Listen to This Blog Post

As of 1Q25, total federal debt reached a staggering $36.2 trillion ($29 trillion held by the public and approximately $7 trillion in intragovernmental debt). The recent passage of the One Big Beautiful Bill Act (OBBBA), as the president’s signature domestic policy legislation of his second term is known, is projected to raise deficits by another $3.3 trillion over the next 10 years, according to the Congressional Budget Office (CBO). How might the current U.S. debt trajectory impact the long-term outlook for asset class returns as defined by Callan’s forward-looking Capital Markets Assumptions?

The Federal Debt: How Did We Get Here?

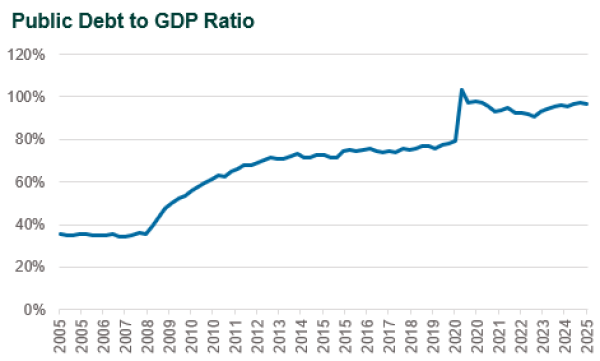

Just 20 years ago, U.S. public debt stood at $4.6 trillion. It has since increased more than six-fold—an annualized growth rate of 9.6%, compared to nominal GDP’s 4.4% annualized growth rate. As a result, the debt-to-GDP ratio has increased from 36% to 97%.

The credit rating agencies have responded. On May 16, 2025, Moody’s downgraded the U.S. from Aaa to Aa1, following earlier downgrades by Fitch (2023) and S&P (2011). Moody’s had maintained its top rating for the U.S. since 1917. The causes of the debt surge include fiscal stimulus and bank bailouts during the 2008 crisis, nearly $6 trillion in COVID-related spending (2020–22), and repeated tax cuts without offsetting spending reductions (2001, 2003, 2017). Beginning in 2022, rising interest rates have substantially elevated debt servicing costs. Indeed, the net interest cost as a percentage of GDP is now 3.0% and projected to rise to 4.1% in the next 10 years, which will surpass defense spending in the near future (in 2024, defense spending was 3.7% of GDP).

The CBO 10-Year Outlook

Absent the OBBBA, the CBO projected the debt-to-GDP ratio to increase to 117% by 2035. With OBBBA, that figure is now projected to increase to 124%. In nominal dollar terms, public debt is expected to grow from $29 trillion to $55 trillion over the next 10 years—an annualized growth rate of 6.7% per year. Since the economy is not expected to grow that fast (CBO’s implied GDP growth rate is 4.4%) the debt-to-GDP ratio is expected to climb.

From the Trump administration’s perspective, OBBBA is expected to stimulate growth by making the 2017 tax cuts permanent, reducing business compliance costs (deregulation), offering repatriation incentives, expanding labor force participation through child care credits, and extending/expanding the provision in the 2017 tax cuts that allowed the full expensing of certain business expenses. This supply-side policy framework results in the debt-to-GDP ratio falling to 94% by 2034—in stark contrast to the CBO. The Council of Economic Advisers (CEA) projections are controversial. Persistent deficits could push interest rates higher, crowd out private investment, and increase inflation risk if the Federal Reserve accommodates deficit spending via balance sheet expansion. The Fed may respond by raising rates or maintaining higher rates (in the 4% – 5% range) to manage inflation expectations.

The Reserve Currency Privilege

The U.S. dollar is the global reserve currency as it dominates global trade, finance, and central bank reserves. The strong global demand to buy and hold U.S. dollars (in the form of Treasuries) enables the U.S. government to borrow at relatively low rates and avoid “capital flight” scenarios.

Today, speculation abounds about the U.S. keeping its reserve currency status given mounting debt and persistent deficit spending. A global reserve currency requires a large stable economy with minimal capital controls, a deep and liquid bond market, central bank independence, and investor confidence that stems from a fair, enforceable, and transparent legal framework (e.g., independent judiciary, the law applied equally, property rights, enforcement of contracts). Furthermore, the currency must be widely used in global trading, lending, commodities, and FX reserves, which then creates a “network effect” (i.e., widely accepted everywhere).

The reserve currency status of the U.S. dollar is likely the case for decades to come as it very entrenched and there is no viable alternative that meets all of the above requirements.

Capital Markets Implications

Callan develops 10-year Capital Markets Assumptions annually using a building block approach. Our current 2025–34 U.S. large-cap equity return forecast is 7.25% and is composed of real earnings growth (2.5%), CPI-U inflation (2.5%), dividend yield/buybacks (2.5%) and a valuation adjustment (-0.25%). We assume real GDP and real earnings growth of 2.5% annually—consistent with 40-year averages but high relative to the last 10–20 years.

While OBBBA may temporarily boost growth through fiscal stimulus, long-run GDP is driven by productivity and labor force expansion. The U.S. labor force is expected to grow just 0.5% annually, constrained by an aging population and low fertility rates. Productivity growth, defined as real GDP per hour worked, depends on innovation, capital intensity, education, and technology adoption. U.S. productivity has averaged 1.5% – 1.7% annually over the past 50 years. Some studies suggest a debt-to-GDP ratio exceeding 120% may lower real GDP growth by 0.25% to 0.5% per year through reduced national saving (which equals private saving – government deficits), higher borrowing costs, and fiscal uncertainty. Based on current data, our 2026–35 real earnings growth assumption may be reduced to 2.25%.

Callan’s long-term equilibrium inflation assumption is 2.25%, and our current 10-year inflation forecast (CPI-U) is 2.5%. The Fed remains committed to its 2.0% target based on the Personal Consumption Expenditures (PCE) Index, which typically runs below CPI-U. The 10-year break-even inflation rate remained steady at ~2.4% following OBBBA’s passage, suggesting limited concern for rising inflation over the next 10 years. Nevertheless, elevated debt levels increase the risk of higher inflation over time. Based on current data, our inflation assumption for 2026–35 may remain at 2.5% or be increased to 2.75%.

Given sustained deficits and rising debt levels, our baseline forecast for Treasury yields may also need to rise. Heavier Treasury issuance may require higher yields to attract buyers, and concerns around future inflation or fiscal credibility could increase risk premiums and volatility. Yield curve steepening is also a potential outcome.

Final Thoughts

While OBBBA may deliver a short-term boost to growth, long-term debt sustainability remains a concern. High and rising debt levels could suppress real growth, elevate inflation risk, and lead to upward pressure on yields. Callan will continue to monitor these developments and incorporate them into our 2026–35 Capital Markets Assumptions later this year.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.