This is one in a series of quarterly blog posts providing context for public defined benefit (DB) plans about their returns over time, from our Public DB Plan Focus Group. Previous posts in the series can be found here.

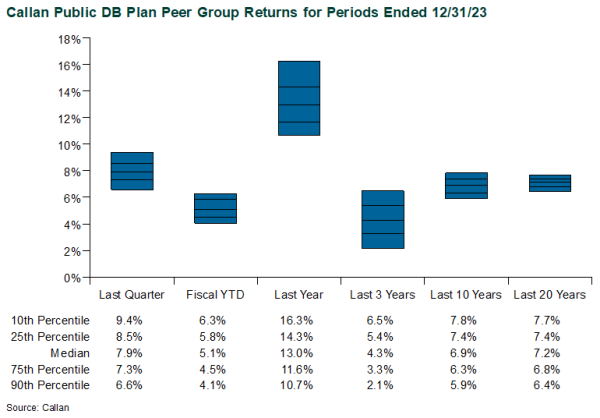

Public plans bounced back in the second quarter of fiscal year 2024 (which ended Dec. 31, 2023), driven by strong returns across most asset classes. Markets rallied following more dovish rhetoric from the Fed in December, as investors believed we may be in for more interest rate cuts than expected in 2024. The median projection for the year-end 2024 Fed Funds rate was 4.6%, down from 5.1% at the September meeting. No members expected higher rates at the end of 2024. Markets have priced in more cuts than the median Fed projection suggests. Public equities and core fixed income, the largest allocations among public plans (average allocation: 48% and 25%, respectively), returned 11% and 7%, respectively, during the quarter.

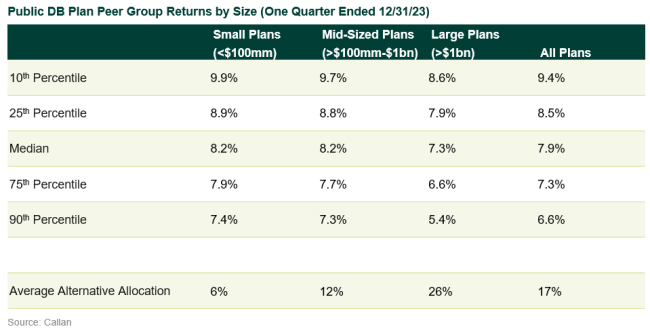

After experiencing losses in the first fiscal quarter, public plans returned approximately 8% in the second fiscal quarter, lifting the median fiscal year-to-date return above 5%. As in previous quarters, small plans outperformed larger plans due to their smaller average allocations to private markets assets. Private real estate and private equity, asset classes in which bigger plans have larger average allocations, were some of the only asset classes to experience negative returns during the quarter. Private real estate specifically, as represented by the NCREIF ODCE Index, was down 5% during the quarter.

Over longer timeframes, larger plans have benefited from their private markets exposure. Over the last 10 years, the median return for large public plans was 0.57% higher than smaller plans (7.17% vs. 6.60%). Should volatility continue to remain elevated, we’d expect continued dispersion in returns experienced by large versus small public plans due to their differentiated exposure to alternative asset classes reliant on the lagged valuation mechanism of private equity and smoothing of returns in real estate.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.