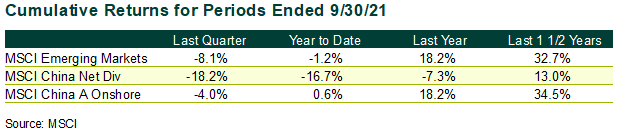

The 8.0% plunge in the MSCI Emerging Markets Index in 3Q21—its worst quarter since 1Q20—stemmed from the stronger U.S. dollar, rising U.S. yields, higher oil prices, and the significant decline of China’s equity market, which comprises about one-third of the Index. China has been hurt by its government’s regulatory interventions, the country’s electricity shortages, and the potential default of Evergrande. Of note, the MSCI China A Onshore Index outperformed the offshore market by over 1,400 basis points during the quarter, because the stocks (e.g., Alibaba, New Oriental Education) that fell the most represent a much larger weight in the offshore Chinese equity market.

Given China’s weight in emerging market indices, institutional investors should understand how active managers have been managing this exposure and adapting to the changing landscape when considering emerging market allocations. This blog post discusses China’s regulatory crackdown, Evergrande and China’s property sector, and the implementation implications for investors.

New Focus by Regulators

Since China opened its economy in the 1970s, annual real GDP growth has averaged 9%, and it has moved from a poor to an upper-middle-income country. However, the growth model in the last four decades has been heavily dependent on low-paid labor, resource-intensive manufacturing, and exports rather than domestic consumption, leading to imbalances such as income inequality, a heavily levered property sector, and a high cost of living.

The regulatory crackdown began in November 2020, when China blocked Ant Group’s initial public offering (expected to be the largest in history) given its concerns about the way the financial technology company was potentially sidestepping banking regulations and using consumer lending data.

Several weeks later, Chinese officials announced they were investigating Alibaba for monopolistic practices. That investigation led to a $2.8 billion fine for the company. Alibaba was not the only company under pressure. The government soon announced probes and fines for several other high-profile internet platform companies, online insurance firms, the education sector, video gaming companies, and Macau casino operators. Regulatory actions have focused primarily on four areas: “common prosperity” (an initiative that focuses on growing the middle class and cutting the cost of living), antitrust, financial stability, and data security.

Evergrande and China’s Property Sector

Real estate makes up nearly 30% of China’s GDP, much more than the U.S. Chinese property developers have also grown rapidly following years of excessive borrowing. Troubles in the sector caught the attention of market participants when the heavily indebted property giant Evergrande and other developers missed bond payments and faced the threat of defaulting. While the news was concerning, it is important to understand Evergrande’s size in the equity and fixed income markets. Its shares represent less than two basis points of the standard Emerging Markets Equity index; in debt markets, its liabilities represent a larger slice of the high yield space but still mere basis points of total onshore China debt.

Property developers in China may continue to face increased regulation as the government seeks to curb excessive risk and debt in the financial system. The government is focused on future sustainable growth, and excessively high property prices hurt housing affordability. This could lead many families to have fewer children, which is a headwind for solving China’s problem with its aging population. Authorities in China have also ramped up efforts to rein in excesses in the property sector and curb speculation among home buyers. Measures include limiting rampant borrowing among developers and tightening rules for mortgage lending. As a result, China’s construction activity and new home prices are expected to decline. If this occurs, it could potentially lower a company’s long-term return on invested capital and impact its valuations. This would have the effect of transforming Chinese property developers into quasi-utilities, with controls and regulations on their profitability.

Implementation Implications

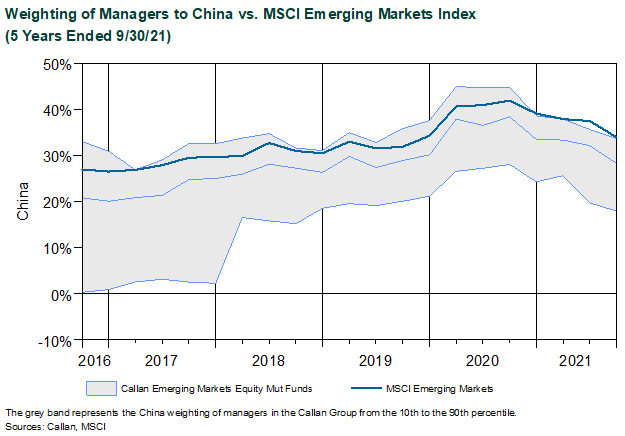

China represents about 34% of the MSCI EM Index as of 9/30/21. As shown in the chart below, more than 90% of the managers in the Callan Emerging Markets Equity Mutual Fund Peer Group are underweight to China. In addition to knowing the relative country weight, investors should also understand what their managers are investing in within China given the concentration of the index. In fact, more than 50% of Chinese stocks in the index by weight are allocated to only two sectors: Communication Services and Consumer Discretionary. These two sectors experienced significant outperformance in 2020 before being at the forefront of China’s regulatory crackdown in 2021. According to a survey we conducted in 3Q21, most growth and core managers were hurt by heavier exposure in Communication Services and Consumer Discretionary. Value managers, on the other hand, tended to have higher allocations to Financials and Consumer Staples stocks, which was additive to relative performance in 2021.

Further, many managers have been attempting to ensure that the industries and stocks they hold within China are aligned with Beijing’s priorities. This includes limited exposure to over-levered real estate operators, increasing exposure to low- to mid-level consumer-focused firms (particularly local brands) and cloud and semiconductor areas, investments in energy names that focus on reduced carbon and particulate pollution, and the promotion of Hong Kong rather than overseas exchanges for Chinese companies’ capital markets activities. Some quantitative managers have been modifying their models to adapt to the changes in the real estate sector.

Closing Thoughts

We believe that investors should consider the changing landscape in China and understand the approaches used by active managers when making an emerging market asset allocation decision.

While it’s unclear whether there will be further impacts on more market segments, there are signs that the Chinese government is sensitive to market concerns. During this latest selloff, Vice Premier Liu He and representatives of China’s Securities Regulatory Commission actively reached out to global investment banks and other market participants in an attempt to calm their concerns. The officials reiterated their continued support for the stock market and private enterprise, including overseas listings. They also emphasized their commitment to further opening China’s financial markets to foreign investors.