Listen to This Blog Post

U.S. equity markets performed well throughout 3Q25, supported by positive developments in trade negotiations, healthy corporate earnings, and persistent strength in AI capital expenditures. The U.S. yield curve steepened (with short-term rates falling more than long-term rates), gold surged, and the U.S. dollar continued to weaken, reaching its largest annual decline since 1973. The 10-year Treasury ended the quarter at 4.15%, down modestly from 4.23%.

3Q25 Hedge Fund Performance

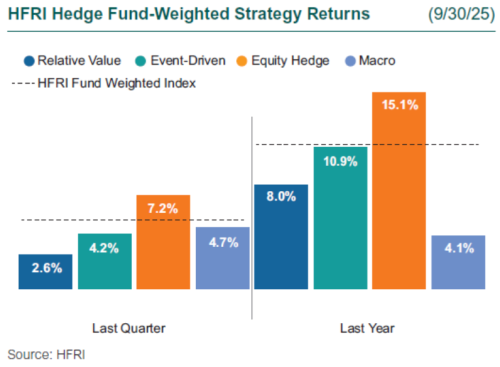

Hedge funds had another strong quarter, driven by equity hedge, as the AI boom continued to push up “growthier” names. Macro strategies performed well, driven by positioning in gold, equities, and interest rates. Event-driven strategies saw positive momentum as M&A activity picked up along with AI-related deals. Relative value strategies ended higher, as managers profited from the Fed rate cut.

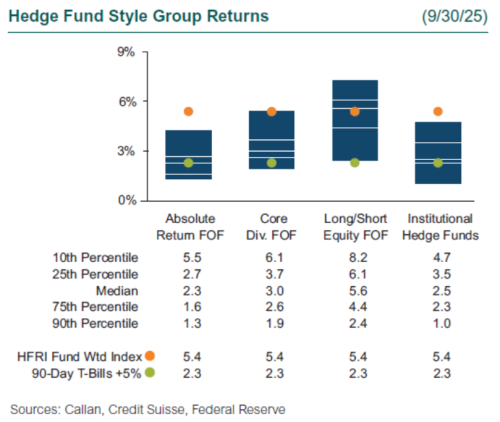

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median manager in the Callan Institutional Hedge Fund Peer Group rose 2.5%. Within this style group of 50 managers, the average hedged equity-focused manager gained 5.1%, as growth-oriented companies drove performance. The average hedged rates-focused manager rose 3.0%, as managers were able to navigate interest rate volatility during the quarter successfully. Meanwhile, the average hedged credit-focused manager moved 1.7% higher, as managers were able to profit off both long and short credit positions. Following a difficult start to the quarter, cross-asset multi-strategy funds added 1.2% in a generally risk-on environment.

Within the HFRI indices, the best-performing strategy was equity hedge, up 7.2%, as managers focused on higher beta names saw strong performance. Event-driven strategies also had a strong quarter, up 4.2%, as managers profited off higher beta companies that have some type of ongoing special situation. Relative value strategies also had a positive quarter, up 2.6%, as managers were able to profit off fixed income volatility during the quarter. Macro strategies ended higher at 4.7% as managers had difficulty trading around interest rate volatility while commodity trading offset some of the losses.

Across the Callan Hedge FOF database, the median Callan Long/Short Equity FOF ended up 5.6%, as managers with exposure to higher beta stocks drove performance. The Callan Diversified FOF gained 3.0%, driven by exposure to relative value and equity hedge managers. The Callan Absolute Return FOF rose 2.3%; macro managers were a slight drag on performance while equity and relative value managers aided gains.

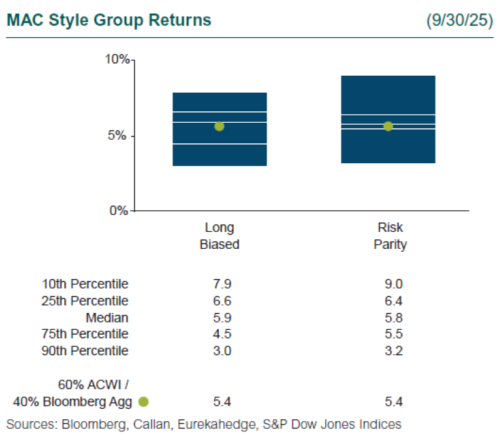

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

Within Callan’s database of liquid alternative solutions, the Callan MAC Long Biased median gain was 5.9%, as managers got strong performance from equities, fixed income, and commodities. The Callan MAC Risk Parity median was up 5.8%, as equities were the main contributor to performance.

As we enter the final quarter of 2025, hedge funds continue to be in a favorable environment despite a strong equity market. Opportunities are being driven by higher dispersion, policy/regime change, elevated credit, and event-driven opportunity sets, which align well with credit and event-driven hedge funds. Macro managers remain well positioned to generate alpha across rates, equities, commodities, and currencies. Callan continues to focus on selective hedge fund exposure that has structural tailwinds.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.