Listen to This Blog Post

U.S. equity markets ended a choppy quarter higher, helped by strong corporate earnings as the Fed continued to lower rates during the quarter. Broad markets were volatile during the final quarter of the year, as mixed macroeconomic signals, concern around AI spending and valuations, and the longest U.S. government shutdown in history weighed on markets. Long-term rates moved modestly higher in 4Q25, with the 10-year Treasury ending the year at 4.17% and the 30-year at 4.84%. Rate volatility remained a key driver of equity dispersion and valuation sensitivity, particularly for high-growth Technology and capital-intensive Industrial sectors.

The S&P 500 performance was characterized by shifting leadership as the market balanced continued corporate earnings durability against persistent fiscal concerns. Rate expectations remain an important swing factor for equity valuations and factor leadership, particularly as markets price in a potential easing cycle for 2026.

4Q25 Hedge Fund Performance

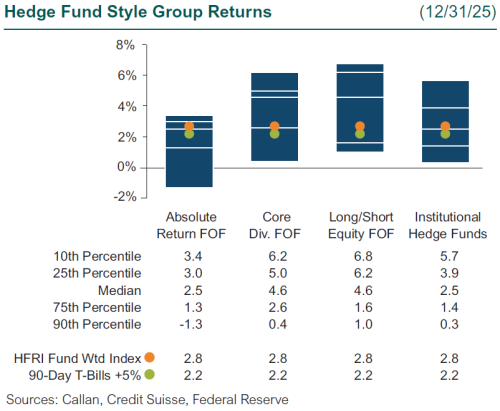

Serving as a proxy for large, broadly diversified hedge funds with low beta exposure to the equity market, the median manager in the Callan Institutional Hedge Fund Peer Group rose 2.5%. Within this style group of 50 peers, the average hedged equity manager gained 3.6%, as health care, industrials, financial services, and less-crowded technology exposures drove performance. The average hedged credit manager was up 1.4%, as credit relative value contributed positively to strategies during the final quarter of the year.

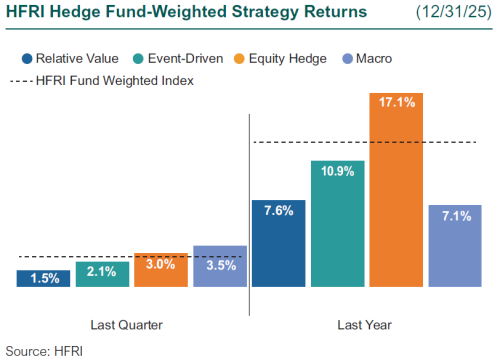

Within the HFRI Indices, the best-performing strategy was macro, which had a strong final quarter and gained 3.6%, as managers profited from long metals and selective equity exposures along with short Japanese rates and U.S. and U.K. curve-steepening. Equity hedge was up 3% as alpha was generated on both the long and short sides amid high dispersion across health care, industrials, and financials. Event-driven strategies ended the quarter up 2.1%, as managers were able to profit from improved deal certainty, stable financing conditions, and healthy merger spreads late in the quarter. Relative value rose 1.5%; credit relative value contributed positively as dispersion widened materially within the category.

Across the Callan Hedge FOF database, the median Callan Core Diverse FOF ended 4.6% higher, helped by their exposure to macro and equity hedge managers. The Callan Long-Short index rose 4.6%, as higher beta managers outperformed those strategies running with lower net exposure. The Callan Absolute Return FOF Index ended up 2.5%, as managers with lower net exposure captured less of the upside during 4Q.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

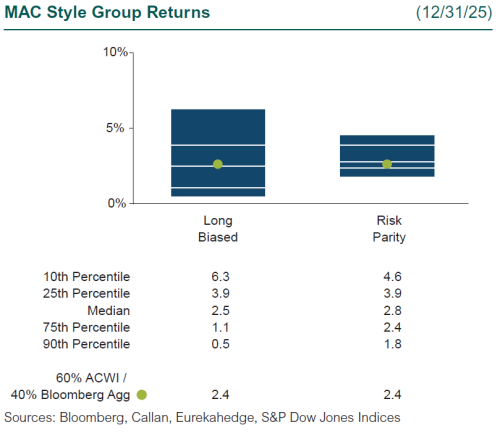

Within Callan’s database of liquid alternative solutions, the Callan MAC Risk Parity median return was 2.8%, as managers profited from equity, fixed income, and commodity exposure during the quarter. The Callan MAC Long Biased median return was 2.5%, as strategies profited from strong performance from both growth and value equities.

As we enter 2026, this appears to be a constructive environment for hedge funds relative to traditional long-only assets, driven by elevated dispersion, policy uncertainty, and idiosyncratic outcomes across equities, credit, and macro markets. Following five years of strong hedge fund performance, returns are increasingly attributable to alpha rather than beta, reinforcing the case for active, risk-controlled strategies. While headline valuations and credit spreads are priced to perfection, cross-sectional volatility remains high, favoring skilled security selection, relative value, and event-driven approaches. Callan expects greater dispersion across manager performance, placing a premium on underwriting discipline, portfolio construction, and liquidity management.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.