This is one in a series of quarterly blog posts providing context for public defined benefit (DB) plans about their returns over time, from our Public DB Plan Focus Group. Previous posts in the series can be found here.

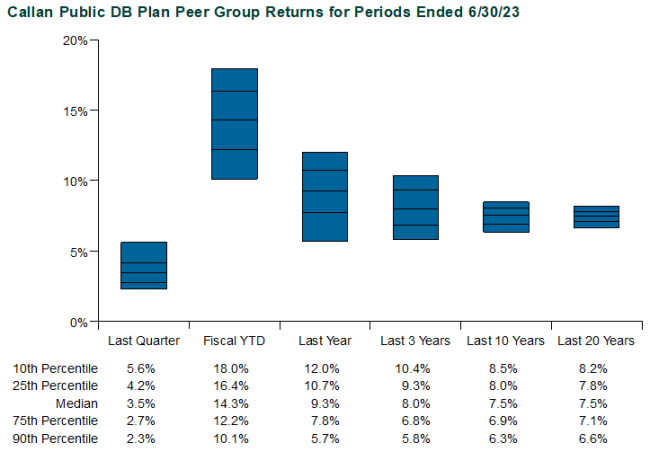

Public defined benefit (DB) plans bounced back in fiscal year 2023, after suffering the second-worst fiscal year on record in 2022 (median public plan return: -9.51%). After a slow start in 3Q22 (median public plan return: -4.45%), public plans surged, driven by strong results from global equity markets and a slight reprieve from rising interest rates.

While there is still work to be done to reach December 2021’s high water mark, public DB plans have recovered over 60% of the losses from fiscal year end 2022. Public funds are back on track to exceed their expected return assumptions, as longer-term results are ahead of an assumed return of 7.25% (75% of public plans have an assumed return of 7.25% or lower).

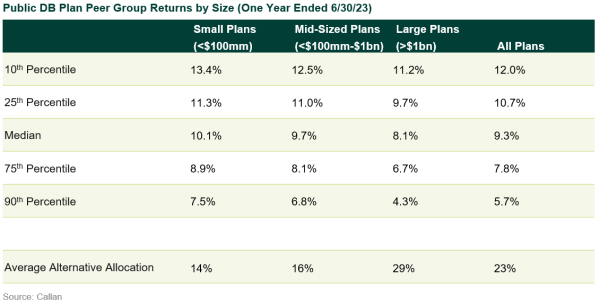

In a reversal from fiscal year 2022, smaller public DB plans outperformed large plans for fiscal year end 2023. As we highlighted in last year’s review of fiscal year performance, the allocation to private market investments had an outsized impact on comparable results, largely driven by their unique pricing mechanisms. Large plans outperformed smaller plans in 2022 as their heavier allocation to alternatives benefited results, as asset classes like real estate and private equity were slower to realize changes in the market, therefore delaying losses.

In 2023 private market valuations continue to absorb the losses experienced in the previous year, while public equity has rallied sharply (Russell 3000 Index 2023 fiscal year return: +18.95%). Smaller plans tend to have a lower exposure to alternative asset classes and greater allocations to public equities, helping their results. Over the long term, we’d expect the difference in pricing mechanics of private markets versus public markets to smooth out over time.

As always, we believe that public DB plans should focus on the ultimate purpose of the assets; identify their goals and objectives; and develop an investment program that balances the need for asset growth, income, liquidity, and risk mitigation. This will help ensure benefit payments for all. Public plans should focus on long-term results and avoid overreacting to near-term market fluctuations. As illustrated by 2022 and 2023, capital markets can change quickly, and investors should avoid chasing the latest in vogue asset classes.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.