Listen to This Blog Post

U.S. fixed income markets appear priced to perfection, with investors receiving diminishing marginal compensation for assuming credit risk across both investment-grade and leveraged credit markets.

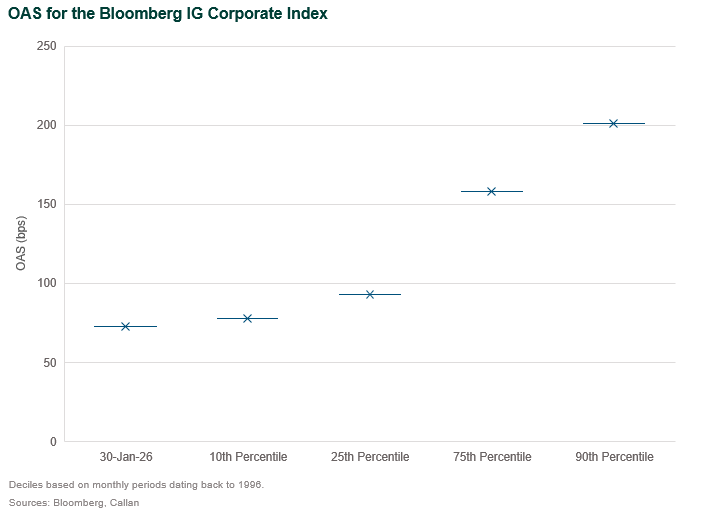

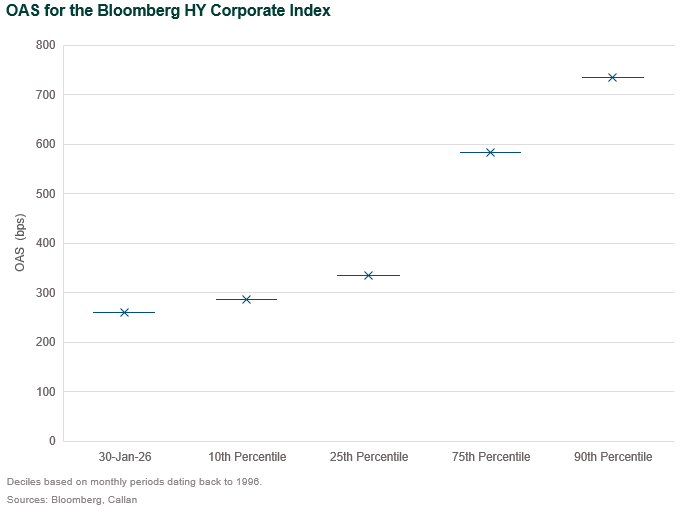

Option-adjusted spreads (OAS), which measure the additional yield investors receive over U.S. Treasuries, are at historical lows across investment grade and high yield markets. As of January 2026, average OAS ranks in the bottom decile of monthly periods dating back to 1996.

Several macro and technical factors have contributed to narrowing credit spreads in recent years. A primary driver, however, has been the persistence of attractive absolute yields since the Federal Reserve raised interest rates by 425 bps in 2022 and another 100 bps in 2023, which supported strong investor demand for credit. This dynamic has been particularly attractive to yield-oriented investors such as insurance companies, which typically buy-and-hold investments with an emphasis on income generation. This approach differs from that of many traditional investment managers, which tend to focus more heavily on relative value and total return.

As valuations have become less compelling, active managers have been more discerning about lending at current market levels and have reduced active risk-taking across many portfolios. Increasing geopolitical risks, fiscal and monetary uncertainty, and an ever-changing U.S. foreign and domestic policy landscape have also contributed to a consensus view favoring cautious, defensive positioning, particularly within multi-sector Core and Core Plus cohorts.

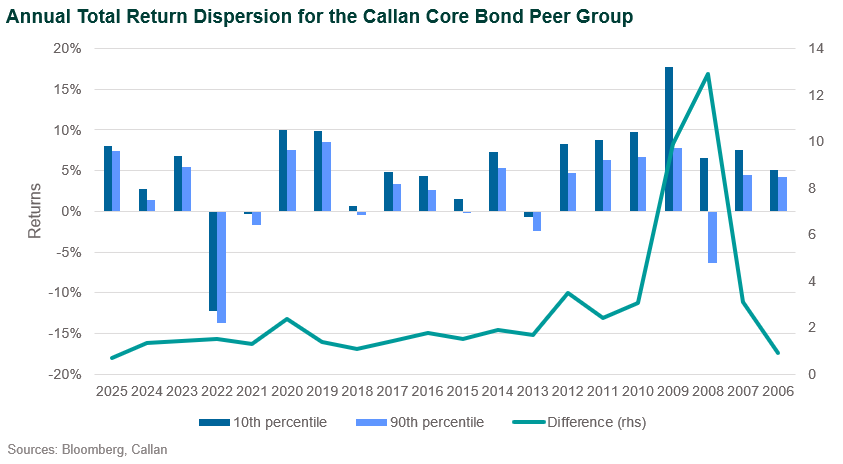

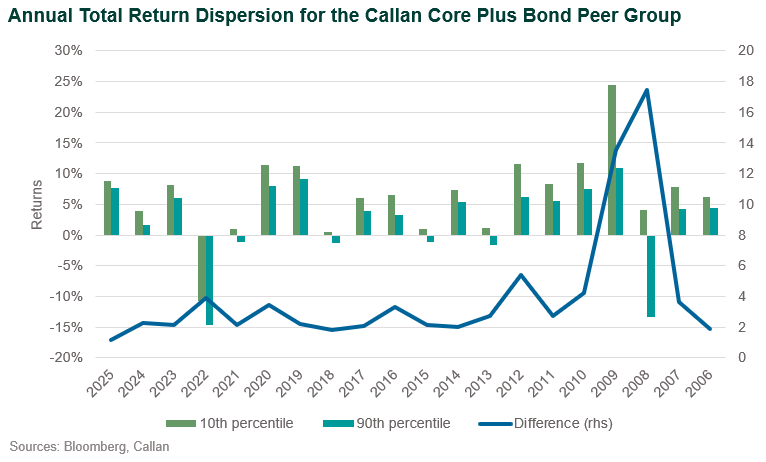

An examination of Callan’s Core and Core Plus Fixed Income peer groups supports this observation. Annual total return dispersion last year, measured as the difference between the 10th and 90th percentile, was the narrowest since 2006. Callan has previously described this dynamic as “herd positioning,” in which active managers are largely indistinguishable based on performance alone. The same story exists when examining the difference between the 25th and 75th percentiles (37 basis point differential for Core, 55 basis points for Core Plus), which are common performance thresholds used by institutional investors when analyzing existing and prospective investment managers.

The takeaway: Managers appear defensively positioned in anticipation of potential disruptions in fixed income markets, and return dispersion may remain subdued even if volatility increases.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.