Prior to the Global Financial Crisis, issuers of commercial mortgage-backed securities (CMBS) passed 100% of the risk to bondholders. After the GFC, the Dodd-Frank Act instituted new rules requiring that any institution securitizing a pool of commercial mortgages retain at least 5% of the bond.

This risk retention is designed to give the CMBS issuer an incentive to ensure that the security includes high-quality loans and to align the interests of the issuer with bondholders. These rules went into effect in December 2016.

The Many Flavors of These Bonds

Secured by mortgages in commercial properties, a CMBS can include either conduit bonds or single asset/single borrower (SASB) bonds:

- Conduit bonds typically have deal sizes that are often close to $1 billion and are collateralized by mortgages on properties representing a diverse range of commercial property sectors. The bonds are typically comprised of 50 to 100 loans that range in size from $1 million to $100 million. The majority of the underlying mortgages have a 10-year term with fixed-rate, monthly payments. The mortgage properties are typically fully leased.

- SASB bonds are backed by a single loan, and are either single asset or single borrower. Single asset refers to bonds in which the underlying collateral is a loan on one commercial asset, while single borrower refers to a portfolio of assets held by the same borrower. SASB bonds can vary greatly: The underlying loans can be either fixed or floating rate and come with maturity terms that vary from deal to deal.

Regardless of the type of CMBS, all commercial mortgage-backed securities are divided into tranches, and they are repaid in order of these tranches from the senior-most AAA tranche to the lowest, unrated tranche. Investors holding the junior tranches are the most likely to absorb losses on the securities if the underlying mortgages perform poorly; in exchange, given the risk position, these tranches offer the potential for higher yields.

Explaining Risk Retention

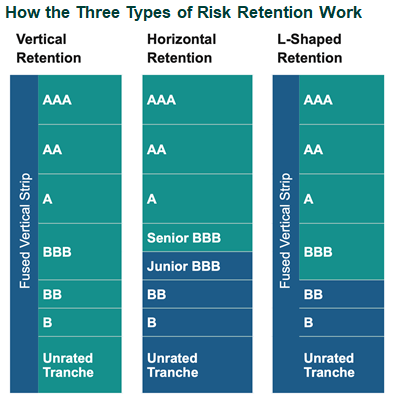

Three structures have been used to implement risk retention:

- Vertical Retention: This requires a CMBS issuer to retain 5% of the face value of each tranche of securities at the time of issue. The 5% pieces are fused together to form a single vertical strip. Only the CMBS issuer is permitted to own the vertical strip, and it must hold the strip until the bond is paid down to 33% of the original balance, which typically takes 10 years.

- Horizontal Retention: This requires a CMBS issuer to retain a share of the most subordinated classes that represents 5% of the fair value of the securitization. CMBS issuers are permitted to sell this horizontal interest to a third-party investor that is required to retain the risk retention interest for a minimum of five years, subject to certain restrictions to ensure the CMBS issuers’ interests remain aligned with those of the bondholders. In addition, there are restrictions on the third-party buyer’s affiliations with other parties in the transaction, the identity of the buyer has to be disclosed, and the buyer must pay in cash at closing. After five years the horizontal interest can be sold to another third-party buyer, subject to restrictions.

- L-Shaped Retention: This requires a CMBS issuer to retain a vertical interest and horizontal interest that on a combined basis represent at least 5% of the value of the securitization. As with the horizontal structure, a third-party buyer may acquire and retain the horizontal interest, but the vertical interest must be retained by the CMBS issuer until the CMBS trust pays down to 33% of the original balance.

Assessing the Market

For investors willing to take on additional risk, tighter regulation of CMBS’s has created opportunities. While horizontal risk-retention investors take on duration and structure risk by putting themselves in the first loss position for a fixed term, liquidity is exchanged for yield accretion. Illiquidity premiums for horizontal SASB bonds ranged from 150 bps to 200 bps in 2017 (when investors began buying the bonds) and fell to a range of 100 to 125 bps in 2019. For conduit risk-retention bonds, illiquidity premiums were approximately 200 bps in 2017 and by 2019 were 150 bps to 200 bps.

Investors can access horizontal risk-retention bonds largely through private real estate debt funds and separate accounts with investment managers that have expertise in both real estate and public markets investing. It is important that an investor work with a manager that has closed on risk-retention purchases and has demonstrated to the CMBS issuer it can meet the obligations and execute agreements required by the risk-retention regulations.

This blog post provides a summary of our recent paper on the subject, click below to read the full report.