Callan conducted a survey of institutional private equity investors to offer insights relevant to the limited partner community. We focused on deployment models, patterns of investment and commitment activities over time, governance and oversight, staffing and resources, and responsibilities for program administration functions. Our Private Equity Survey included 69 institutional investors with $1.2 trillion of total plan assets. Respondents’ private equity programs totaled $103.3 billion and included 2,715 partnership investments made with 540 unique general partners.

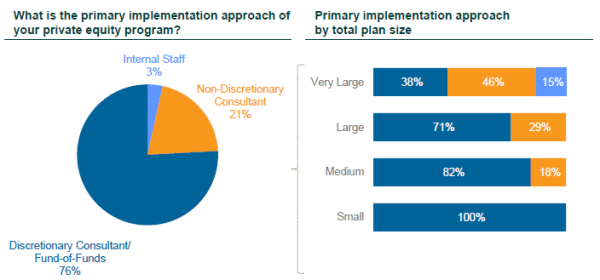

At a broad level, our Survey found that an array of governance, oversight, staffing, and other administration issues affect how institutional private equity portfolios are constructed, monitored, and managed. We found these factors led to less than ideal choices for implementing the programs (e.g., internal staff, non-discretionary consultant, etc.), often including sub-optimal use of the discretionary consultant/fund-of-funds model for certain private equity programs.

Other highlights from the survey:

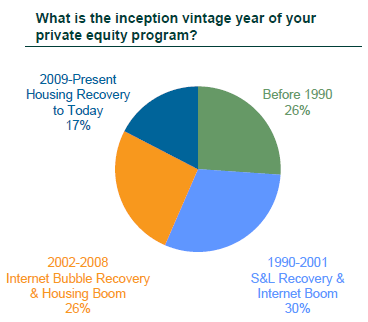

- Inception years varied widely, with more than half of respondents investing in private equity before 2002. All respondents focused on vintage year diversification; commitments were made in approximately 91% of the vintage years available for investment after program launch. Not surprisingly, investors tended to skip commitments to vintages following periods of market disruption, as they reevaluated investment objectives and commitment budgets.

- Investors’ private equity programs were similar, with a heavy emphasis on investments. These investments were placed with a narrow—and increasingly concentrated—universe of general partner sponsors. In peaking markets, the commitment rates to existing general partners in both ongoing and new strategies grew. In 2016, 82% of the private equity commitments reported were with existing general partners, the highest rate across all years analyzed.

- Governance and oversight body involvement helped drive the implementation approach. Private equity programs administered by internal staff reported wider latitude to make operational, strategic, and implementation decisions, while discretionary consultants/fund-of-funds were primarily used for plans with a high degree of oversight body involvement across all functions.

- Staffing was a widespread source of frustration. This primarily stemmed from limited resources and challenges in hiring and retaining experienced staff. In a parallel study, we found private equity staffing was top-heavy, with ambiguity around the path of career progression and the trajectory of compensation growth.

- In administering institutional private equity programs, investors valued core disciplines. These included strategic planning, structuring, and pacing; qualitative manager monitoring; performance reporting, benchmarking, and audit; and primary partnership due diligence. Nonetheless, respondents noted that a majority of staff time was spent performing back office and administrative tasks.

Find the full survey here. For more of our coverage of private equity, please find our latest edition of Private Markets Trends here.

103

The amount, in billions of dollars, invested in private equity by the institutions in our survey.