Listen to This Blog Post

In 2016, Callan published “Risky Business,” a paper that focused on the challenges faced by institutional investors in the low return environment they found themselves in. The paper received a lot of attention, including from The Wall Street Journal, largely due to the graphic illustrating what was required in terms of asset allocation to earn a 7.5% expected return over various time periods. Our analysis found that investors in 2015 needed to take on three times as much risk as they did 20 years before to earn the same return.

Given that attention and the interest in our work from the institutional investing community, we wanted to update our analysis on a regular basis to reflect current conditions and to extend the comparison over a longer time period.

Our core fixed income return assumption held steady at 4.75% for our 2026-2035 Capital Markets Assumptions, remaining well above the low point of 1.75% reached in 2022. Public equity return expectations also remain unchanged from a year earlier, centered around 7.25% for large cap U.S. equity. 2026 return expectations for private markets asset classes also remain unchanged from 2025. Finally, we maintained our 10-year inflation assumption at 2.5%.

The Callan Risky Business Methodology

The impact of elevated inflation on food, energy, housing, and the financial markets, coupled with threats to the world economy from tariffs and geopolitical strife, leave institutional investors facing a challenging investing environment despite reasonably strong return expectations.

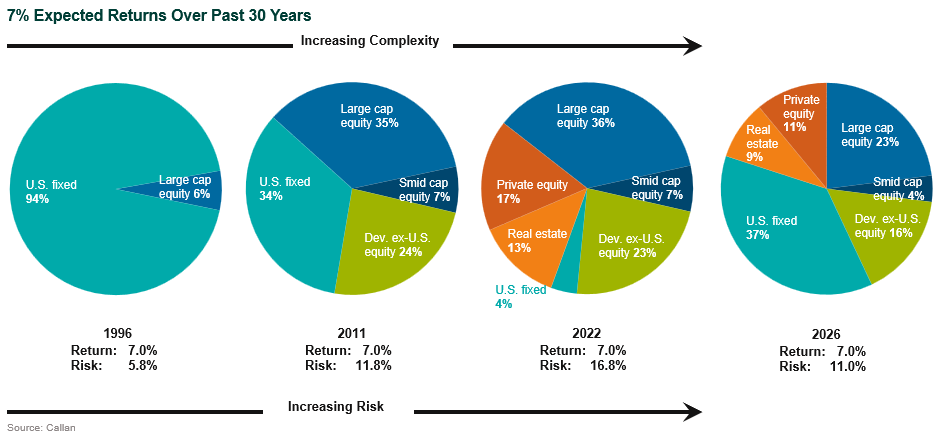

To find out how challenging, our experts examined what it would take for an investor to achieve a nominal 7% expected return over the next 10 years. Using our proprietary CMAs, we found that investors in 2026 needed to take on almost twice the risk as they did 30 years ago, with 63% of the portfolio in return-seeking assets versus 6% in 1996.

Investor portfolios are now more complex than ever. Whereas in 1996 a portfolio made up almost entirely of bonds was projected to return 7%, by 2026 an investor would need to include 63% of the portfolio in return-seeking assets (stocks and private markets) to achieve comparable return expectations. Today’s 7% portfolio is much more reasonable than it was just four years ago though. In 2022 an investor was required to include 96% of the portfolio in return-seeking assets to earn a 7% expected return while today over a third can be in fixed income.

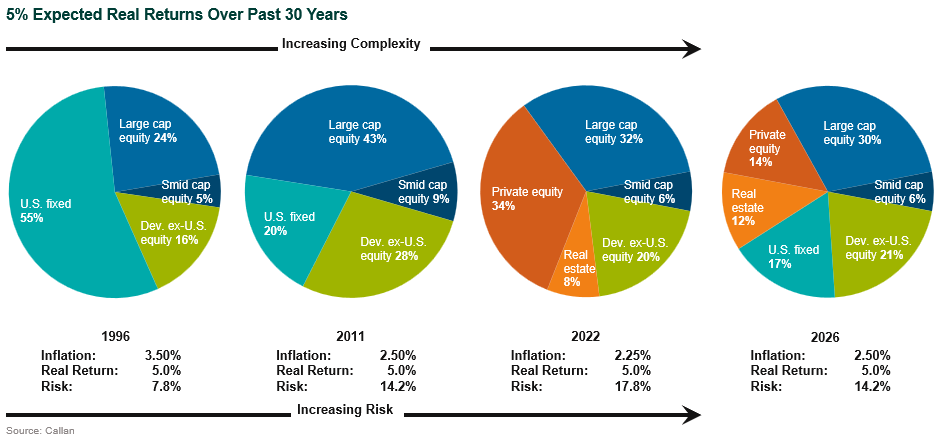

To be sure, the mid-‘90s were a different time, with not only higher fixed income yields but also higher inflation. Therefore, we examined what it would take to earn a 5% real return given our prevailing inflation expectations at the time. The graphic below shows that the pattern of increasing complexity over time remains similar over the 30-year period. Today investors need to take on almost twice the volatility than they did 30 years ago to earn a 5% real expected return despite a 100 basis point decline in inflation.

While investors are cautiously optimistic that inflation is coming under control and a recession has been averted, uncertainty surrounding what lies ahead and the impact on portfolios is always on the minds of our clients. Whether assessed in a nominal or real framework, our conclusions from our 2016 study remain unchanged: Investors require more complex and risky portfolios to meet their return targets than they did 30 years ago. While 2026 marks a significant improvement over just four years ago in terms of the risk required to earn a specific return target, clients must continue to assess whether their portfolio’s risk and complexity is appropriate based on their specific circumstances.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.