Foundations Adopt ESG at the Highest Rate; Endowments No. 2

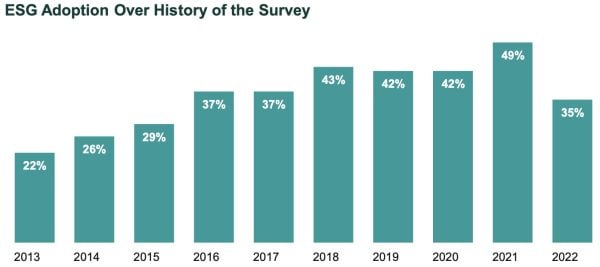

Callan’s annual survey on environmental, social, and governance (ESG) principles is designed to better understand the views of institutional investors and the trends driving ESG adoption. In our recently published 2022 ESG Survey, we found that 35% of respondents incorporated ESG into their investment decision-making process, down 14 percentage points from the previous year’s level, the first decline since 2019 and the lowest level since 2015. This can be attributed in large part to a significant drop in the share of public plans incorporating ESG, likely due to a shift in the respondents to this year’s survey.

At the same time, we found that 20% of respondents not yet incorporating ESG were considering doing so, also a decline from last year’s figure but higher than for most years prior to 2020.

This year’s survey reflects input from 109 U.S. institutional investors. Respondents included public, corporate, and nonprofit defined benefit (DB) and defined contribution (DC) plans, as well as endowments and foundations, with assets under management (AUM) ranging from small (under $500 million) to large (more than $20 billion). More than a third of respondents were public plans, either DB or DC, the largest share by investor type, while endowments and foundations represented 30% of respondents. By size, 35% of respondents have $3 billion or more in assets, while 37% have less than $500 million in assets. By sector, the largest share (29%) came from the government.

Highlights of the 2022 ESG Survey

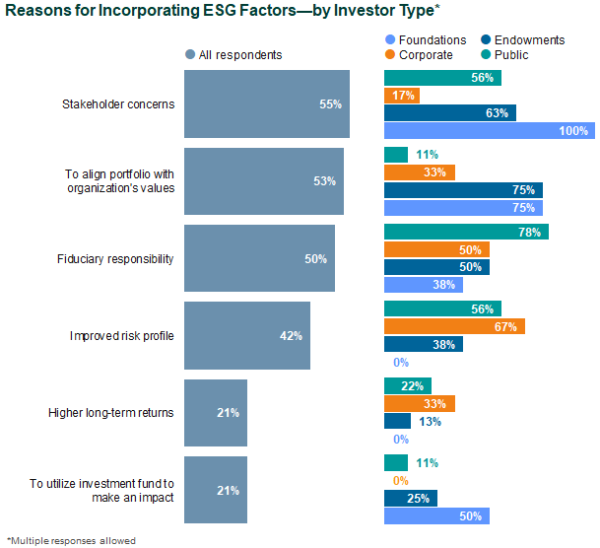

- Investor type: Foundations (53%) incorporated ESG at the highest rate among survey participants, closely followed by endowments (47%). Of corporate plans, 26% incorporated ESG, up from 20% in 2021. But for public plans, only 24% incorporated ESG compared to 63% in 2021, reflective of the variety of public plans that can make up the respondent group in different surveys.

- Investor size: 47% of plans between $3 billion and $20 billion in AUM incorporated ESG, the highest by size, closely followed by 45% of plans over $20 billion in AUM.

- Investor location: ESG adoption was highest by investors in the Northeast and lowest by those in the Mountain region. We observe increasingly polarized ESG policies at the state and municipal levels. There are both states requiring ESG incorporation by public plans and states banning ESG incorporation in various forms.

- Adoption over time: Two-thirds of respondents that incorporated ESG began doing so within the last seven years.

- DC plans: The survey also highlighted data from the proprietary Callan DC Index™ and reported that 14% of DC plans offered a dedicated ESG option. Usage remained low, however, with an average allocation of 2.7%. Using the results of our most recent Callan DC Survey, we also noted that 7% of plan sponsors intend to add an ESG option in the next year.

- Those not incorporating it: 60% of respondents did not incorporate ESG into investment decision-making. Of these respondents, 47% said the benefits of doing so were unproven or unclear and 34% said they did not believe there is convincing research tying ESG to better performance.

- Motivations: The most frequently cited reason for incorporating ESG was stakeholder concerns, followed closely by the desire to align the portfolio with the organization’s values.

- Allocations: Only 26% of respondents that incorporated ESG maintained an ESG allocation separate from their main portfolio, indicating broader integration is preferred.

- Implementation: Our survey broke implementation down into two methods: inclusion in investment decision-making and adoption into the manager selection process. The most common form of ESG incorporation in the investment decision-making process was adding language to the investment policy statement, with nearly three-quarters of respondents that incorporated ESG doing this. Regarding manager selection, three-quarters of respondents that consider ESG incorporate it with every investment manager selection.

- Environmental actions: The most common actions taken regarding environmental investment strategies were decarbonizing the portfolio (21% of respondents incorporating ESG) and allocating a portion of assets to positive environmental impact/climate solutions (21%), followed closely by shareholder advocacy (20%) and divesting fossil fuel investments (17%).

- Product interest: Active U.S. equity (45%) topped the list of public markets asset classes for which investors sought more product offerings. Private equity (35%) led the list of private markets strategies.

- Future direction: 52% of respondents that had incorporated ESG factors in investment decision-making did not plan to make any changes to their usage of ESG factors in the coming years, indicating that many of those adopting ESG have already made sufficient strides and will need to make fewer changes.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.