In the United States, fixed income investors continued to hunt for yield in this low-interest rate environment, while non-U.S. bonds benefited from a weaker U.S. dollar. Emerging market bonds also benefited from both the hunt for yield and the dollar’s decline.

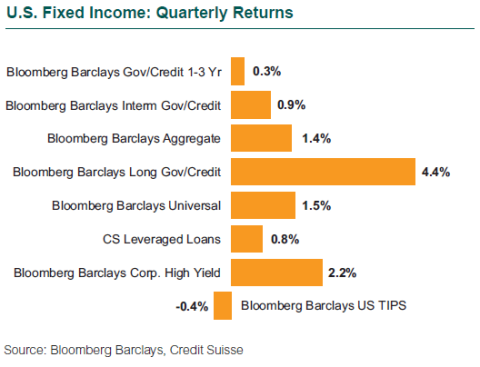

Corporate bonds performed best in the second quarter on strong demand. Investors continued their hunt for stable yields that are higher than what is available for like-duration government bonds. The Bloomberg Barclays US Corporate Bond Index was up 2.5% (+3.8% year to date), while the Bloomberg Barclays US Aggregate Bond Index rose 1.4% (+2.3% YTD). Credit fundamentals remained strong with solid earnings growth and a modest (but acceptable) economic growth environment; corporate balance sheets appeared to be in good shape. And although rates have moved higher on the front end, overall the curve has flattened; the demand for yield is providing support for spread sectors broadly.

The Bloomberg Barclays High Yield Corporate Index increased 2.2%. Low interest rates continued to be a catalyst pushing investors out the risk spectrum in search of higher yields. Default expectations are low across most sectors, providing some comfort to investors. Energy was the only high-yield sector to decline (-0.66%). Rising inventories and concern over OPEC policy put pressure on oil prices, which have fallen approximately 17% so far this year.

In the government market, municipal bonds outperformed Treasuries. The Bloomberg Barclays Municipal Bond Index was up 2.0%, compared to the Bloomberg Barclays US Treasury Index (+1.2%). Results were bolstered by lowered expectations for tax reform and favorable supply/demand technicals. The Fed, viewing inflation weakness as temporary, raised rates by 25 basis points, as expected. The yield curve flattened over the quarter, with short rates rising and longer rates falling. The 10-year U.S. Treasury yield closed the quarter at 2.31%, down from 2.40% as of March 31, though it hit a 2017 low of 2.12% earlier in June. The 2-year U.S. Treasury yield climbed 11 bps to close at 1.38%.

TIPS underperformed as expectations for inflation sank, a reversal from the previous quarter; the Bloomberg Barclays US TIPS Index fell 0.4%. The 10-year breakeven spread (the difference between nominal and real yields) was 1.73% as of quarter-end, down from 1.97% at the end of the first quarter, as inflation came in below expectations for the third consecutive month.

Non-U.S. Bonds: Our Pain, Their Gain

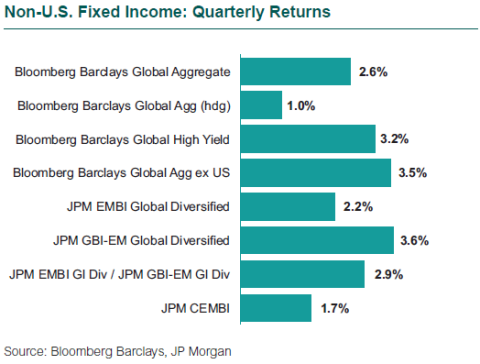

A weaker U.S. dollar helped unhedged non-U.S. bonds and hindered hedged bonds. The Bloomberg Barclays Global Aggregate ex-US Bond Index (unhedged) jumped 3.5%, while the hedged index rose only 0.6%. The U.S. dollar lost nearly 7% versus the euro and almost 5% versus a broad basket of developed market currencies. Positive economic growth and hawkish rhetoric from the European Central Bank (ECB) and the Bank of England drove strong results in the euro and the British pound compared to the U.S. dollar. The quarter closed with an upbeat assessment of the euro zone’s recovery from the president of the ECB, Mario Draghi, fueling speculation that the tapering of ECB asset purchases may be on the horizon. This change in tone spooked investors and sent global yields higher and stocks lower going into quarter-end.

Despite growing geopolitical tension and pressure on energy and commodity prices, the demand for yield drove returns in emerging market (EM) debt amid a strong technical climate supported by robust investor flows. The dollar-denominated JPM EMBI Global Diversified Index was up 2.2%, and the local currency-denominated JPM GBI-EM Global Diversified Index jumped even more sharply, rising 3.6%. The weaker U.S. dollar and relatively higher local yields pushed EM local debt returns up for the quarter and the year, continuing the post-election rebound.

1.4%

The second quarter increase in the Bloomberg Barclays US Aggregate Bond Index.