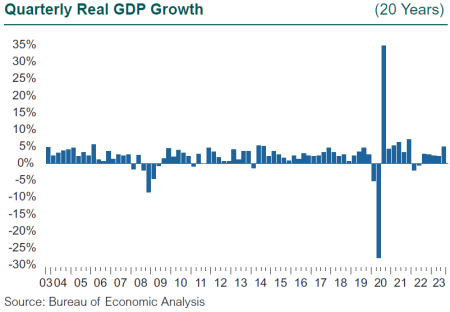

A year ago, no one saw this coming. Recession was on everyone’s radar for 2023, and the only disagreement was the quarter in which it would show up. Then the U.S. economy generated 2.2% GDP growth in 1Q and another 2.1% in 2Q. The strong job market continued to add new jobs, inflation came down from the 9% spike last summer, and wage growth boosted consumer incomes and spending. Now 3Q GDP has clocked a stunning 4.9% gain, mocking all those who try to predict economic growth (including us). This despite the Federal Reserve’s rate hikes, the war in Ukraine, elevated inflation, and geopolitical uncertainty. How are we defying economic gravity?

The robust 3Q economic report is the result of strong retail sales, industrial production, and investment in inventory. Retail sales came in much stronger than expected, driven by demand for building materials, recreational goods, and vehicles, as well as core goods such as food and household items. Growth in total consumption expenditures has been broad-based and spread across both goods and services, and it accounted for more than half of GDP growth in 3Q. This surge in spending suggests that many U.S. consumers feel financially secure and are spending freely in a tight labor market.

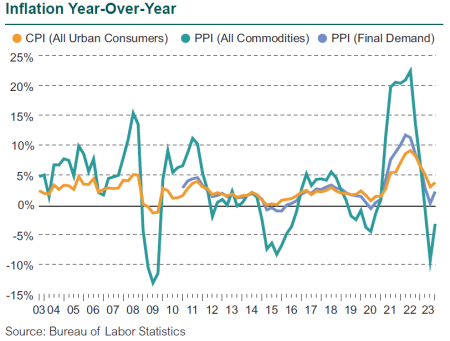

Headline inflation fell from 9% (year-over-year) in June 2022 to 3% in June 2023, a remarkable reduction. The decline likely reflected both the un-knotting of global supply chains following the pandemic, and the efforts of the Federal Reserve and central banks around the globe to contain inflation with higher interest rates. The lower rates also reflected a denominator effect, perhaps twice, in which the sharp rise in 2022 came off an abnormally low base for prices set during the lockdown in 2020 and 2021, and price increases were measured during the first half of 2023 against the now-higher prices set in 2022. However, headline inflation (including food and energy) edged back up in each of the last three months.

Labor markets are tight. The U.S. economy added 336,000 new jobs in September and has created an average of 260,000 per month this year. (For reference, a monthly rate of 200,000 suggests continuing growth in the economy.) The unemployment rate remains below 4%, coming in at 3.8% in September. Finally, the Job Openings and Labor Turnover Survey (JOLTS) reported that the U.S. economy had 9.6 million job openings at the end of August, and 6.4 million unemployed people, so a ratio of unemployed people to job openings of just 0.7.

The current strong GDP growth suggests we may not see an easing in tight labor markets for some time. Hence, the prospect for continued inflationary pressure from the labor market is high. Average hourly earnings have grown between 4.0% and 5.0% (annual rate) during the first three quarters of 2023, meaning real wages finally turned positive starting in May, and this real growth carried through September (wage growth is exceeding inflation). Inflation has come down significantly from its 2022 peak, but getting down to the Fed’s stated goal of 2% will take more time, and some discomfort.

The housing market is in a conundrum. Housing starts have fallen in response to substantially higher mortgage rates, but not as much as might be expected. After plummeting earlier in the year, single-family starts rose 3.2% in September, while multi-family starts surged 17.6%. The single-family housing market is historically tight—and tightening. Inventory of homes for sale declined for the eighth straight month in August to 857,000, a record low. Low inventory has driven home prices up, and with mortgage rates at 7.5%, buying a home is increasingly unaf-fordable. As a result, sales of existing homes have collapsed.

If we thought clouds loomed at the start of 2023, there are more now. Interest rates are higher still and financial conditions are tight. Geopolitical uncertainty has certainly not abated (the conflict in the Middle East began in the fourth quarter and is not reflected in 3Q data). Another shutdown of the U.S. government is lurking. The full impact of higher interest rates is working through the real estate market, the cost of capital, the cost of home ownership, and the cost of debt to government, business, and consumers. The UAW strike began in mid-September, and the impact will likely show up in 4Q. The bond market has been calling for a recession since May 2022, with an inverted yield curve, and the curve has only become more inverted over the past year.

Expectations that the Fed would be done with rate hikes and would soon revert to rate easing have been continually thwarted by the strength in the job market, in industrial activity, in exports and by strong consumption expenditures. Financial conditions tightened toward the end of 3Q as investors pushed up yields on the long end of the Treasury curve. This tightening may less reflect a change in expectations for short-term monetary policy than investors’ lower demand for term risk, as banks lower allocations to Treasuries. Investor sentiment also may indicate concern about our Congress. That the U.S. economy continues to thrive through such crosswinds has been both remarkable and baffling.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.