Listen to This Blog Post

One of the most quoted lines in classic literature and adapted through modern culture is “water, water, everywhere, nor any drop to drink.” The line refers to a ship becalmed in a sea of saltwater, surrounded by abundance but unable to use it in its current form to slake the thirst of a ship’s crew. The source is a narrative poem, “The Rime of the Ancient Mariner” by Samuel Taylor Coleridge, first published in 1798.

We as a modern economy are drowning in data, but the reliability of many indicators and the traditional interpretation of how market and financial data interact and help us forecast are under serious reconsideration. The shutdown of the U.S. government in the fall of 2025 delayed the release of inflation, employment, and GDP data. We view these broad data points as the canvas against which much more detailed production, consumption, income, and business spending and investment can be cast to get a picture of where we might be heading in the U.S. and the global economy.

Data Cloud Picture of the Economy

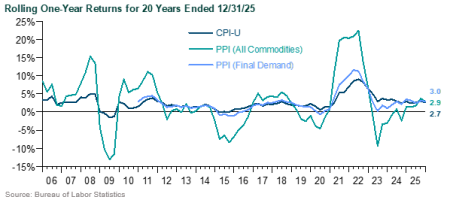

After the release of these government data resumed, questions emerged about the quality of the data and the mixed and frankly crossed signals given off by these and many long-trusted market indicators. The fallibility of these data is baffling forecasters, policymakers, businesses, and consumers all. Can job growth grind to a halt in the U.S. for more than six months yet unemployment does not rise and GDP surges? How can we boost tariffs substantially, applied to many products still purchased throughout the U.S. economy, to effective tariff rates unseen in over 70 years, but inflation only floats up a touch and does not spike? How does consumer sentiment fall while spending continues to rise? Why is the stock market shooting through the roof while 2025 offered such a wild ride and uncertainty remains high? Investors loathe uncertainty, or so I have been led to believe for decades.

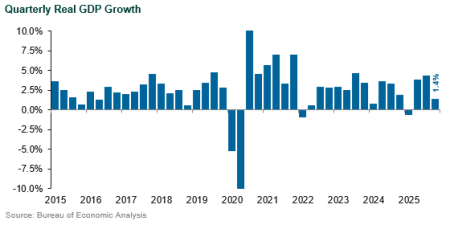

During the second and third quarters of 2025, the truism was that the highest option value for corporations planning investment, expansion, or capital spending was to do nothing in the face of policy uncertainty. That position has faded, and business investment has been strong, and blindingly so in the technology push to build up AI capabilities. U.S. GDP actually shrank in 1Q25, falling by 0.6% annualized, only to surge by 3.8% in 2Q and 4.4% in 3Q, higher quarterly growth rates than any time since 3Q23. The 4Q25 release was delayed until Feb. 20, 2026, almost a month late. GDP rose 1.4% (annualized) in 4Q25, down from the surging growth of 2Q and 3Q, but right on target for the average of expectations as reported by the Blue Chip consensus of forecasters.

In the meantime, the job market has reversed course, shifting from a “tight” characterization with strong monthly increases and high turnover to one of substantial loosening. The rule of thumb in economics for the U.S. non-farm job count has been characterized as the following: any count over 100,000 new jobs per month means the economy is still expanding. A count as high as 200,000 new jobs means the economy is expanding rapidly, and a booming labor market can see counts as high as 300,000 or more. Anything below 100,000 monthly new jobs has in the past pointed to growing softness and a potential contraction in consumer spending, rising unemployment, falling GDP growth, and potentially a contraction in the overall economy.

In 2024, we averaged 167,000 new jobs per month. In the first four months of 2025, the labor market generated an average of 123,000 new jobs. From May through December 2025, non-farm jobs increased just 93,000 total, less than the monthly average since the start of 2024. Included in this sharp drop in the new job count was the decline in October due to the U.S. government shutdown. Yet the unemployment rate ticked up modestly, from 4.0% in January 2025 to 4.4% in December. Our interpretation of unemployment rates would have in the past considered 4.4% as historically low and a sign of a strong demand for labor and therefore a strong economy. What is going on? A halt to job creation is usually associated with a rise in the unemployment rate, as natural growth in the labor force (those working and those seeking work) would see fewer new jobs per participant seeking work. However, the decline in immigration and the number of foreign-born workers has limited the increase in the total number of people unemployed, hence the unemployment rate has risen only modestly. So labor force, employment, and growth rules of thumb are upended. Added to this uncertainty are questions about the quality of the labor market data; the most immediate measure of workers—the non-farm employment totals—are created by employers, and employers have to be encouraged to respond to the monthly employment surveys. There is evidence the response rate of employers has been affected by the uncertainty introduced by the immigration changes in the workforce.

COVID-19 delivered a supply and demand shock to the global economy, and the historical interpretation of the economic data collected during the pandemic and the patterns of interaction thought to predict the economy were severely tested. Reliable indicators of, say, recession are not so reliable; witness the incorrect annual prediction of recession at the start of each of the past three years. Even something as reliable as an inverted yield curve has proven to be a reliable indicator of, well, current interest rates but not the sentiment that normally leads to recession. Further dives into the details of the data, all that data in which we are swimming, are likely required to find the true source of signal in our more complicated world order.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.