Listen to This Blog Post

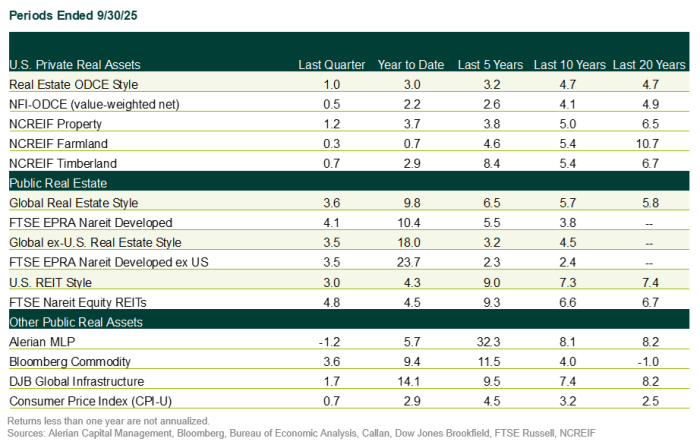

U.S. private real estate continued to show signs of early-stage recovery in 3Q25. Valuations appear to have stabilized after a prolonged reset triggered by higher borrowing costs, and income returns remained positive across regions and property types. Appreciation results were mixed, however, as Office and Retail assets struggled while most other sectors notched modest gains or held steady. Real estate investment trusts (REITs) advanced but lagged broad equities, and infrastructure fundraising rebounded sharply—driven almost entirely by mega funds.

Private Real Estate | Valuations Stabilize as Activity Picks Up

Higher interest rates remain the dominant force shaping private real estate. Borrowing costs have climbed meaningfully over the last two years, and valuations have largely adjusted. In 3Q25, appraisals edged higher across most sectors, suggesting that values may have bottomed. Income returns strengthened, supported by relatively stable occupancies and disciplined expense management.

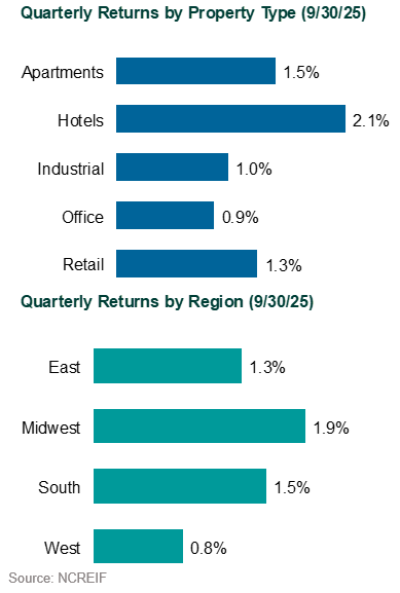

Appreciation trends diverged by property type. Industrial, residential, and niche sectors generally gained ground, while Office and Retail assets depreciated. The West region trailed the broader market as continued repricing of Southern California industrial properties weighed on results. Manager dispersion inside the NCREIF Open-End Diversified Core Equity (ODCE) Index stayed wide, reflecting differences in portfolio composition and exposure to challenged assets.

Transaction activity also improved, extending the momentum that began earlier in the year. Rolling four-quarter totals rose, even as volumes remain below five-year averages. The quarter-over-quarter uptick was driven in part by the reversal of tariff policy, which removed a source of uncertainty for buyers and sellers. Elevated interest rate volatility continues to slow dealmaking, but valuations have adjusted to reflect higher financing costs, creating a clearer—if still cautious—pricing environment.

Redemption queues continue to shrink. ODCE queues stood at roughly 12% of net asset value (NAV), down sharply from the 1Q24 peak of 19.3%. Some of the improvement stems from rescinded requests at a handful of large managers, while increased transactions also aided queue reductions. Even with the recent progress, queues remain elevated compared to long-term norms.

Dry powder remains ample. North American private real estate investors hold more than $230 billion in uncalled capital, creating capacity to pursue distressed opportunities, structured equity, and recapitalizations as valuations stabilize.

REITs | Solid Quarter but Behind Broader Equities

Global REITs advanced in the quarter but continued to trail global equities. Global REITs gained 4.1% compared to the MSCI World Index’s 7.3% increase. U.S. REITs climbed 4.8%, also lagging the strong 8.1% rise in the S&P 500 Index.

Valuations remain compelling. Global REITs traded at an –8.0% discount to NAV, wider than the long-term average discount of –3.9%. The discount suggests that public markets continue to price in uncertainty around interest rates, refinancing conditions, and property-level fundamentals, particularly in Office.

Real Estate Capital Markets | Refinancing Pressures Mount

Lending markets showed early signs of thawing. Bank issuance increased, though additional sources of capital are needed to support refinancing demand. A sizeable wave of maturities scheduled for 2025—driven by prior short-term extensions—will test liquidity, especially across multi-family and office loans.

While office conditions remain challenging, there is an increasingly positive sentiment as the highest-quality assets in strong sub-markets are experiencing leasing strength. Demand is starkly bifurcated between newer vintage, highly amenitized assets, while demand continues to drift for older vintage assets as companies recalibrate space needs.

Infrastructure | Mega Funds Dominate a Rebound in Capital Raising

Infrastructure fundraising regained momentum in 1H25, reaching the highest level since 1H22. Capital flowed overwhelmingly to mega funds, with 80% of commitments going to roughly six managers. The closed-end fund market continues to broaden, with new offerings in infrastructure debt, energy transition, digital infrastructure, and emerging markets. Open-end infrastructure funds also expanded, with multiple entrants since 2020.

Tailwinds include accelerating digitalization, robust demand for power and grid upgrades, and continued support for energy transition initiatives. Headwinds persist as well, including tariff and recession risk, high interest rates, and shifting regulatory policies.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.