Market volatility spiked in February, coinciding with declines for the S&P 500 Index and the Bloomberg Barclays U.S. Aggregate Bond Index. Callan surveyed leading multi-asset class (MAC) strategy providers to understand how the products reacted in this newly volatile environment because many of these investment approaches purport to provide downside protection, diversification, and/or minimal correlation to equity markets. MAC strategies also have very different investment approaches that should cause dispersion in returns from one strategy to the next, even within categories.

While one month is too short to assess long-term investment performance, we thought it would be interesting to look for common themes across strategies. Our survey covered returns and their drivers, as well as changes to investment outlooks and portfolio positioning, and included these categories:

Risk premia: Long and short exposure to risk factors (e.g., momentum, value, and carry) across multiple asset classes. Expected volatility can range from 5% to 12%.

Long biased: A well-diversified MAC strategy with a long-term growth orientation. May be long only or long/short. Typically trying to achieve equity-like returns with less risk.

Absolute return: MAC strategy that employs relative value trades and hedging to mitigate directional bets. Emphasizes downside protection, resulting in lower volatility.

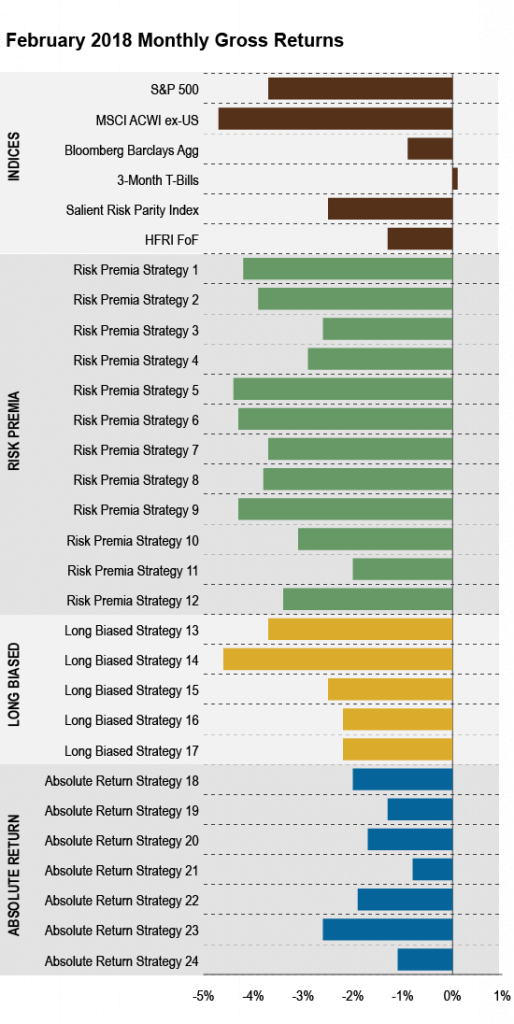

All the strategies that we sampled suffered drawdowns in February.

Risk premia strategies fell an average of -3.5% and notably displayed lower dispersion than previously observed, with monthly returns falling into a narrow range of -2% to -4.4%. Volatility, carry, trend, and equity value were key detractors during the month, according to the managers we surveyed. If we continue to observe more months like February, it will call into question the belief that alternative risk premia can diversify a portfolio during times of market stress.

The low return dispersion between a presumably wide variety of risk premia strategies is curious given that managers have very different factor designs and often don’t choose the same weights for each factor. For example, strategies are split on whether or not they pursue the volatility risk premium, generally associated with selling options contracts. Volatility, as reflected in options markets, was at the epicenter of February’s rough patch for markets. A number of market participants with highly concentrated short U.S. equity volatility positions were forced to unwind trades at distressed valuations in a short period of time and close down their products. The lack of dispersion serves as a reminder that investors should exercise care when seeking diversification from multi-manager structures.

Long biased strategies fell an average of -2.9% in February, which was less than the average for risk premia. Long biased managers confirmed that equity beta was indeed a key driver of negative returns for February.

Absolute return managers fell an average of -1.4%. The relatively smaller drawdown for absolute return managers was expected due to their low exposure to equity/bond beta and emphasis on downside protection.

All MAC managers reported that return results landed within expectations, so none were among those forced to close down their products. This should serve as a reminder on the importance of diversification and risk management.

A flare-up in volatility and simultaneous drawdown in equity markets resulted in all the diversified MAC strategies we sampled experiencing negative returns in February despite pursuing very different investment processes and sources of return across categories. Results for long biased and absolute return were in line with our expectations. One month and a small sample size is insufficient data to evaluate a category of strategies, therefore February did not provide any significant evidence that MAC strategies can’t play a role in investor portfolios.

For more on MAC strategies, please see our paper on the topic.