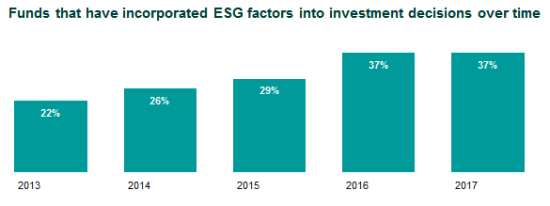

In Callan’s 2017 ESG Survey, we found that adoption rates of environmental, social, and governance (ESG) factors into the investment decision-making process among institutional investors has leveled off. In 2017, 37% of fund sponsors incorporated ESG factors into their investment decisions, which is unchanged compared to 2016.

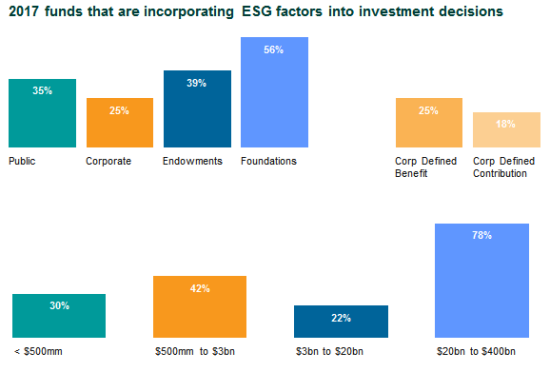

Larger funds (greater than $20 billion in assets) and foundations consistently had the highest rate of ESG incorporation (78% and 56% respectively), our survey revealed. For larger funds, some respondents indicated this stemmed from their greater resources and bigger participant pools with constituents asking for ESG investment options. ESG factor adoption for foundations was more closely associated with an alignment of the specific mission and goals of the institution.

Other highlights from the survey:

- 50% of respondents did not attempt to define ESG, implying an acceptance of the standard definition.

- The most frequently cited reason for incorporating ESG factors into investment decision making was a fiduciary responsibility to do so.

- Respondents located in the Pacific region of the country had the highest rate of ESG factor incorporation (56%).

- The most frequently cited implementation method for incorporating ESG factors was to add specific language to the investment policy statement.

Our 2017 ESG Survey included 105 institutional investors with $1.1 trillion of total plan assets. This is the 5th anniversary of our survey, which first published in 2013.

Find the full survey here.

Increase in the rate of ESG adoption since inception of the survey in 2013.