Callan conducted a survey in mid-April to assess what defined contribution (DC) plan sponsors have done in response to the CARES Act and the recent economic turmoil spurred by the pandemic. The survey includes responses from 63 non-government plan sponsors, and in general we found that their actions were primarily influenced by the industry they are in and the actions taken by their recordkeeper. Read more about the CARES Act provisions here.

In addition to the plan sponsor survey, Callan surveyed 15 DC recordkeepers to understand their capabilities and how they were responding.

Among our other findings:

- 21% of the DC plan respondents had taken some type of workforce action, including salary reductions, layoffs, or furloughs.

- A third of recordkeepers added the capability for coronavirus-related distributions (CRDs) across all the plans they served, and required sponsors to opt out if they did not want to offer this option.

- The other recordkeepers required sponsors to opt in.

- 53% of recordkeepers automatically waived minimum required distributions, which the CARES Act permitted for calendar year 2020.

- 64% of recordkeepers had already instituted DC plan loan deferment provisions permitted by the CARES Act.

- The vast majority of sponsors said they had no plans to suspend or reduce their matching contribution. This was especially so for plan sponsors with a union population.

- But sponsors that had taken some sort of workforce action were more likely to have either suspended or reduced the match.

Workforce Actions

DC plan sponsors face an economic situation in a high state of flux. As a result, a number have taken a variety of workforce actions (i.e., salary reductions, furloughs, layoffs) to manage business needs. But at the time of our survey most had not. This may change as the situation evolves and we will provide updates as needed. Read more about the implications of workforce actions on the DC plan here.

By industry, though, the response varied widely. No insurance, energy/utilities, or construction/mining companies had taken any action. The same was true for nonprofit organizations. At the other end of the spectrum, half of the health care and technology respondents had taken such a step, the highest proportion among the industries surveyed. Health care was impacted by the cancellation of most specialty procedures, resulting in job disruptions, while technology companies were affected by the drop-off in on-site support visits.

Coronavirus-Related Distributions

How plans implemented coronavirus-related distributions (CRDs) was dependent to a degree on what their recordkeeper did. Nearly half of plans did so when recordkeepers required that plans opt out, compared to only a quarter when the recordkeepers required plan sponsors to opt in.

But in both scenarios, roughly a fifth of plans said they planned to offer CRDs.

What Sponsors Have Done Regarding CRDs

When looked at through the lens of industry-type, all tech companies offer the option. But only 8% of nonprofits, educational institutions, and health care organizations did so.

The adoption rate was noticeably higher for sponsors that had taken some sort of workforce action.

Minimum Required Distributions

The CARES ACT waives minimum required distributions (MRDs) from DC plans for calendar year 2020, including the initial distribution payment related to 2019 that would have been required by April 2020. Slightly more than half of recordkeepers automatically waived MRDs. In a down market, delaying these distributions permits participants to continue to invest and recover from the downturn.

Loan-Related Provisions

Four out of five recordkeepers had not determined the timing for when they would take advantage of a CARES Act provision that increased the loan maximum for individuals who qualify because of pandemic-related financial issues. The loan provisions may be difficult for recordkeepers to administer, as their systems are designed to reject loans above the previous maximums, and the loans are only available for a limited time period (i.e., through Sept. 22, 2020). Many plan sponsors also note concerns with the burden of repaying a large loan: repayments on a $100,000 loan with a prime+1% interest rate and five-year loan term would equal $1,853 per month.

One in five plan sponsors say they have increased loan maximums. Half of energy/utilities and technology respondents indicated they have increased loan maximums for qualified individuals, while no education, health care, or nonprofit organizations did so.

The act also allowed plan sponsors to delay loan repayments due from the enactment date until Dec. 31, 2020, for qualified plan participants. Missed loan repayments by participants who are not considered qualified individuals will continue to trigger a default and deemed distribution.

The extension of loan due dates could be problematic to administer, as plan sponsors and recordkeepers would need to identify those participants who would be considered a qualified individual. Nearly two-thirds of recordkeepers have the capacity to support these loan deferment provisions, as the actual programming to implement has a longer runway. There may be a lag in plan sponsors implementing this provision as loans may not be subject to a default yet, which permits additional time for plan sponsors to consider.

While one in five plan sponsors have implemented loan deferments, similar to the number of plans that have increased loan maximums, more plan sponsors indicated that they plan to allow participants to defer loan payments (30%), compared to those that plan to implement the higher maximum limit (19%).

Half of technology respondents indicated they have deferred loan repayments.

Match Reduction or Suspension

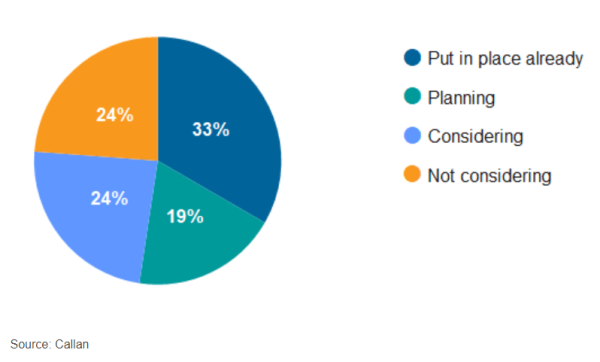

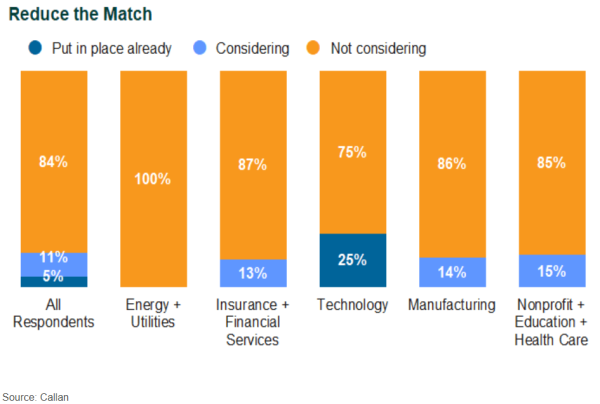

We also explored whether plan sponsors had considered or already reduced matching contributions. These numbers may vary in the coming months depending on the scope and duration of the crisis.

Only 5% of plan sponsors indicated they had reduced the match. Only 3% indicated they had frozen matching contributions. But the decision to do so varied by industry and whether the plan sponsor had implemented any workforce actions.

Plan sponsors with union populations or in regulated industries are less likely to have taken action on matching contributions.

But of respondents that had laid off employees, 40% reported reducing the match and a further 20% of those indicated they had suspended the match. Read more about match suspension considerations here.

Plan sponsors have taken steps to provide more information to participants during the pandemic. The majority of respondents reported participant communications focused on market volatility and emotional investing.

Nearly a quarter of plan sponsors that have had a workforce action have communicated about available loan and distribution options, compared to less than 15% of employers with no workforce actions. This group was also slightly less likely to rely on their recordkeeper’s standard materials.

Evolving Circumstances

Aside from the grave threat to public health and the resulting impact on economic conditions, one of the greatest challenges COVID-19 presents is the lack of a clear timeline and endpoint. Plan sponsors and participants are seeking to make decisions based on circumstances that cannot be anticipated. Plan sponsors should seek to support their participants’ current needs, balanced with the long-term objectives of the DC plan as required by ERISA, while documenting their fiduciary decisions and the process to implement those decisions.