Listen to This Blog Post

Real assets delivered mixed results in 4Q25 as public and private markets responded differently to easing valuation pressures, shifting interest rate expectations, and uneven fundamentals across sectors. While several segments showed early signs of stabilization, dispersion remained a defining feature—particularly within real estate.

Private Real Estate: Uneven Recovery

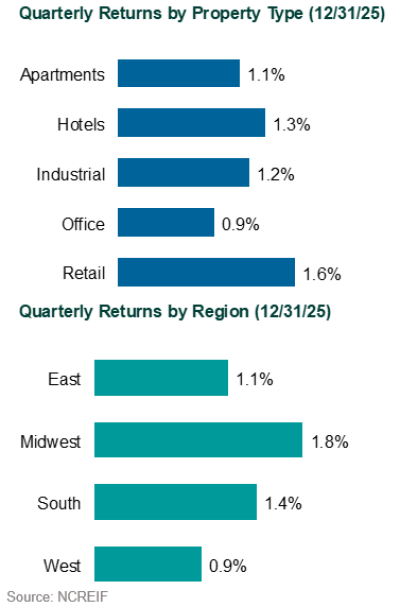

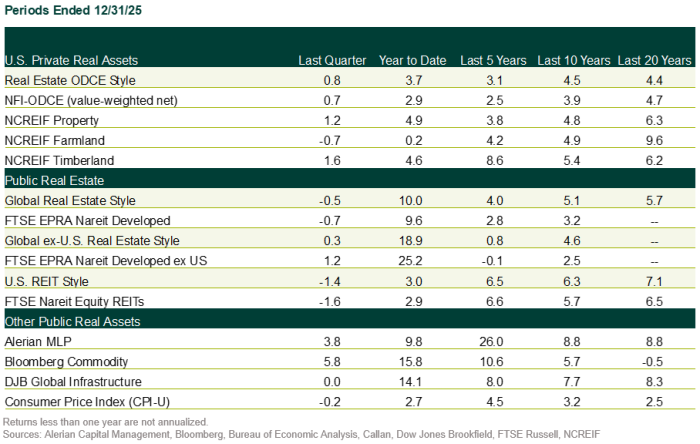

Private real estate performance improved, though recovery remains uneven. Valuations appear to have bottomed and are now in the early stages of recovery. Income returns were positive across sectors and regions, underscoring the durability of contractual cash flows even after several quarters of valuation pressure. Appreciation results, however, were mixed. Most property types posted flat or positive appreciation, while Office and Hotel continued to record declines. Regional dispersion also persisted: the West lagged, largely reflecting softer industrial fundamentals in Southern California.

Public Real Estate: Continued Lag vs. Public Equity

Public real estate continued to lag broader equity markets. U.S. REITs declined in 4Q25, underperforming the S&P 500 Index, while global REITs also trailed global equities. Despite this near-term weakness, global REITs are trading at a meaningful discount to net asset value—well below historical norms. Sustained discounts, combined with ample private capital, continue to support take-private activity and highlight the growing disconnect between public and private real estate pricing.

The FTSE EPRA Nareit Developed REIT Index, a measure of global real estate securities, declined by 0.7% during 4Q25. U.S. REITs, as measured by the FTSE Nareit Equity REITs Index, decreased by 1.6%. The FTSE EPRA Nareit Asia Index (USD), representing the Asia/Pacific region, rose by 1.1%. European REITs, as measured by the FTSE EPRA Nareit Europe Index (USD), increased 1.8%.

Liquid Real Assets: Modest Gains

Liquid real assets posted modest gains, led by commodities. Precious metals drove much of the strength, with gold recording its strongest annual return in roughly four decades. Central banks continued to increase gold reserves, reinforcing its role as a diversifier, while a weaker U.S. dollar supported demand. Listed natural resources also benefited from materials strength and steady energy demand. In contrast, listed infrastructure advanced modestly, constrained by elevated long-term yields and weakness in segments such as natural gas utilities and energy pipelines. Real estate investment trusts (REITs) declined during the quarter as higher yields weighed on valuations, while Treasury Inflation-Protected Securities (TIPS) were essentially flat as inflation expectations remained stable.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.