High yield allocations late in the cycle may seem like a bad idea, but investors’ need for yield in the face of falling rates for government bonds is strong.

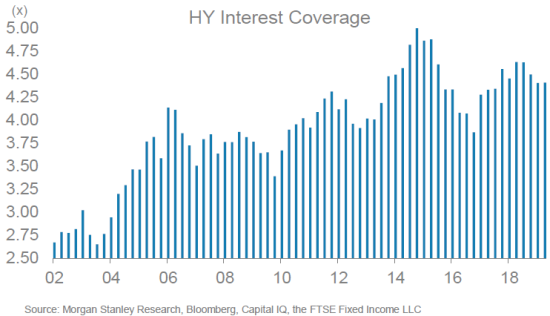

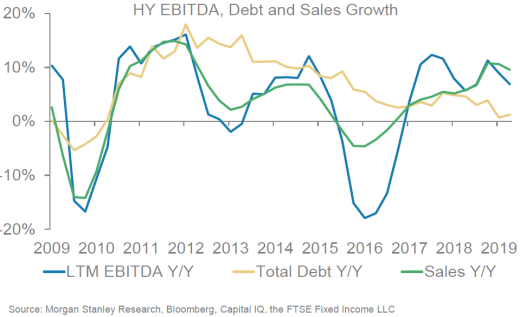

The credit market is still appealing. The higher coupon-clipping aspect of spread has led to superior returns over time. High yield fundamentals broadly speaking remain stable, although with signs of slight deterioration, according to Morgan Stanley, with interest coverage steady at roughly 4.5x though EBITDA growth has been weaker over the past year. However, the fundamentals are much better than just a few years ago, when the collapse in oil prices socked energy and the entire high-yield universe traded down.

High yield managers are cautious, telling us they have to really pick their spots. Long-term appeal aside, many managers are trying to rotate out of the sector; sentiment is that now is not a good time to initiate positions. Managers focused on credit are moving up in quality, in anticipation of an economic downturn and widening spreads, saving dry powder for a plunge back into distressed opportunities.

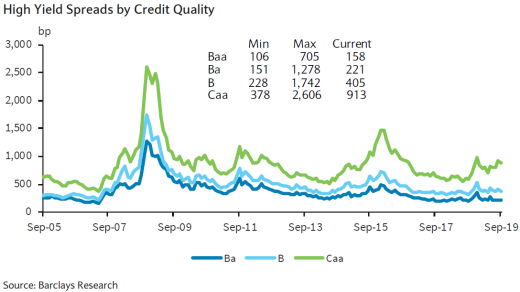

High yield spreads are tight (375 bps OAS, Bloomberg Barclays High Yield Index, 10/23/19), although not at their all-time lows (233 bps 05/23/07). The sentiment is for widening in the next 6-18 months. The tightening in high yield has thus far been concentrated in the Ba- and B-rated segments, with spreads tightening to a lesser degree in the Caa segments.

The institutional investors that Callan works with are focused on the U.S. high yield market; we do not see much global high yield exposure. High yield investing requires boots on the ground, making non-U.S. high yield more daunting and expensive for U.S. investors.

High yield runs the risk of becoming a bit of an orphan in the U.S. The greatest take-up of high yield is in U.S. public defined benefit plans. But these plans are now pursuing private credit in their search for yield and diversification, as a component of their growth assets, and they are concentrating their public fixed income in Treasuries and other higher-quality sectors to provide a sleeve of liquidity and flight-to-quality protection.