This blog post from our Corporate DB Plan Focus Group is one in a series of monthly updates about the impact of interest rates on corporate defined benefit (DB) plans, designed to highlight trends in the market and inform plan sponsors about significant developments.

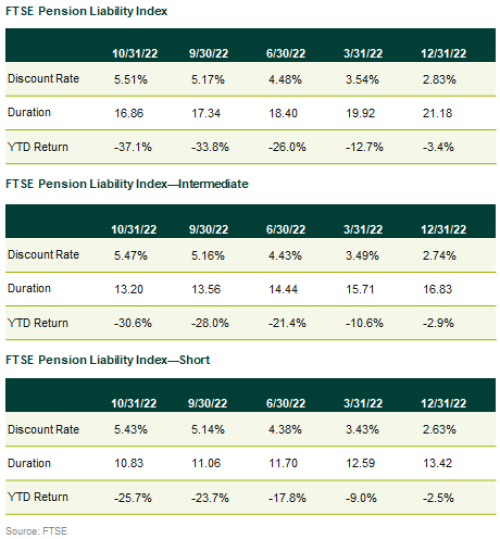

Discount rates were up across the board in October, increasing by approximately 37 basis points for the typical shorter-duration corporate DB plan discounted at the FTSE Above Median curve. Compared to last month, when spreads and rates increased, the spread for the Bloomberg US Long Corporate AA Index fell by 8 bps in October. The 8 bps spread tightening was more than offset by the 27.5 bps increase in the 10-year Treasury.

October 2022 Discount Rate Update

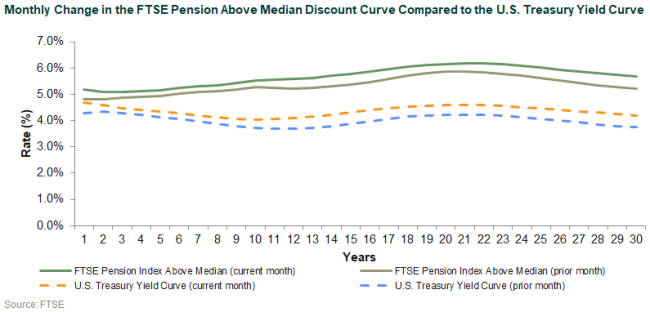

The October discount rate and Treasury curves both shifted up in a non-parallel manner, but meaningfully less than the increase during September. Recall that the Fed increased the Fed Funds target rate by 75 bps in September, which was encapsulated in the front end of the curve moving up nearly 90 bps and the back end of the curve shifting up about 46 bps (i.e., the curve flattened). In October, the effect of the widely anticipated 75 bps Fed Funds increase (which occurred in early November) was mostly priced in, but the curve continued to bear-flatten.

Pension Liability Index Detail

Discount rates, as of the end of October, are now at or slightly above two times their beginning-of-year rates. Notably, for plans that are underhedged, this has resulted in a meaningful decrease in the liability (more than 37% for the FTSE Pension Liability Index (FTSE PLI)), with generally a less severe reduction in the associated asset pool, especially in light of stronger equity returns over the month. Shorter-duration plans, which tend to be more mature and often well along their glidepaths, are typically more insulated from changes in interest rates, indicating that the funded ratio remained largely flat for the month. These plans (as shown by the FTSE PLI – Short in the table) have seen liabilities shrink by more than 25% year to date (YTD).

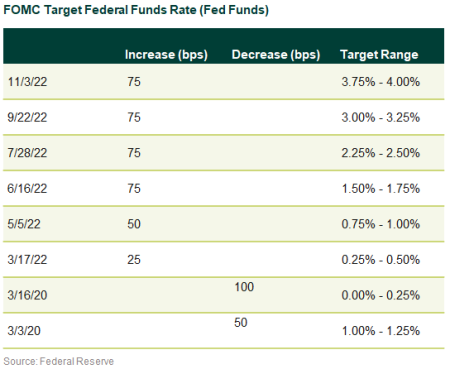

Fed Funds Rate

The Fed executed its latest increase in the Fed Funds target range in early November. As illustrated in the table below, this marks the sixth increase this year and a 375 bps increase from the beginning of the year. As we noted in last month’s update, this is not the first time the Fed has raised rates by this much over such a condensed time horizon, but it has been over 40 years since the U.S. economy has seen its central bank move this swiftly to combat rising inflation.

Financial Statement Impact

Pension expense is a factor modeled in all of our asset/liability studies, but it often takes a backseat to contribution amount, volatility, and balance sheet materiality. Pension expense, simplistically, is increased by service cost (open, accruing plans) and interest costs. This is offset, in part, by the expected rate of return. In an environment in which interest costs have risen so rapidly, many plan sponsors are taking a closer look at the impact of pension expenses. As capital markets assumptions change (see our post here) in light of the new interest rate paradigm, plan sponsors should evaluate whether they need to take the same level of risk to maintain their current return assumption.

Disclosures

Certain information herein has been compiled by Callan and is based on information provided by a variety of sources believed to be reliable for which Callan has not necessarily verified the accuracy or completeness of or updated. This report is for informational purposes only and should not be construed as legal or tax advice on any matter. Any investment decision you make on the basis of this report is your sole responsibility. You should consult with legal and tax advisers before applying any of this information to your particular situation. Reference in this report to any product, service, or entity should not be construed as a recommendation, approval, affiliation, or endorsement of such product, service, or entity by Callan. Past performance is no guarantee of future results. This report may consist of statements of opinion, which are made as of the date they are expressed and are not statements of fact. The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to subsidiaries or parents, or post on internal web sites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.