I was introduced to the term “RUD” when a SpaceX rocket exploded four minutes after take-off roughly a year ago. Interestingly, this type of event was not unexpected, and the control room actually cheered because there was a high probability that the rocket wouldn’t survive four minutes of flight. Such is the cost of innovation.

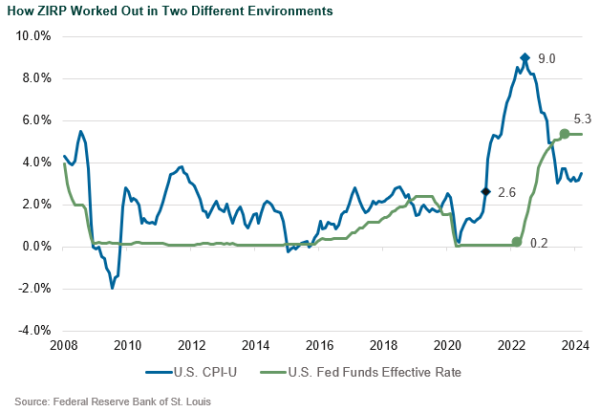

In a similar vein, the Federal Reserve in the wake of the Global Financial Crisis (GFC) engineered something never seen before: ZIRP, or zero interest rate policy, which lasted from 2008 to 2015. Surprisingly, inflation did not take off and the global banking system was recapitalized and survived a long period of near zero net interest margin.

More recently, in the wake of COVID-19, the Fed dusted off the ZIRP playbook and lowered interest rates from ~1.5% to zero. However, this time inflation was lying in wait. Inflation rose from 2.6% in March 2021 to 9.0% in June 2022. In its zeal to tamp down inflation, the Fed quickly raised interest rates starting in March 2022 from 0% to 5.3% in 18 months after 40 or so years of secular decline from 19.0%.

And as planned, inflation fell to a more moderate 3.5%. Yet wringing out the remaining bits of inflation to hit the Federal Reserve target of 2.0% may be more difficult than anticipated by the soft-landing camp. Among the factors working against the Federal Reserve is the simple math of base rate effects in which a few higher than expected inflation prints require larger counterbalancing lower prints, and the stimulative effects of the $1.2 trillion U.S. spending bill, the $1 trillion Infrastructure Investment and Jobs Act, the $500 billion Inflation Reduction Act, the $278 billion Chips and Science Act, and the remaining effects of the $2 trillion CARES Act.

This change in the market environment reminds me of the David Foster Wallace adage, “Fish don’t know they are in water.” What that means is that markets are seeing inflation for the first time in over 40 years and may not see the obvious reality that a real economic slowdown is practically necessary for the Federal Reserve to reach its 2.0% inflation target.

Going back to the SpaceX rocket’s RUD, it happened after the point of greatest aerodynamic pressure on the rocket, which is one of many mileposts where disaster is expected to occur. These exogenous factors are known, but no one really knows how or if they will lead to success or failure ahead of time; they are just part of the business. Similarly, the long and variable effects of interest rate hikes are known factors in potentially planting the seeds of the next recession. As borrowing costs rise, unsustainable business models that survived on free money and profligate consumer spending habits reveal themselves.

So what ends up being the set of exogenous factors that lead to the U.S. or global economy’s Economic Rapid Unplanned Disassembly? Much like the SpaceX RUD of April 2023, the number of potential catalysts is immeasurable and changes day by day. With a war on the doorstep of Europe, a potential war between two Mideast adversaries, roughly 40% of U.S. small cap stocks unprofitable, and the 10 largest U.S. large cap stocks representing 32% of the S&P 500’s market capitalization (the highest in many decades), it seems that a stiff wind could turn a soft landing into a RUD pretty quickly.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.