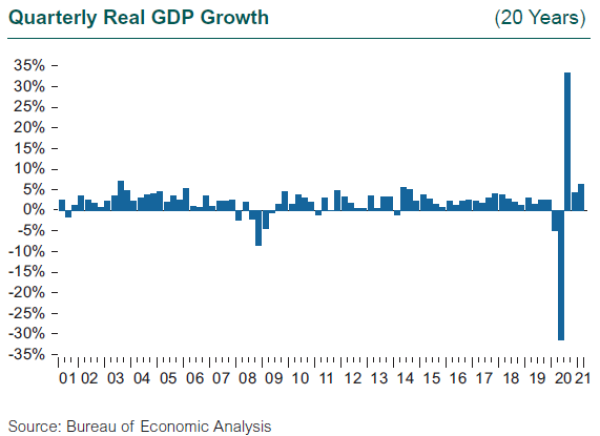

U.S. GDP notched a solid 6.4% gain in 1Q21. The U.S. economy may be on track for a truly eye-opening expansion, with initial projections from high-frequency GDP trackers such as GDPNow pointing to growth rates of 9% or even higher for 2Q. At that rate, GDP is likely to return to its pre-pandemic peak by midyear. For context, after the Global Financial Crisis (2008-09), it took 3½ years before real GDP reclaimed its pre-recession highs. At the start of the pandemic, the level of real GDP dropped more than 10% from March to June 2020. But the recovery in the second half of the year meant annual GDP growth measured -3.5% compared to 2019, although that is still the worst annual loss in 75 years. The steep decline and the rapid recovery surrounding the pandemic have been unprecedented.

The robust 1Q21 result reflects the grand reopening enabled by the expansion of vaccinations against COVID-19 and improvements in containing the spread of the virus in the United States. After a faltering start to the vaccination roll-out, supplies and distribution methods began catching up to demand as the quarter came to a close. Expectations that a majority of American adults will be vaccinated by the end of June have fueled sustained optimism by consumers and a move toward a full economic reopening by all businesses, particularly those most affected by the pandemic: travel, hospitality, passenger transportation. As the country moves toward the reopening of places of work and the retreat from work-from-home orders, expect a surge in demand for business and personal services as well. This reopening will not be without hitches, as supply chains have been seriously impacted around the globe, and the mismatch of the supply of labor and demand to fill jobs may take the rest of the year (or longer) to be sorted out.

Around the globe, the move toward reopening has been far less even and sustained, as the rollout and availability of the vaccine has been much less robust than in the U.S. Spikes in COVID infection rates in India, Brazil, Canada, and many European countries constrain both business and consumer confidence, and health care systems are under even greater stress in India and Brazil than at any time since the start of the global pandemic. The lagging distribution of vaccines to many countries may hinder their reopening and recovery well into 2022, as well as travel into and out of these regions.

The biggest hole to fill in the U.S. economy is in the job market. We lost over 22 million jobs in March and April last year, and recovered just 13 million by the end of the year. After a weak January, however, key metrics of the U.S. job market have perked up substantially. Monthly job creation climbed to 558,000 in February and 780,000 in March, for a total of 1.5 million new jobs in the first quarter. The unemployment rate fell to 6.0% in March and is expected to continue moving down toward 5%, while the number of initial unemployment claims, which has remained stubbornly high at more than triple the “normal” rate of 200,000 per week, fell below 600,000 at the start of April, as the pace of job formation has picked up.

Massive fiscal stimulus is clearly the major contributor to rapid growth in 2021, fueling consumer optimism alongside the vaccine and the reopening of state and local economies. The U.S. Treasury reported that $339 billion in stimulus payments were distributed in March, which boosted personal income by a stunning 21%. Personal consumption expenditures drove GDP growth, rising by 10.7% in the quarter, along with surges in investment in housing, equipment, and intellectual property. Pent-up demand and stimulus payments spurred spending on durable goods (motor vehicles), nondurable goods (led by food and beverages), and services (led by food services and accommodations). In addition to the stimulus, federal government spending jumped to cover administration of the Paycheck Protection Program as well as purchases of the vaccines for distribution to the public.

Amid the general optimism in the U.S., one concern has emerged: inflation. As the hitches in supply and demand for goods, services, and labor are worked out, CPI rose 2.6% and the producer price index jumped 12% in the quarter. However, investors should be cautious when interpreting annual comparisons to temporarily depressed prices at the start of the pandemic. For instance, both of these price indices reflect a sharp recovery in energy prices, which fell through the floor last year.