Callan conducted a survey of institutional investors to offer insights regarding the fees paid for investment management services. This is the seventh installment of our Investment Management Fee Survey, and 2016 marks the 30-year anniversary of the original publication.

The research features highlights of total fund-level fees, performance-based fees, and fee negotiation practices, but the heart of the questionnaire focuses on actual fees paid by asset owners to fund managers compared to published fee schedules at the asset class level. Our 2017 Investment Management Fee Survey included 59 institutional investors with $1.1 trillion of total plan assets and 279 investment managers with $13.9 trillion of total assets under management.

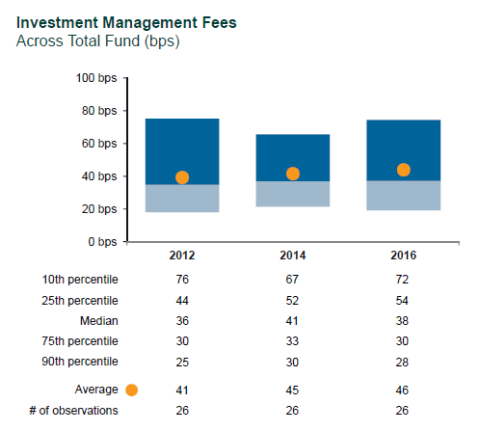

At a broad level, our Survey found that total fund-level fees were mostly unchanged compared to historical observations. In 2016, fund sponsors paid a median 38 basis points in investment management fees across the total fund, unchanged compared to 2014. This runs somewhat counter to the narrative in coverage of the investment management community, which oftentimes describes widespread fee compression across the industry.

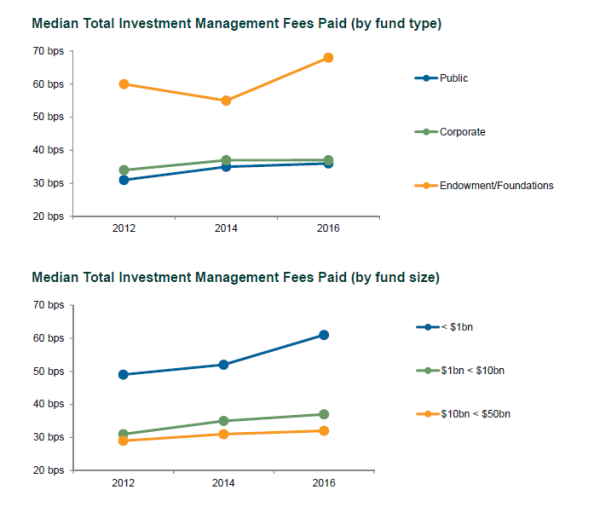

Smaller funds (less than $1 billion in assets) and endowments and foundations consistently paid the most in investment management fees. For smaller funds, that mostly stemmed from their lack of economies of scale. For endowments and foundations, the higher fees resulted from their relatively larger allocation to alternative asset classes.

- Alternatives, including hedge funds, hedge fund-of-funds, real estate, and private equity, was consistently the most expensive asset class allocation, with median fees of 90 bps. Fixed income was the cheapest, at 21 bps.

- Although we didn’t observe a significant decrease in the overall fees paid by plan sponsors to investment managers, 21% of investment managers plan to lower fees in the future.

- Performance-based fees are becoming less popular among investment managers. In 2016, 64% of respondents reported offering performance-based fees compared to 75% in 2014.

- The most frequently cited concern regarding fees was whether or not active managers are providing the value-added to justify the fees levied. Close to half of all respondents (49%) chose this answer.

38

The median total investment management fees paid in 2016, in basis points.