with less than $10 billion in assets under management (AUM), while 10% managed more than $100 billion. The vast majority (just over 80%) were U.S.-based firms. The study data reflected responses to a set of questions in Callan’s proprietary database as of March 31, 2025, and we expect to update the results every other year.

Key Takeaways from our 2025 ESG Study

Activity around ESG slowed by most measures.

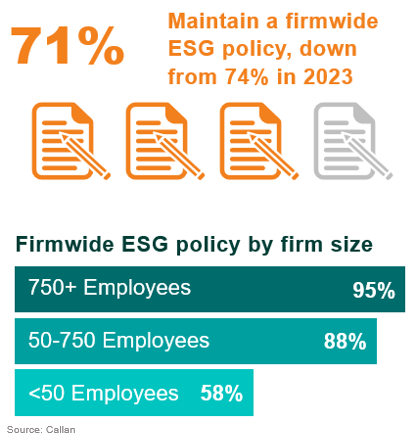

- ESG Policies: The percentage of firms maintaining a firmwide ESG policy declined to 71% in 2025, down from 74% in 2023.

- Dedicated ESG Staff: The percentage of firms employing full-time ESG professionals (35%) fell from 41% in 2023.

- Callan’s ESG Score: Callan’s proprietary ESG Score provides a quantitative, high-level assessment of a firm’s adherence to industry best practices, ranging from 0 to 3. The median score remained unchanged at 2.05.

- Integration of ESG Research: 76% of firms reported integrating ESG research across their investment platforms, compared to 77% in 2023.

- Third-party ESG Research: 64% of managers subscribed to third-party ESG research, a 5 percentage point decrease from the prior study. This practice remains most common among public equity and fixed income managers.

- Engagement Activity: ESG engagement with company management on financially material topics was most common among private equity (68%) and real estate (66%) managers, followed by public equity (50%) and fixed income (47%).

Large vs. Small Organizations

Larger firms continued to demonstrate greater resources and depth in ESG implementation, and this was reflected in a discernable skew in several areas.

- Higher ESG Scores: Large firms (>$100 bn AUM) had a median ESG Score of 3.00, compared to 1.41 for small firms (<$10 bn AUM).

- Firmwide ESG Policies: Nearly all large firms had a published ESG policy, versus only 60% of small firms.

- Sustainability Reporting: About 90% of large firms (>750 employees) published annual or quarterly sustainability reports, compared to just over 20% of small firms (<50 employees).

- Dedicated ESG Professionals: Roughly 90% of large firms (>750 employees) employed full-time ESG professionals, compared to 59% for medium-sized firms (50-750 employees) and 16% of small firms (<50 employees).

- Centralized ESG Research: Around 70% of firms with over $10 billion in AUM maintained an internal ESG research repository, compared to 50% of smaller organizations.

- Proxy Voting Policies: More than 70% of firms over $10 billion in AUM had proxy policies addressing ESG, versus fewer than 50% of those under $10 billion.

- ESG Engagement: Engagement on ESG topics was reported by over 80% of large firms (>$100 bn AUM), compared to 40% of small firms (<$10 bn AUM).

U.S. vs. Non-U.S. Firms

Non-U.S. investment organizations continued to have a greater focus on sustainability investment practices than U.S. peers in several key ESG areas.

- Sustainability Reporting: Over half of non-U.S.-based firms published sustainability reports, compared to about one-third of U.S.-based firms.

- Carbon Footprinting: Over two-thirds of non-U.S.-based managers reported carbon footprinting capabilities, versus roughly 40% of U.S. firms.

- Proxy Voting Policies: More than 75% of non-U.S.-based equity managers had proxy policies addressing ESG, compared to just over 50% of U.S.-based firms.

- ESG Engagement: ESG engagement was part of the investment process at over 70% of non-U.S.-based firms, compared to just under 50% of U.S. managers.

Looking Ahead

Callan’s 2025 study highlights a plateau in ESG policy adoption and resource allocation, particularly among smaller U.S. firms. Nonetheless, integration of material ESG factors in investment processes remains widespread, and engagement practices continue to evolve across asset classes. Callan has observed increasing divergence between firms that continue to enhance their sustainability practices and those that are maintaining or reducing their efforts. Ongoing shifts in regulation, disclosure, and client priorities will continue to shape how firms approach ESG integration in the years ahead.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.