Each year, when we create our Capital Markets Assumptions, we publish a blog post outlining how we have done with our projections over time, using a representative portfolio consisting of 60% equity, 30% fixed income, and 10% real estate.

Our assumptions include projections for return, risk, and correlation and are used to inform the strategic planning process for all of our clients. The main purpose of the projections is to help clients design efficient portfolios. The projections are also used to form expectations for 10-year total portfolio returns to assist in a variety of planning exercises.

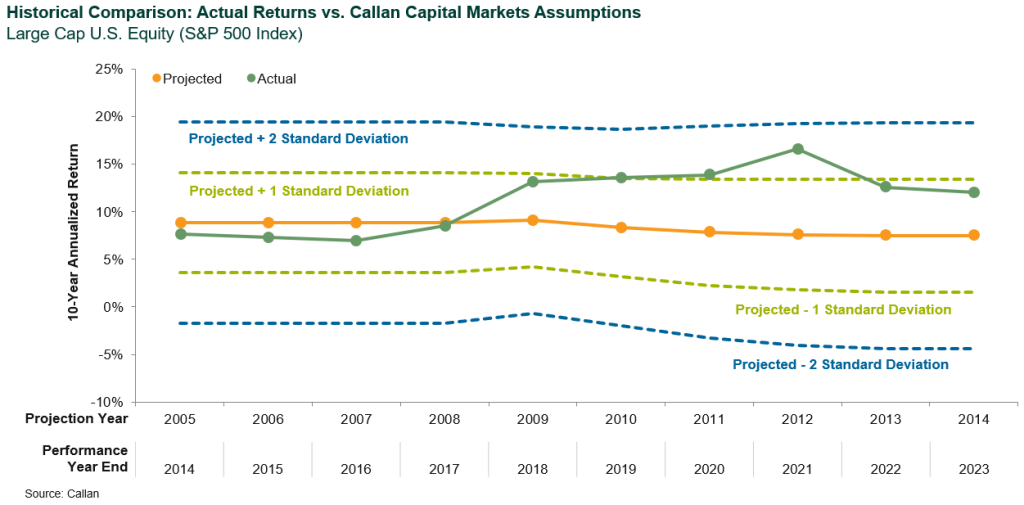

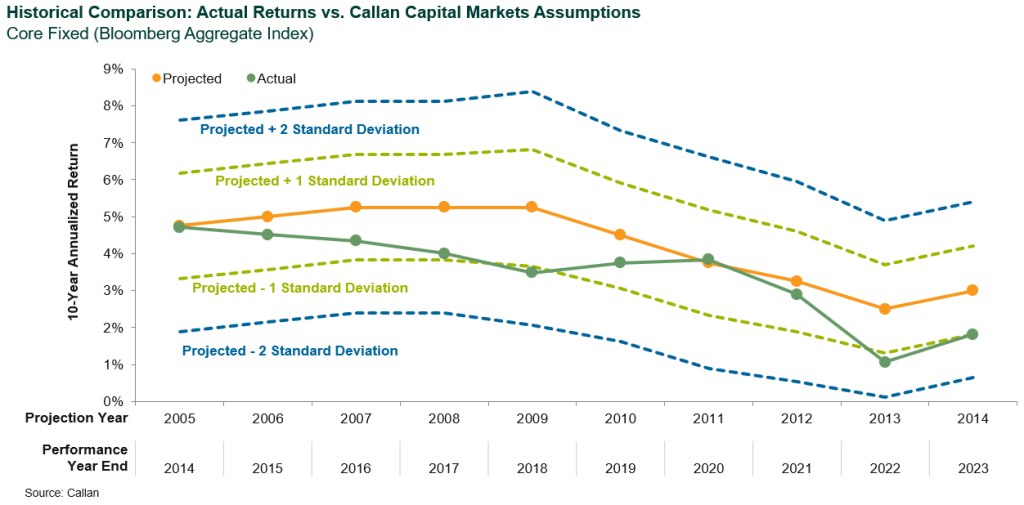

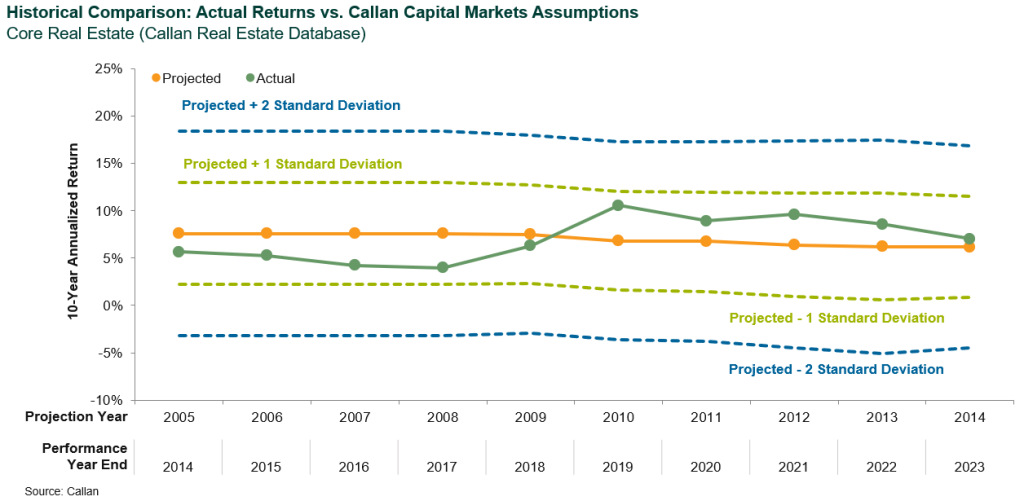

In this post we thought we would share how our assumptions have performed for specific asset classes:

- Large cap equity

- Core fixed income

- Core real estate

10 projection years are shown, with the most recent projection being 2014, which encompasses the 10-year period ended Dec. 31, 2023. The charts that follow are similar in format to the chart that accompanies the blog post linked above about a 60%/30%/10% portfolio.

For large cap equity, actual returns have generally been within one standard deviation of our projected returns. The 10-year periods ended in 2019, 2020, and 2021 contain two calendar year returns in excess of 30%, seven to eight double-digit calendar year returns, and only one single-digit calendar year decline.

For core fixed income, actual returns have generally been within one standard deviation of our projected returns, though typically on the low side. The 10-year periods ended in 2022 and 2023 contain the 13% decline in calendar year 2022.

For core real estate, actual returns have been within one standard deviation of our projected returns, with actual returns exceeding projected returns starting in the 10 years ending in 2019.

Our ability to project the return and risk of portfolios with several asset classes is stronger than our ability to project the return and risk of individual asset classes in isolation. Overestimation of one asset class is typically offset by underestimation in another asset class, resulting in reduced forecasting error for projections of portfolios including these asset classes.

The key takeaway from this exercise is that capital markets assumptions are generally good for describing a range of reasonable potential outcomes for a diversified portfolio, making them effective tools for designing efficient portfolios and for simulating the risk of financial variables.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.