Remember the BRIC countries? The acronym was coined in 2001 by Goldman Sachs economist Jim O’Neill for the economies of Brazil, Russia, India, and China to convey that their relative economic growth would continue to exceed that of the so-called Group of 7 (Britain, Canada, France, Germany, Italy, Japan, and the United States) and thus their increasing global economic importance should be recognized by the G-7.

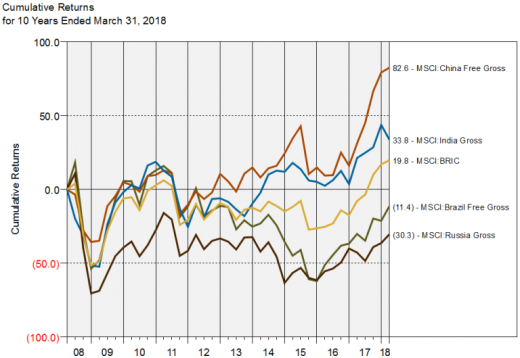

We don’t have to look back that far to see how much times have changed in the emerging markets from the heyday of the BRICs. Both Brazil and Russia have experienced recessions in the past decade, while India and China have continued to grow, and their stock markets have experienced much stronger returns than those of Brazil and Russia.

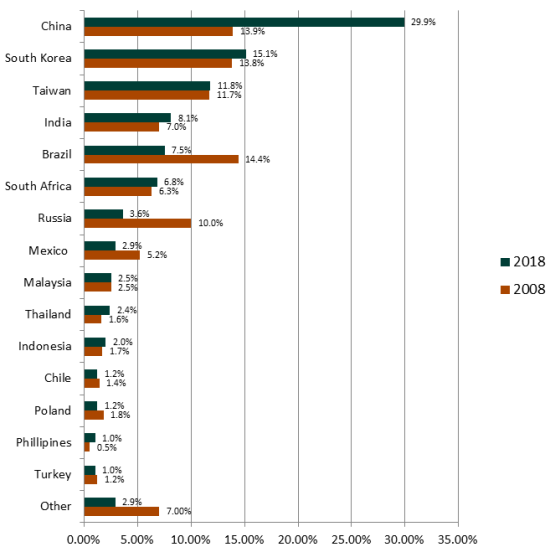

China in particular has become an increasingly large part of the emerging markets, and that has driven changes in both the country and sector weights in the MSCI Emerging Markets Index. Ten years ago, China was 13.9% of the index, and that weight has now more than doubled to 29.9%. Conversely, Brazil and Russia’s weights have both plummeted—Brazil’s by nearly half and Russia’s by more than half.

With the inclusion of China A-shares in the MSCI EM Index in 2018 (see Callan’s paper on this subject here), China’s relative index weight is expected to grow. China has not only the world’s second-largest economy but also its second-largest equity market, after the U.S. ($12 trillion versus $26 trillion as of March 31, 2018). Initially, the China A-share stocks included in the index will account for only 0.73% of the EM index. However, China’s weight within the EM Index, including the addition of A-shares and overseas-listed Chinese companies, is expected to swell from roughly 30% to over 40%. China, South Korea, and Taiwan are already 56.8% of the MSCI EM Index. In 2008, the top three countries of Brazil, China, and South Korea represented only 42.1% of the index.

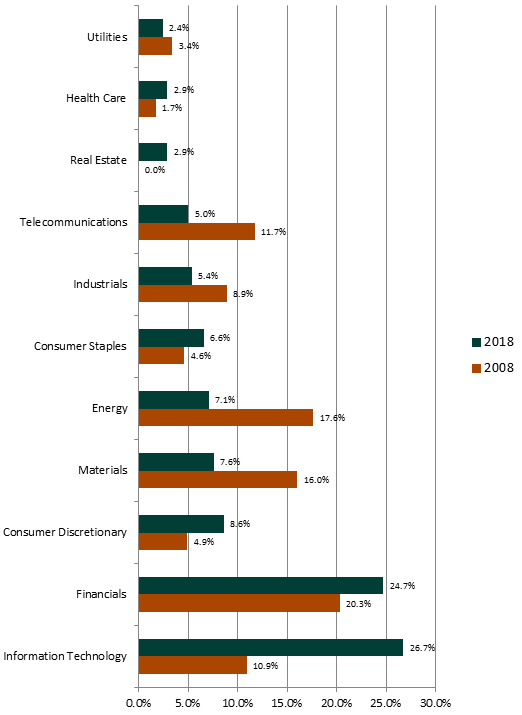

Sector weights have also changed drastically in the past 10 years, with an overall shift to new economy sectors from cyclical, commodity sectors. Information Technology (26.7%), Financials (24.7%), and Consumer Discretionary (8.6%) now comprise 60% of the MSCI EM Index. A decade ago, the market was relatively less concentrated (the top three sectors represented 53.9% of the index), and two of the three largest sectors were energy and materials.

What does all this change mean for asset owners investing in emerging market equities?

- Start with a review of your emerging market exposure. If you have active emerging market managers, consider their country and sector exposures relative to the index.

- For instance, some active emerging market managers have been structurally underweight in China for reasons that include valuations and governance concerns. Managers should be able to explain the rationale of their China positioning.

- In a multi-manager structure, country and sector positioning are factors to consider when reviewing whether manager exposures are complementary.

- If your exposure to emerging markets is purely passive, consider the increasing level of concentration by country and sector, and whether exposure to emerging markets should be structured differently to mitigate these concentration risks.

- As we look to the next decade, asset owners with large emerging market equity portfolios may consider having dedicated China exposure given the size and growth of the market.

One cautious note: As the diverging path of the BRIC economies and stock markets has shown us, past performance is no guarantee of future returns.