A post-election rally, higher interest rates, and political uncertainty in Europe and Asia left global markets unfazed as stocks and bonds rallied. Both U.S. and non-U.S. stocks delivered stellar returns in the first three months of 2017. That put some juice into the performance of institutional funds tracked by Callan, which did far better than they had in the last quarter of 2016.

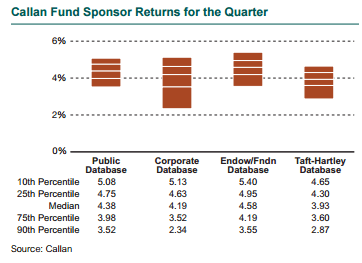

The median return for all fund types for the first quarter clocked in at +4.31%, compared to only +0.65% in the fourth quarter. Endowment and foundation funds bested all other fund types and jumped 4.58%, while Taft-Hartley plans slipped in the ranks and had the lowest median return, up only 3.93%.

How funds did depended in large part on where they had their money. Endowment and foundation plans have the highest exposure to non-U.S. equity, which performed quite well despite an ousted South Korean president and an unpredictable French election. The MSCI ACWI ex USA Index rose 7.86%, the MSCI EAFE Index gained 7.25%, and the MSCI Emerging Markets Index jumped 11.44%.

On the other end of the spectrum, Taft-Hartley plans had the most exposure to U.S. equity and the lowest to non-U.S. and global equity. While U.S. equities delivered strong returns, they lagged their overseas counterparts; the S&P 500 Index surged 6.07% and the Russell 1000 Index rose 6.02%. Taft-Hartley plans had an average allocation of 11.2% to non-U.S. equity, which was the lowest of all fund types.

Although Taft-Hartley plans had the worst performance in the first quarter, they had the best returns over the last three (+5.99%) and five years (+8.22%) due to their home country bias in equities and the dominance of U.S. versus non-U.S. stocks. Endowment and foundation funds had the best performance in the first quarter (+4.58%) and last year (+11.32%).

4.31%

The median return for all fund sponsor types in the first quarter.