The recent Annual Meetings of the International Monetary Fund and World Bank Group, which I attended along with thousands of global fixed income investors, policymakers from governments issuing debt, economists, and other market participants, offered a wealth of insight and analysis for institutional investors on the global financial picture.

In its World Economic Outlook report, the IMF upgraded its forecast for global economic growth in 2018 by an almost imperceptible 0.1 percentage points to 3.7%. The IMF also assessed economic prospects over the medium term and raised a variety of warning flags:

- Aging demographics

- The shrinking slack between economic growth and economic potential (referred to as the output gap)

- Slow measured productivity and wage growth

- Threats to globalization (e.g., Brexit)

- Difficult-to-predict policy direction in the United States

- Geopolitical tensions

- Risks to global financial stability

Credit ratings agencies responsible for assessing the risk of sovereign defaults also pointed out that the cyclical upturn in growth expected across most emerging market economies did not give them cause to upgrade their ratings, which are intended to look through the credit cycle.

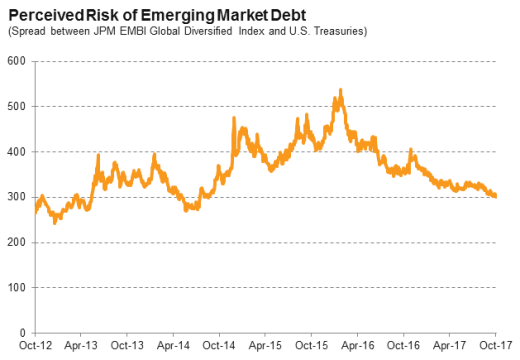

While the IMF’s tone was cautious and a number of economists were decidedly pessimistic, the bullishness among global and emerging market fixed income investors was palpable. Optimists pointed to easy global financial conditions characterized by low volatility and record inflows into emerging market debt and equity funds. This has resulted in riskier assets, such as high yield corporate bonds and emerging market debt, strongly outperforming safer assets such as U.S. Treasuries this year.

Evaluating whether current valuations will be justified and recent strong short-term performance of riskier assets will continue comes with a lot of uncertainty. But investors able to take a long-term view may benefit from the diversification and potential for increased return that global and emerging market fixed income can provide to a traditionally U.S.-biased fixed income portfolio.