In 2016, Callan published “Risky Business,” a paper that focused on the challenges faced by institutional investors in the low return environment they found themselves in. The paper received a lot of attention, including from The Wall Street Journal, largely due to the graphic illustrating what was required in terms of asset allocation to earn a 7.5% expected return over various time periods. Our analysis found that investors in 2015 needed to take on three times as much risk as they did 20 years before to earn the same return.

Given that attention and the interest in our work from the institutional investing community, we wanted to update our analysis once again to reflect current conditions and to extend the comparison over a longer time period.

2021 turned out to be another truly historic year as the pandemic continued to rage across the globe. Since the bottom of the cycle in 2020, the speed of the recovery has been remarkable. Annual GDP growth reached 5.7% in 2021, after suffering a decline of 3.4% in 2020. Central banks around the world continued to maintain low interest rates while federal government support for businesses and workers extended well into 2021. Inflation spiked as supply chains remain tangled and demand soared. Inflation and interest rates are top concerns for investors, workers, consumers, businesses, and central banks, in particular the U.S. Federal Reserve.

We began the assumption-setting process for 2022 with the expectation that we might have to lower our return projections yet again given the market run and rich valuations in many equity asset classes. However, following our rigorous modeling and evaluation process, we made only a handful of adjustments to our Capital Markets Assumptions. We maintained our return expectations for all public market equity segments at the same level as one year earlier, centered around 6.5% for large cap U.S. We held our core U.S. fixed income assumption at 1.75% for the next 10 years. Returns for private market equity-oriented asset classes—private equity, real estate—remained unchanged as well. We increased our 10-year inflation assumption to 2.25% from 2.0%, thereby lowering the real return for equity and core fixed income by 25 basis points.

The Callan Risky Business Methodology

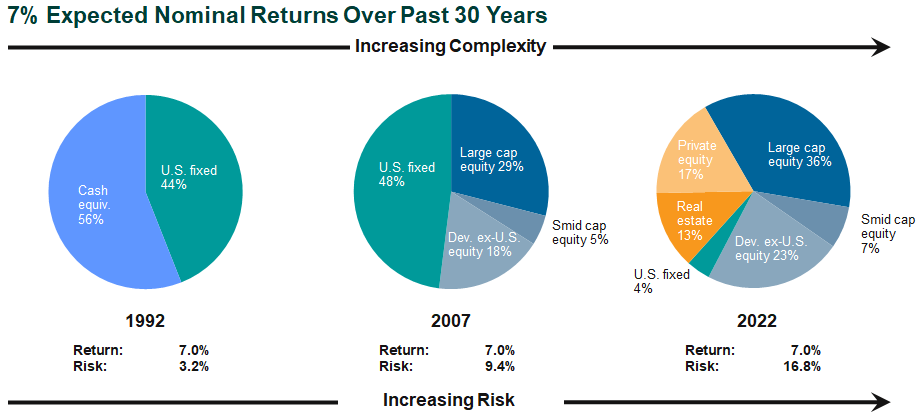

Coupled with the continued uncertainty around the strength of a post-pandemic recovery and the impact of rising inflation on financial markets, institutional investors continue to face a difficult investing environment. To find out how difficult, our experts examined what it would take for an investor to achieve a nominal 7% expected return over the next 10 years. Using our proprietary Capital Markets Assumptions, we found that investors in 2022 needed to take on over 5 times as much risk as they did 30 years ago.

Return-seeking portfolios are now more complex and expensive than ever. Whereas in 1992 a portfolio made up of 56% cash (cash!) and 44% bonds was projected to return 7%, by 2022 an investor would need to include 96% in return-seeking assets (stocks and private markets) to achieve comparable return expectations.

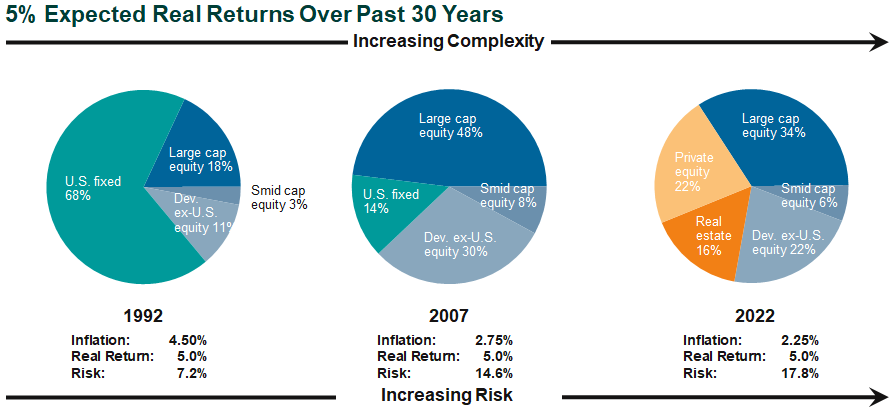

To be sure, the early ‘90s were a different time, with not only higher fixed income yields but also higher inflation. Therefore, we examined what it would take to earn a 5% real return given our prevailing inflation expectations at the time. The graphic below shows that the pattern of increasing complexity over time remains similar over the 30-year period, although the level of additional risk is lower. Today investors need to take on roughly 2½ times the volatility as they did 30 years ago to earn a 5% real expected return, versus over 5 times the risk when matching nominal return expectations.

While investors are cautiously optimistic that we’ve weathered the worst of the pandemic’s impact on the markets given the widespread availability of vaccines and the apparent peaking of the Omicron variant, uncertainty surrounding what lies ahead and the impact on portfolios is on the minds of many. Whether assessed in a nominal or real framework, our conclusions from our 2016 study remain unchanged: Investors require far more complex and risky portfolios to meet their return targets. Clients must assess based on their specific circumstances whether such “risking up” and increased complexity is appropriate.