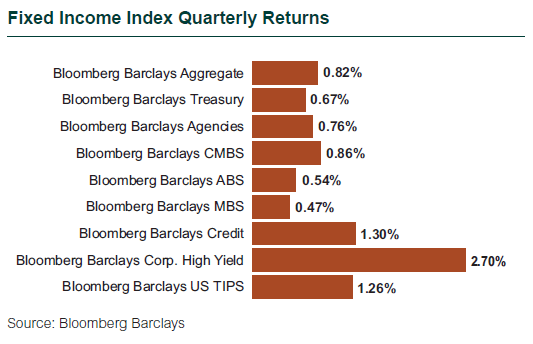

During the first quarter, the U.S. bond market generated positive returns across the board due in part to strong economic data and upbeat investors. U.S. fourth quarter GDP grew at an annualized rate of 2.1%, consumer spending rose 3.5%, and the unemployment rate fell to 4.7%. High yield bonds performed best; the Bloomberg Barclays High Yield Index climbed 2.70% for the quarter.

The Fed increased rates by 25 basis points in March, to a range of 0.75% – 1.00%, as U.S. economic indicators continued to signal growth; two additional hikes are expected over the rest of the year. The Treasury yield curve flattened during the quarter as short-term Treasuries rose while longer-term issues fell. Despite hitting an intra-quarter high of 2.62%, the benchmark 10-year Treasury note ended the quarter at 2.39%, 5 bps lower than the yield at the end of 2016.

For the quarter, U.S. Treasuries increased 0.67%; long Treasuries (+1.40%) outperformed intermediate ones (+0.54%). TIPS were up 1.26% as expectations for future inflation rose. At the end of the quarter, the 10-year breakeven inflation rate, a market-based gauge of investors’ expectations for future inflation, stood at 1.97%.

All fixed income sectors reported returns in the black as both the corporate credit market and the structured-debt market benefited from strong investor demand; the Bloomberg Barclays U.S. Aggregate Bond Index rose 0.82%. Issuance in the investment-grade primary market totaled $390 billion, easily surpassing the prior record of $357 billion in the second quarter of 2015.

Overall, spreads tightened and investor appetite for bonds remained strong despite the headwind of higher rates. High yield spreads over comparable Treasuries tightened by 26 bps and delivered the strongest return. Lower-rated bonds outperformed higher-rated issues; BBB-rated securities generated an excess return of 85 bps and outperformed AAA securities by 70 bps. Investment-grade and ABS spreads tightened by 5 bps and rose 1.22% and 0.54%, respectively. Mortgage-backed securities (MBS) (+0.47%) underperformed duration-matched Treasuries by 17 bps. Commercial mortgage-backed securities (CMBS) rose 0.86% for the quarter and benefited from strong demand.

Municipal bonds also delivered a strong quarter as expectations for U.S. tax reform fell and new issuance remained light. The Bloomberg Barclays Municipal Bond Index jumped 1.58%.

0.82%

The return of the Bloomberg Barclays U.S. Aggregate Bond Index in the first quarter.